Avalanche (AVAX) Targets $100 as Layer-1 Protocols Shine

Key Insights:

-

Avalanche (AVAX) hit a Friday high of $86.95 as bulls target a return to $100.

-

Demand for Layer-1 protocols has surged, with Avalanche network updates also AVAX positive.

-

Technical indicators are beginning to flash green, suggesting more upside ahead.

It was a bullish day for AVAX on Friday, with AVAX leading the top ten crypto majors on the day. The rest of the top 10 cryptos, by market cap, saw more modest gains, with Ethereum (ETH) up 4.42% to come a distant second.

Following a 7.22% rally on Thursday, AVAX jumped 8.13% on Friday to end the day at $85.93.

Network Updates and Interest in Layer-1 Protocols Deliver Support

Interest in Avalanche has surged following news that Avalanche users can stake TerraUSD (UST) in the Anchor Protocol. Avalanche users can now stake their UST without needing to place their funds off-chain.

Anchor Protocol (ANC) has made plenty of headlines in recent weeks. The DeFi staking platform offers UST stakers annual percentage yields (APY) of 20%.

AVAX Price Action

At the time of writing, AVAX was down by 0.08% to $85.86.

Technical Indicators

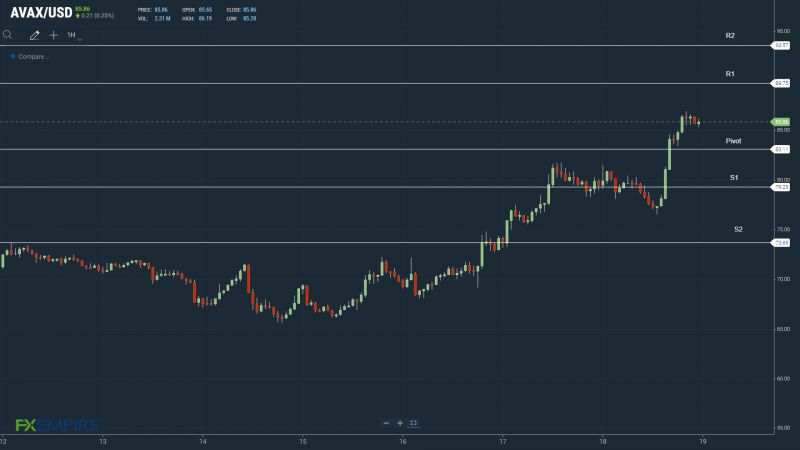

AVAX will need to avoid the day’s $83.11 pivot to make a run on the First Major Resistance Level at $89.75. AVAX would need the broader crypto market to support a breakthrough Friday’s high of $86.95.

An extended rally would test the Second Major Resistance Level at $93.57 and resistance at $95. The Third Major Resistance Level sits at $104.01.

A fall through the pivot would test the First Major Support Level at $79.29. Barring an extended sell-off, AVAX should avoid a return to sub-$75. The Second Major Support Level sits at $73.69.

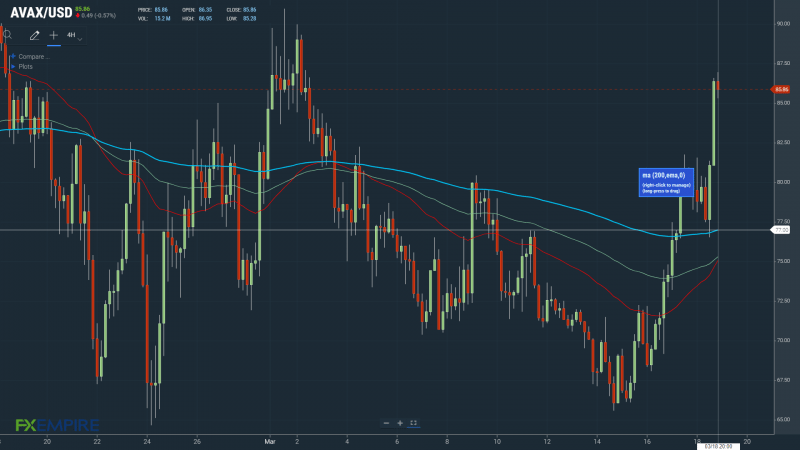

Looking at the EMAs and the 4-hourly candlestick chart (above), it is a bullish signal. AVAX continues to hold above the 200-day EMA currently at $77.00. This morning, the 50-day EMA has converged on the 100-day EMA, delivering support. The 100-day EMA has also narrowed to the 200-day EMA, bringing the Major Resistance Levels into play.

A bullish cross of the 50-day through the 100-day EMA would bring $95 levels into play.

Avoiding sub-$85 and the 200-day EMA would support a return to $100.

This article was originally posted on FX Empire