Investing legend Bill Miller says there are many good values in the market even after relief rally

It’s a good time to get the perspective of the recent market rally from legendary investor Bill Miller, who beat the S&P 500 SPX,

“No one knows how long the war in Ukraine will last nor what its outcome will be,” writes Miller in his latest market perspective. “No one knows how high inflation will go nor when it will begin to subside. No one knows if oil prices will stay over $100 or begin to decline or even double from here. No one knows how many times the Federal Reserve will raise rates nor what impact, if any, reducing its balance sheet will have on the economy.”

Miller attributed the change in sentiment to multiple factors: “market-friendly comments from Chinese officials, coupled with a well-signaled and discounted Fed rate hike of 25 basis points and some hope of progress for a negotiated settlement in the Russian war on Ukraine.” Perhaps that’s not much, but given the deep pessimism of short-term investors, it was enough.

Miller said there are many good values in the market, proceeding to tick off several.

A strong U.S. economy and a Fed that has started to lift rates will make it likely that a rotation to value from growth stocks has begun, while energy stocks don’t reflect oil prices in the $70s, much less $100s, he said. (The Miller Value Opportunity Fund he co-manages had Diamondback Energy FANG,

Chinese stock valuations are too low, particularly when the government is easing and wants to help the market. And housing stocks with valuations in the low-to-mid single digits don’t “reflect even a modest continuation of the current fundamentals, he said. (Taylor Morrison Home TMHC,

Miller said airlines and cruise ships should see years of strong demand due to robust consumer balance sheets and a solid economy (Norwegian Cruise Line NCLH was a top ten holding at the end of 2021), and mega-cap tech leaders like Amazon AMZN,

The chart

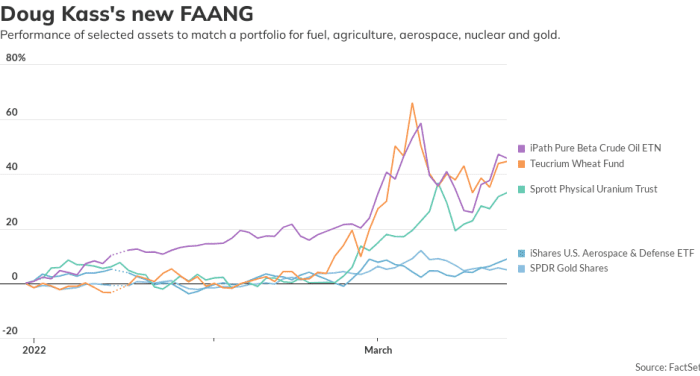

Doug Kass, the president of Seabreeze Partners Management, says there’s a new FAANG: F for fuel, one A for agriculture, another A for aerospace (as in aerospace and defense), N for nuclear and G for gold and critical metals.

A MarketWatch-compiled average of his new FAANG assets, equal weighted using popular exchange traded funds, yields a 27% return for 2022. Kass says he’s long the GLD exchange-traded fund and has invested in stocks in the other sectors, and expects supply/demand imbalances to keep boosting these themes.

The buzz

President Joe Biden embarks on a four-day trip to Europe as the West weighs more sanctions against Russia, which kept up its offensive against Ukraine.

General Mills GIS,

A badly damaged black box was found from the China Eastern Airlines Boeing BA,

Microsoft MSFT,

Federal Reserve Chair Jerome Powell makes his third public comments in a week, this time on a Bank for International Settlements panel on emerging challenges in a digital world. Cleveland Fed President Loretta Mester late Tuesday proposed front-loading rate hikes. New-home sales data is due at 10 a.m. Eastern.

The markets

U.S. stock futures ES00,

Top tickers

Here were the most active stock-market tickers as of 6 a.m. Eastern.

| Ticker | Security name |

| GME, |

GameStop |

| AMC, |

AMC Entertainment |

| TSLA, |

Tesla |

| MULN, |

Mullen Automotive |

| BABA, |

Alibaba |

| HYMC, |

Hycroft Mining |

| AAPL, |

Apple |

| CENN, |

Cenntro Electric |

| TLRY, |

Tilray Brands |

| NVDA, |

Nvidia |

Random reads

Ash Barty, the top female tennis player in the world, retires at the ripe old age of 25.

Goldman Sachs CEO David Solomon is taking his DJ skills to Lollapalooza.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.