Get ready for $900 billion of stock purchases this year, says Goldman Sachs. Here’s who’s buying.

Wall Street is looking a little less surefooted as a new week begins, with oil sliding as fresh COVID lockdowns in China adding to a hefty worry pile. Bonds continue to slump as well.

But maybe don’t bet against stocks, which have been regrouping since an early March pullback. “‘Less bad than feared’ is a valid trading thesis and it has rewarded everyone that had the courage to buy March’s bounce, said Jani Ziedens, blogger at CrackedMarket.

“While bad, our economy appears strong enough to survive rate hikes, inflation, oil prices, and a war in Europe,” he added.

And our call of the day from Goldman Sachs sees retail “diamond hands” and corporate buybacks driving stock purchases from herre.

“Diamond hands” is Reddit message board parlance for those investors who hold on to volatile assets, resisting pressure to sell. Goldman forecasts households will scoop up $150 billion in stocks this year, as that asset class still looks better than beaten-down bond yields. The bank’s economists see 10-year Treasury yields hitting 2.7% by year-end from 2.48% currently.

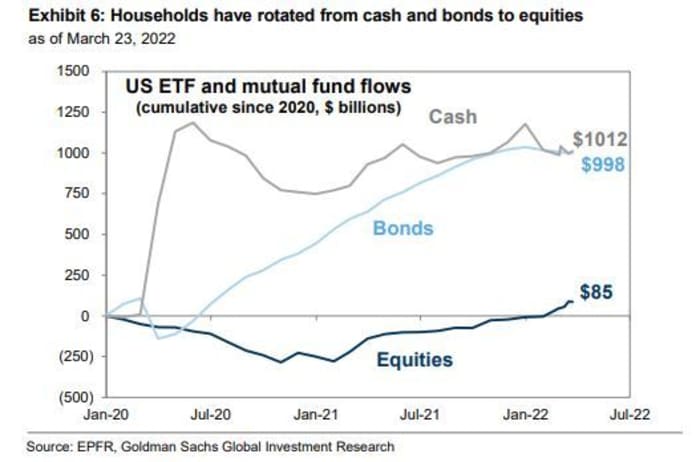

Households had already been rotating away from bonds and cash into equities year-to-date, with Goldman data showing equity funds have attracted $85 billion in flows since early 2020, against nearly $2 trillion for U.S. money market and bond funds.

The bank expects foreign buyers to scoop up $50 billion in U.S. equities, which look like a haven asset given the economic and geographic distance from the brutal conflict in Ukraine.

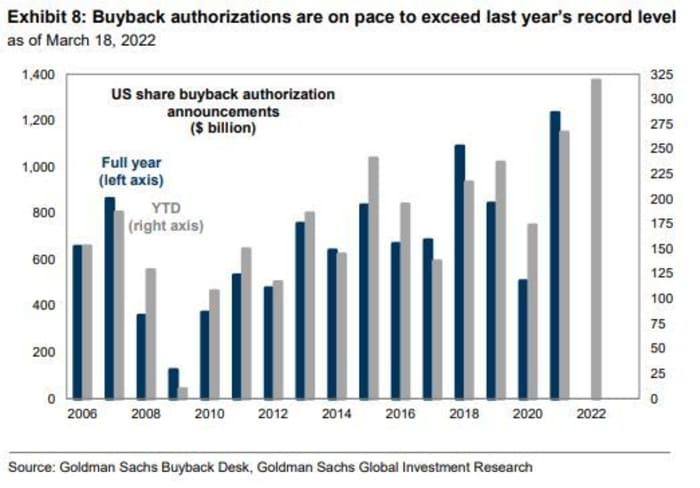

But the biggest source of stock buying for the rest of the year will come from the corporate side, with high cash balances and solid earnings growth supporting that demand. The bank expects all-time high net corporate equity demand of $700 billion for 2022.

Look to mutual and pension funds to supply $900 billion of that equity, said the Goldman team.

“Rising interest rates and strong trailing equity returns have likely aided the funding levels of U.S. pension funds,” said Goldman, which expects $400 billion in stock sales from that side. Mutual funds are likely to sell $500 billion as a shift from active to passive investing continues, Kostin and the team said.

The buzz

Tesla stock TSLA,

Stock in Poly POLY,

Financial hub Shanghai will lock down in two phases this week for citywide mass COVID tests, as cases surge. Among companies affected, Tesla TSLA,

The Russian offensive against Ukraine continues, but President Volodymyr Zelensky said his country could declare neutrality and offer security guarantees to Russia. Negotiators head back to the table in Turkey.

Highlights of a busy week for data include the Fed’s favorite inflation indicator and U.S. jobs numbers for March. Ahead of that, the February trade deficit in goods fell for the first time in three months.

Apple AAPL,

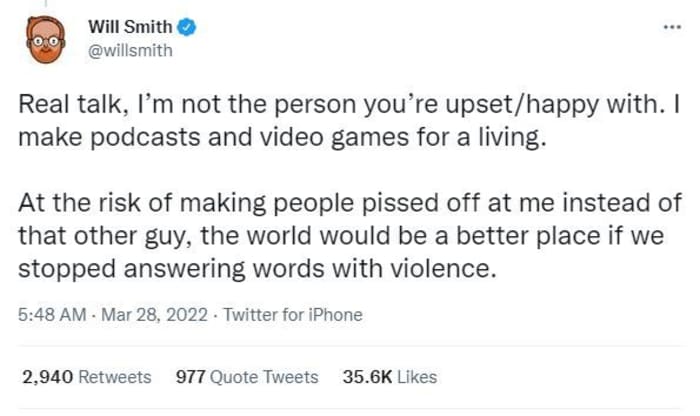

“CODA” delivered the first best-picture hit for Apple AAPL,

The markets

Stocks DJIA,

Top tickers

These were the top-searched tickers on MarketWatch as of 6 a.m. Eastern Time:

| Ticker | Security name |

| GME, |

GameStop |

| AMC, |

AMC Entertainment |

| TSLA, |

Tesla |

| NIO, |

Nio |

| MULN, |

Mullen Automotive |

| HYMC, |

Hycroft Mining |

| TLRY, |

Tilray Brands |

| AAPL, |

Apple |

| SNDL, |

Sundial Growers |

| NILE, |

Bitnile Holdings |

Random reads

Haunting, almost intact photos recovered from a 1857 ’ship of gold’ wreck.

Could those $140,000 Oscar swag bags gone to worthier causes this year? Some say yes.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.