Trouble Is Brewing Under the Stock Market’s Surface, BTIG Says

(Bloomberg) — Cyclical shares tied to the U.S. economy’s health including banks, homebuilders and transports are struggling against the broader stock market, a telltale sign that investors remain hesitant to pour money into riskier corners of the market, according to BTIG, a U.S. brokerage firm.

Most Read from Bloomberg

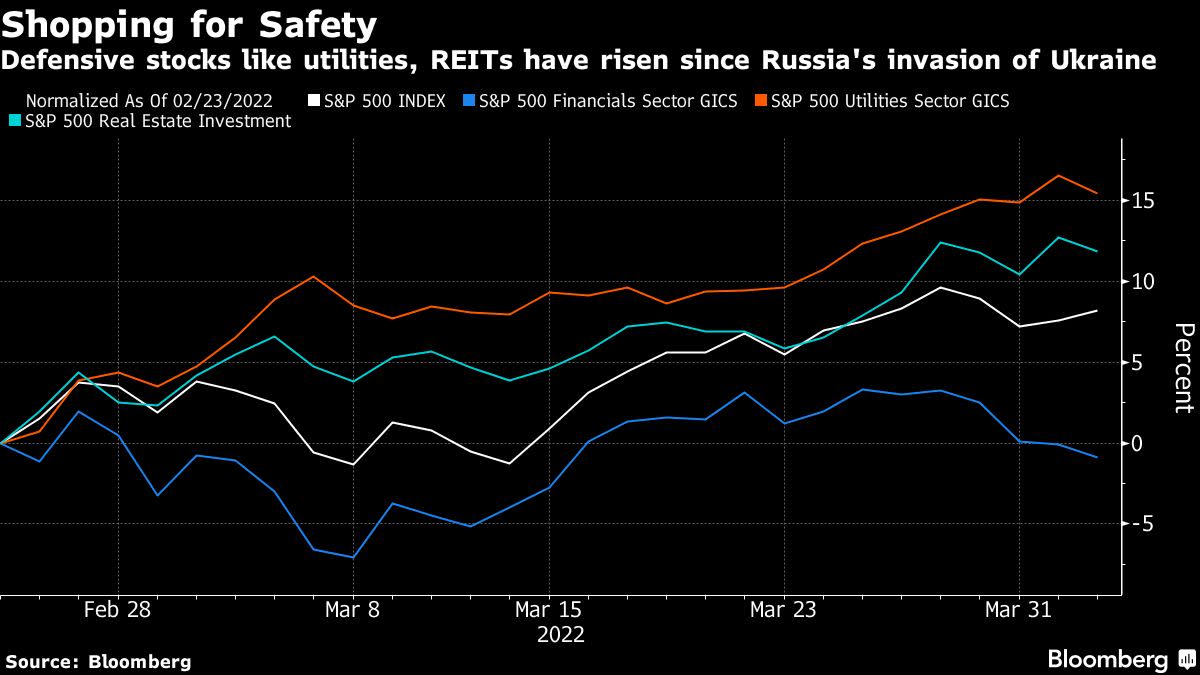

The S&P 500 Index has rebounded 8% since Russia’s invasion of Ukraine on Feb. 24. But sectors perceived as safer such as utilities and real estate have outperformed their cyclical counterparts this year, raising questions about the durability of the benchmark index’s latest rally as investors remain concerned about the trajectory of the global economy. In a note to clients called “Trouble Brewing Under The Hood,” BTIG said it maintains a cautious view broadly on U.S. equities.

“The late March rally broke the market’s downside momentum, but hasn’t thus far done enough to reverse it,” Jonathan Krinsky, chief market technician at BTIG, told clients. “The magnitude and velocity caused many bulls to declare the low is in, and while that could certainly be the case, when we look under the surface, the market is giving a pretty cautious message.”

The recent rally in utilities and REITs has occurred alongside a surge in Treasury yields. Last week, a key part of the yield curve inverted, with the U.S. two-year yield exceeding the 10-year for the first time since 2019. That has triggered worries of an eventual recession.

Investors who are hungry for yield tend to pour money into utilities and real estate in times of uncertainty because they typically pay higher dividends and have steady cash flow. Banks, however, have struggled during yield curve inversions since it can hinder their net interest margins since they’d be borrowing money at higher rates.

Read: Morgan Stanley’s Wilson Says ‘Bear Market Rally’ Is Now Over

In addition, the Philadelphia Semiconductor Index, which has climbed 4% in the past month, is testing support against the S&P 500 and is threatening to turn in a downtrend, Krinsky pointed out. Chip stocks, used in several hot areas of growth from data centers to artificial intelligence, were swept up in this year’s tech rout amid concerns over rising interest rates and supply shortages, but they have showed signs of demand recently. The Philadelphia Semiconductor Index has shed 14% in 2022.

To be sure, strategists at JPMorgan Chase & Co. think growth concerns are overblown and have called for more upside to stocks. BTIG’s cautious view on equities comes as Morgan Stanley said the recent rebound in the stock market will prove short-lived.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.