Russian Railways crashes into default as sanctions hammer Moscow – live updates

Russian Railways has been ruled in default on a bond after missing an interest payment last month in the latest sign that western sanctions are hammering Moscow.

The decision by the Credit Derivatives Determinations Committee comes after the state-owned company failed to make a payment to investors and a 10-day grace period expired.

Contracts insuring the company’s debt against default will be triggered, and holders will now wait to see how much will be paid.

The move, which is the first time a Russian debt instrument has been officially classified as defaulted since the invasion began, could set a precedent for other companies and even the government.

Scrutiny is growing over whether Russia will default on its sovereign bonds after Moscow made two coupon payments in roubles last week. Both notes have a 30-day grace period.

If Russia defaults, it will be the first time it’s happened since the Bolshevik Revolution in 1917.

03:05 PM

Handing over

That’s all from me for today – thanks for following along! Giulia Bottaro will take the reins from here.

02:54 PM

Nasdaq slumps 2pc as outlook darkens

US stocks have extended their declines in afternoon trading as investors focus on surging inflation and the looming threat of further interest rate rises.

Major tech companies led losses on the S&P 500, which the tech-heavy Nasdaq slumped 2pc. Oil prices declined as China’s latest Covid outbreak sparked fears about demand.

Sentiment continues to be driven by worries about the Federal Reserve’s plans for tightening monetary policy, commodity disruptions caused by Russia’s invasion of Ukraine and the prospect of an economic slowdown.

02:41 PM

UK visual effects giant Cinesite gears up for £300m sale

The British visual effects producer whose work includes latest James Bond blockbuster No Time To Die is said to be preparing for a sale that could value it at up to £300m.

London-based Cinesite has hired Goldman Sachs to explore options for the business amid a flurry of dealmaking in the sector, Sky News reports.

Cinesite was founded in Los Angeles in 1991 to work on a remake of the classic Walt Disney film Snow White and the Seven Dwarfs. Its more recent Hollywood hits include Spider Man: No Way Home and Rocketman.

The company is minority-owned by Gryphion Capital Investments, which backed it in 2019 alongside new debt facilities from Barclays and NatWest.

02:22 PM

Russia hits out at Google over ‘dead Russians’ auto-fill

Moscow has demanded that Google takes immediate steps to remove what it described as threats against Russians amid claims Google Translate suggested the phrase “dead Russians” instead of “dear Russians”.

The country’s communications regulator said that when “dear Russians” was typed into Google’s translator, it had also offered the variant “dead Russians” under the “Did you mean” section.

The regulator, known as Roskomnadzor, said it did not offer such variants for the phrase with other nationalities.

Google didn’t appear to be suggesting this variant when the Telegraph tried it out.

Roskomnadzor said it had told Google to “immediately take measures to exclude statements of threats against Russian users”.

02:07 PM

Energy sales drive Russia’s surplus to record high

Russia’s current account surplus has surged to the highest since at least 1994 as revenues from oil and gas exports surged and imports plunged in the wake of western sanctions.

Russia’s central bank said its current account reached a surplus of $58.2bn (£44.7bn) in the first quarter, more than 2.5 times the $22.5bn reported a year earlier.

While sweeping western sanctions are expected to trigger the biggest recession in decades, the measures so far haven’t targeted Russia’s all-important energy sector, keeping a key source of revenue to the Kremlin alive.

However, a slump in imports is contributing to Russia’s surging inflation and hitting living standards for ordinary citizens.

01:48 PM

Elon Musk ‘reserves right’ to buy more Twitter shares after shunning board

Now that he’s no longer joining Twitter’s board, Elon Musk may buy up more shares in the social media company.

The billionaire’s abrupt reversal over taking up a board seat has fuelled more speculation over his intentions for Twitter since becoming its largest shareholder.

By not becoming a director, Mr Musk is no longer bound by an agreement to keep his stake at no more than 14.9pc.

According to a filing today, the Tesla boss has no “present plans or intentions” to acquire additional shares, but “reserves the right to change his plans at any time”.

The filing also said Mr Musk could engage in discussions with the board about potential mergers and strategic alternatives.

And, in an eyebrow-raising detail for the prolific tweeter, the filing noted that he can express his views to the board “or the public through social media or other channels.”

Read more: ‘For the best’: Twitter chief welcomes Elon Musk’s decision not to join board

01:37 PM

Wall Street opens lower amid interest rate worries

Wall Street has started the week on the back foot as worries over higher interest rates hit major tech stocks.

The S&P 500 dropped 0.6pc and the Dow Jones was down 0.3pc. The tech-heavy Nasdaq was the hardest hit, tumbling 1.2pc.

01:26 PM

Fuel supplies disrupted as protests continue

There’s been further disruption to fuel supplies for petrol stations as environmental protests continued to target key oil terminals.

Howard Cox, founder of Fair Fuel UK, said hundreds of motorists had had problems filling up their vehicles in recent days because of protests. He added that shortages primarily involved diesel and occurred mainly south of the Midlands.

Earlier, as many as 12 people were locked to pipework at the Inter Terminal in Essex while others occupied a tunnel near Warwickshire’s Kingsbury Oil terminal, according to environmental group Just Stop Oil.

It’s the eleventh day of protests, during which Essex and Warwickshire police have arrested more than 500 people so far.

A spokesman for the UK Petroleum Industry Association said:

The ongoing protest activity is affecting some deliveries, but disruptions are localized and short-term only. Fuels continue to be delivered, meaning stocks are being replenished.

01:03 PM

Cardboard crisis looms as Putin’s war threatens packaging shortages

One of the world’s biggest paper makers has warned of shortages as mills scramble to secure enough wheat – a key part of the manufacturing process.

Howard Mustoe has more:

Starch from wheat, potatoes and other food is used to make paper for packaging. Wheat and starch prices have soared this year, risking the possibility of shortages, and governments are likely to have to prioritise food over paper if the situation persists.

Paper is becoming more common for food packaging and a shortage could mean a return to single-use plastics, which are harder to recycle.

Alex Manisty of DS Smith, the FTSE 100 packaging giant, said: “Corrugated board for cardboard boxes is absolutely critical for the food and drinks supply chain.

“The worry is that when we get into next year that there might be shortages. For big companies like us we have contracts in place, but it is definitely something that could be an issue.”

12:48 PM

Oil prices slump 5pc on China Covid fears

Oil’s losses have deepened this afternoon, with prices dropping more than 5pc as Covid lockdowns in China spark jitters about demand.

Benchmark Brent crude slumped below $98 a barrel to its lowest level in a month, while West Texas Intermediate hit a six-week low under $94.

Shanghai is entering its third week of lockdown amid a resurgence in Covid cases in the city, raising concerns that demand could cool.

Meanwhile, traders are also weighing up dimming hope of a European ban on Russian oil imports.

12:35 PM

Apple faces extra charge in EU streaming probe

Apple is said to be facing an additional EU antitrust charge in the coming weeks as part of an investigation into music streaming triggered by a complaint from Spotify.

The European Commission last year accused the iPhone maker of harming competition in the music streaming market through App Store rules that force developers to use its own in-app payment system. Regulators in the US and UK are also looking into the issue.

Extra charges, reported by Reuters, are usually issued to companies when the watchdog has gathered new evidence or has modified some elements to boost its case.

12:18 PM

Pod Point inks charging deal with BMW

Pod Point has secured a deal with BMW to become the preferred supplier of domestic charging points.

The three-year contract means the German car manufacturer will refer its UK customers to Pod Point when they buy a BMW or Mini electric vehicle.

Shares in the London-listed firm jumped as much as 6.6pc following the announcement.

11:10 AM

Wall Street set to open in the red

Wall Street looks set to follow the FTSE into the red this afternoon as political and economic risks weigh on sentiment.

US stocks are pointing lower, suggesting there’ll be more pressure on global shares after the Federal Reserve last week signalled sharp interest rate rises and balance sheet reduction to curb soaring inflation.

Futures tracking the benchmark S&P 500 fell 0.5pc, while the Dow Jones was down 0.2pc. The tech-heavy Nasdaq slumped 1pc.

10:57 AM

Staycations out of favour as holidaymakers head for the Med

Going for a dip off the picturesque Cornish coast may sound picture-perfect, but for many British families it is not enough to be tempted away from foreign getaways this year.

While pandemic-induced travel restrictions brought about the rise of the “staycation”, swathes of families are now once again opting for holidays in far-flung destinations.

Hannah Boland reports:

Staycations out of favour as holidaymakers head for the Med

10:46 AM

Gas prices fall as Russian flows stay stable

Natural gas prices have declined for the seventh straight session, with Russian flows to Europe continuing undisturbed as the war in Ukraine grinds on.

Orders for Russian gas shipments via Ukraine edged higher today, but remained below capacity, while the Yamal-Europe pipeline continued to flow eastwards to Poland from Germany.

Levels of gas flowing through the main Nord Stream pipeline remain high and stable.

While the EU last week agreed to ban coal imports from Russia, gas has so far escaped sanctions – largely due to Europe’s heavy reliance on Russian imports.

Benchmark gas prices fell 2.2pc, while the UK equivalent was down 4.4pc.

10:34 AM

AIG weighs cutting insurance cover for Russia and Ukraine

Insurance giant AIG is said to be considering cutting cover for Russia and Ukraine to shield itself from hefty claims as sanctions intensify and the war drags on.

AIG is looking at adding exclusion clauses to policies for businesses operating in the region across a range of policies, Reuters reports. Other major insurers are also said to be looking to exclude Russia, Ukraine and even Belarus from their policies.

If AIG were to cut back cover for businesses and companies operating in Russia and Ukraine it would be the first major insurer to do so, potentially paving the way for others to follow suit.

While many companies have suspended operations in Russia or pulled out completely, some multinationals are still doing business there, as well as in Ukraine, in sectors ranging from agriculture to energy. They require insurance to keep their businesses open.

Local companies also rely on insurance for damage to goods, buildings and vehicles and for injury or loss of life of employees.

10:13 AM

Oil slumps as China lockdowns spark demand worries

Oil prices have continued their decline this morning as China’s Covid resurgence worsened, fuelling fears of lower demand from the world’s biggest importer or crude.

Benchmark Brent crude fell 2.3pc to hover just above $100 a barrel, while West Texas Intermediate was trading below $96.

Oil has now wiped out most of its gains since Russia’s invasion of Ukraine as the market continues to be gripped by volatility.

Fresh lockdown measures in Shanghai, as well as emergency oil releases by the US and IEA, have cooled wholesale prices, which jumped to almost $140 last month.

10:04 AM

Russian Railways ‘in default’ over missed bond payment

Russian Railways has been ruled in default on a bond after missing an interest payment last month – the first such decision since Moscow was slapped with tough sanctions.

A failure-to-pay credit event occurred after a coupon due on March 14 failed to reach investors by the end of a 10-day grace period, according to the Credit Derivatives Determinations Committee.

Contracts insuring the company’s debt against default will be triggered, and holders will now wait to see how much will be paid.

The decision comes as investors focus on whether the country’s sovereign bonds will default after Russia made two coupon payments in roubles last week, even though the notes didn’t allow for it. Both notes have a 30-day grace period.

If Russia defaults, it will be the first time it’s happened since the Bolshevik Revolution in 1917.

09:51 AM

There’s no reason for a Russian debt default, says Kremlin

The Kremlin has once again insisted that Russia has the resources to pay its debt, meaning there was no objective reason for a default.

Kremlin spokesman Dmitry Peskov said: “There can only be a technical, man-made default.

“There are no objective reasons for such a default. Russia has everything it needs to fulfil all its obligations.”

Russia has edged closed to default after sanctions forced it to pay dollar bondholders in roubles. The cost of insuring the Kremlin’s debt now signals a record 99pc chance of default within a year.

Earlier today Moscow halted bond sales for the rest of the year, warning borrowing costs would be “cosmic”.

09:45 AM

Warehouse industry doubles amid online shopping boom

The UK’s transport, logistics and warehousing industry has almost doubled since 2011 thanks to surging demand for online shopping.

A report from the ONS shows the industry has grown by a fifth since the start of Covid alone, making it Britain’s fastest-growing sector.

It grew at twice the pace of information and communication – despite the continued growth of tech – and eight times faster than retail overall.

In 2021, the number of UK business premises classified as “transport and storage” was 88% higher than in 2011 and 21% higher than in 2019.

Transport and storage includes:

▪️passenger transport

▪️haulage

▪️warehousing

▪️and postal and courier activities. pic.twitter.com/YGMxA68XT5— Office for National Statistics (ONS) (@ONS) April 11, 2022

09:38 AM

Glencore regains IPO price after 11 years

Glencore is trading back above its initial offering price for the first time since 2011 as Russia’s invasion of Ukraine continues to drive up commodities prices.

Shares rose above 530p this morning, having surged 42pc this year.

Nearly all the company’s most important commodities are trading at or near record levels, with markets in turmoil as the war and ensuing sanctions fuel fears over supply.

The share price growth also comes after a strong year for the world’s largest commodities trader. Glencore reported record profits in February and announced $4bn (£3bn) in share buybacks and dividends.

09:19 AM

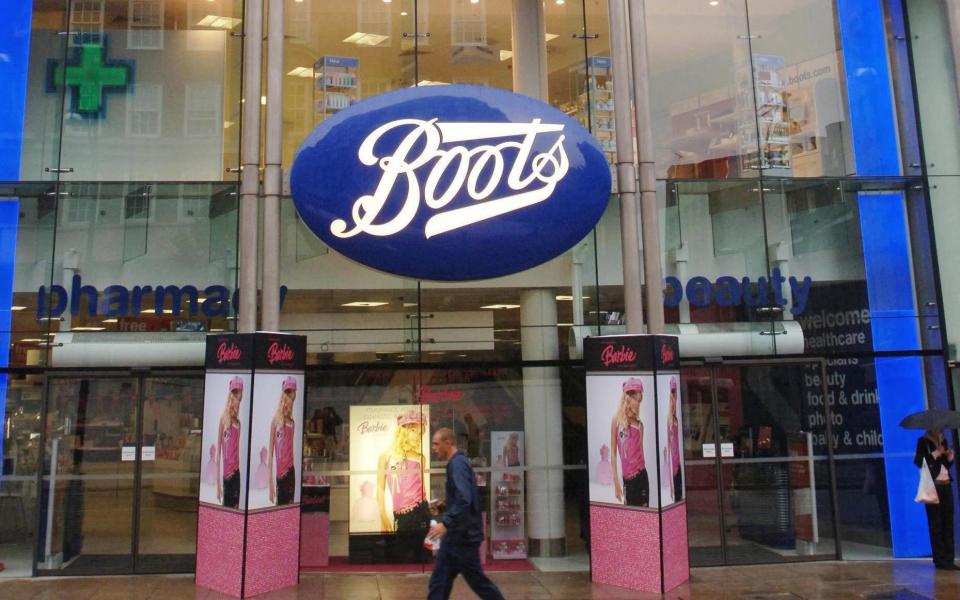

American owner set to lose billions on Boots sale

ICYMI – The American owner of Boots risks losing billions after the one-time favourite to buy the chemist chain valued the retailer at a steep discount.

Oliver Gill has the story:

Buyout funds CVC and Bain indicated that they were willing to pay just £4bn for the business, according to City sources. The consortium bowed out of the running last month. A spokesman for Boots said that the pair did not lodge a formal offer.

Walgreens, the US retail giant, took control of Boots in 2014 in a deal worth £9bn. It has put a £7bn price tag on the UK chain after selling its wholesale arm last year.

The low valuation is significant because CVC’s UK head is Dominic Murphy, who sits on the board of Walgreens and has been involved with Boots for 15 years.

CVC and Bain were the early frontrunners after Walgreens hired Goldman Sachs to sell Boots at the end of last year. “He [Mr Murphy] knows where the bodies are buried,” said one City source.

09:02 AM

Pound falls as economic growth falters

Sterling has lost ground against both the dollar and euro after new data showed the UK economy slowed more sharply than expected in February.

GDP rose 0.1pc that month, down from 0.8pc in January and below expectations of 0.2pc.

The pound dipped 0.1pc against the dollar to $1.3025 after briefly falling below $1.30, remaining not far from its lowest level since November 2020. Against the euro it was down 0.4pc at 83.75p.

Despite the grim outlook for the economy, markets are still expecting the Bank of England to raise interest rates at its meeting next month.

08:44 AM

EU leaders working on Russian oil embargo

The EU is drafting proposals for a potential ban on Russian oil imports, bloc officials have said.

Simon Coveney, Ireland’s foreign minister, said the European Commission was “working on ensuring that oil is part of the next sanctions package”.

His Dutch and Lithuanian counterparts also said the bloc was looking at ways at targeting Russian oil – which makes up about a quarter of the EU’s crude imports – as a means to pressure Russia to halt the shelling of Ukrainian cities.

The EU last week announced an embargo on Russian coal, but is yet to roll out wider sanctions against the Kremlin’s energy sector.

While calls have been growing for a ban on oil and gas, the move has faced opposition from Germany, which is heavily reliant on Russian imports.

08:30 AM

Twitter shares slide after Elon Musk backs out of board

Twitter shares have slumped as much as 8pc in pre-market trading after the company said Elon Musk had decided not to join its board.

The U-turn will ignite fresh speculation about the billionaire’s intentions for Twitter. If he doesn’t join the board, the Tesla tycoon won’t be subject to an agreement to keep his stake at no more than 14.9pc.

Read more: Elon Musk will no longer join Twitter’s board

08:24 AM

Pret A Manger to open 20 stores across Ireland

Pret A Manger is set to expand into the Republic of Ireland and Northern Ireland for the first time, opening 20 shops over the next decade.

The coffee chain said the deal with franchise partner Carebrook Partnership will create around 500 jobs. The first site will open on Dawson Street in Dublin this summer.

Carebook is one of Pret’s longest-serving franchise partners, working with the business for more than three decades and overseeing many outlets in London, including Camden, Belsize Park and Finchley.

It comes after the chain last year it planned to double the size of the business within five years, including launching in five new markets by the end of 2023.

Pano Christou, chief executive of Pret A Manger, said:

Setting up shop in the Republic of Ireland and Northern Ireland has been our plan for a long time, and we’re thrilled that we’re finally able to make it happen.

There has long been demand from our neighbours on the island of Ireland to bring Pret’s freshly prepared food and organic coffee, and now with the backing of Carebrook Partnership we’re able to do so. We look forward to making this partnership a success.

08:12 AM

Rouble drops as Russia relaxes some capital controls

The rouble has dropped sharply in volatile trading this morning after Russia relaxed some capital control measures aimed at propping up the currency.

The central bank said it will scrap a 12pc commission for buying foreign currency through brokerages from April 11 and lift a temporary ban on selling foreign exchange cash to individuals from April 18.

The rouble fell nearly 5pc in early trading to 79.90 against the dollar, while it was 4.3pc down against the euro at 86.35.

Moscow is still keeping the rouble supported by forcing companies to convert 80pc of foreign exchange revenues, as well as high interest rates.

07:54 AM

SocGen to sell Rosbank stake as it pulls out of Russia

Societe Generale will take a hit of about €3bn (£2.5bn) after agreeing to sell its Rosbank stake to Russia’s richest businessman.

The Paris-based bank has agreed to sell its entire holding in the Russian lender and its insurance subsidiaries to Interros Capital, the investment firm run by Vladimir Potanin.

SocGen said it’s sticking to its plans for a stock buyback of €915m and 2021 dividend of €1.65 a share despite the financial hit. Shares rose almost 6pc as the deal removed uncertainty over the bank’s Russia exit.

Mr Potanin has a net worth of €29.6bn and is the world’s 43rd richest person, according to Bloomberg. He is president of Norilsk Nickel and has a stake in Russian company Petrovax Pharm.

The oligarch had avoided sanctions by western governments until Canada recently added him to its sanctions list.

07:40 AM

Heathrow has busiest month since pandemic began

Passenger numbers at Heathrow Airport bounced back to their highest since the pandemic began last month thanks to the easing of Covid restrictions.

Heathrow said outbound leisure travel had recovered strongly, but that inbound leisure and business travel remained weak due to high levels of infections and testing requirements for travellers leaving the country.

The transport hub also warned it was unclear whether the current surge in holiday demand was sustainable due to concerns over new variants, high fuel prices and a cost-of-living crisis.

Heathrow is one of a number of airports that have struggled with staff shortages amid Covid-related absences and a surge in demand. It said it was increasing resources as quickly as possible, with 12,000 new starters planned across the airport.

07:30 AM

FTSE risers and fallers

It’s a lacklustre start to the week for the FTSE 100, which has been dragged down by sluggish GDP figures for February.

The blue-chip index has extended early losses to drop 0.5pc, having capped off its fifth weekly gain on Friday.

Oil heavyweights BP and Shell both tumbled 0.9pc while miners including Anglo American and Rio Tinto lost ground, as Covid lockdowns in China dragged down oil and metal prices.

Consumer staple stocks including Unilever and AstraZeneca were also firmly in the red, bringing down the index.

It came after the latest GDP figures showed the economy expanded just 0.1pc in February, with a slump in manufacturing denting progress.

The domestically-focused FTSE 250 slipped only marginally. John Wood jumped around 6pc to the top of the mid-cap index after an upbeat trading update.

07:25 AM

Elon Musk will no longer join Twitter’s board

Tesla founder Elon Musk has decided not to join Twitter’s board, the social media firm’s chief executive tweeted, an unexpected twist to a saga that’s captivated the online community for days.

Musk had held discussions with Twitter’s directors but the entrepreneur ultimately declined their offer of a board seat, Chief Executive Officer Parag Agrawal tweeted. “I believe this is for the best,” the Twitter chief executive said in an internal memo he shared.

07:05 AM

IoD: Production weaknesses a ’cause for concern’

Kitty Ussher, chief economist at the Institute of Directors, says there are worrying signs that underlying demand is weakening.

We have become used to the economic news following the path of the pandemic, and there are elements of this in today’s GDP data for February: a reduction in activity from the scaling back of the Test-and-Trace programme and an increase from the loosening of remaining travel restrictions, particularly for February half term.

However, today’s data may also contain early signs that underlying demand in the economy is weakening, with output in the production sector falling by 0.6pc in February, and particular difficulties in car, electronic and chemical manufacturing.

If this weakness is due to the unavailability of components, then it may correct itself in future although the escalation of the conflict in Ukraine will make that harder in the short-run.

However, if it is due to falling demand from the end consumer, worried about the rising cost of living, then there may be further economic clouds on the horizon in the months ahead.

07:01 AM

FTSE 100 dips at the open

The FTSE 100 has started the week on the back foot after disappointing GDP data for February.

The blue-chip index fell 0.3pc at the open to 7,647 points.

06:57 AM

Expert reaction: Risk of contraction amid cost-of-living crunch

Ruth Gregory, senior UK economist at Capital Economics, says the post-Christmas economic slowdown was even quicker than expected.

The news that the economy was hardly growing at all in February suggests the economy had a little less momentum in the first quarter than we had previously thought, and increases the risk of a contraction in GDP in the coming months as the squeeze on household real incomes intensifies […]

The pace of the recovery was already going to slow once the post-omicron bounce faded and the squeeze on household real incomes intensified. But we hadn’t expected it to slow so much so soon.

We now think the economy may have grown by 1pc quarter-on-quarter in the first quarter as a whole, down from our previous estimate of 1.1pc. And the risks for our economy to grow by 0.2pc quarter-on-quarter in the second quarter are tilted to the downside.

Even so, with high inflation feeding through into higher price/wage expectations, we doubt this will prevent the Bank of England from raising interest rates further to 1pc at its next meeting on 5 May, and to 2pc next year.

06:53 AM

ONS analysis

Darren Morgan at the ONS said:

The economy was little changed in February with the easing of restrictions for overseas travel – an increased confidence in booking holidays in the UK – triggering strong growth in travel agencies, tour operators and hotels.

This was partially offset by the reduction of the Test and Trace vaccination programmes, which made a strong contribution to GDP at the start of the year.

Manufacturing fell notably, with motor manufacturers continuing to struggle to source parts. With today’s growth, the economy now stands 1.5pc above its pre-pandemic level.

06:48 AM

UK economy held back by manufacturing slump

Closer to home, there’s new data out this morning showing the UK economy grew less than expected in February after industrial production and construction shrank.

GDP ticked up 0.1pc, down from a January’s 0.8pc gain and below expectations of 0.2pc, according to the ONS. It means the UK economy is 1.5pc above its pre-pandemic level in February 2020.

There was growth in the services sector as the easing of Covid restrictions helped drive more tourism activity.

But manufacturing dropped unexpectedly, driven by shortages that hit output from car makers. Construction also fell, driven by a decrease in repair and maintenance work.

06:36 AM

World Bank: Forecasts are ‘very sobering’

Anna Bjerde at the World Bank said:

The results of our analysis are very sobering. Our forecasts show that the Russian invasion in Ukraine has reversed the region’s recovery from the pandemic.

This is the second major shock to hit the regional economy in two years and comes at a very precarious time for the region, as many economies were still struggling to recover from the pandemic.

Read more on this story: Russians slash their spending as sanctions batter the economy

06:32 AM

War to ravage Ukraine economy

Good morning.

The World Bank has issued dire forecasts for both Ukraine and Russia this year as a result of the war, warning the outlook could get even bleaker if the conflict drags on.

Ukraine’s economy will collapse by 45.1pc this year, the bank predicted, far worse than the 10pc to 35pc downturn the IMF projected last month. Russia’s GDP is expected to decline 11.2pc.

In a more pessimistic scenario, which reflects an escalation of the conflict, there would be a larger negative impact on the euro area, increased western sanctions and a financial shock due to eroding confidence.

The region’s economy would contract by nearly 9pc – worse than the 2008 global financial crisis – with a 20pc decline for Russia and a 75pc collapse for Ukraine, the report said.

5 things to start your day

1) Up to 40,000 civil service jobs face the axe: The number of civil servants has jumped by more than a fifth to 485,000 in the past seven years in response to Covid and Brexit

2) Russians slash their spending as sanctions batter the economy: Spending falls by 10pc as economists expect Russia to be hit by a deep two-year recession

3) Airlines brace for £100m bill from Easter travel chaos: Further flight cancellations are expected over the next week as Easter travel chaos continues

4) Ambrose Evans-Pritchard: Marine Le Pen’s national socialism is a potent political brew: The economic agenda of Emmanuel Macron’s opponent is a celebration of the welfare state and the French social model

5) Twitter must wean itself off advertising, says Elon Musk: Biggest shareholder calls for price cuts and improvements to Twitter’s paid-for subscription service

What happened overnight

Asian shares dropped on Monday, while the euro edged up a fraction as the far right lost the first round of the French presidential elections.

Japan’s Nikkei plummeted by 0.6pc after shedding 2.6pc last week, while Chinese blue chips lost 1.8pc.

Coming up today

-

Corporate: Sirius Real Estate (trading statement)

-

Economics: GDP (UK), industrial production (UK), manufacturing production (UK), consumer price index (China)