This is how much you made if you bought into the oil crash 2 years ago

If you want to retire rich, the late, great Dan Bunting has some advice for you.

“Always buy the market (i.e., stocks or even just the index) after a spectacular bankruptcy,” my old friend Bunting, a veteran London-based money manager who had seen it all, used to say. It was one of the accumulated items of wisdom he called Bunting’s Laws.

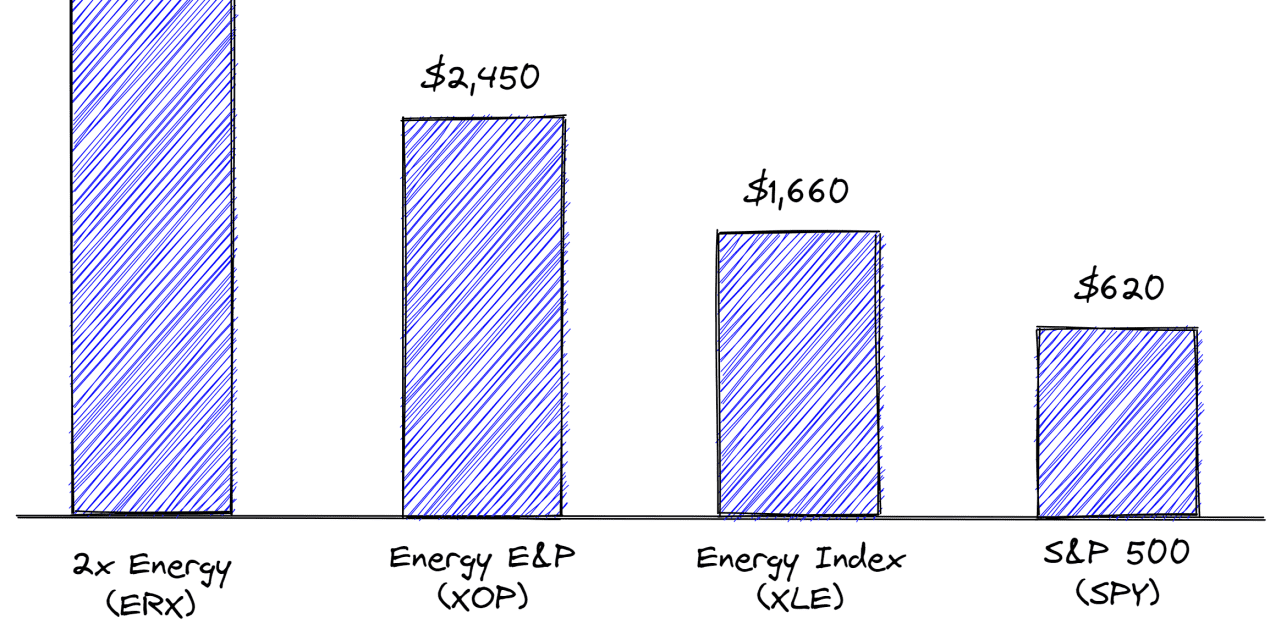

The chart above gives an updated version.

Readers will remember that almost exactly two years ago, on April 20, 2020, the oil market collapsed into negative territory for the first time in history. The sudden COVID-19 crisis and global lockdowns had created such a glut that traders actually had to pay people to take immediate delivery of all their surplus barrels of crude oil.

This grabbed headlines everywhere.

What kind of idiot would have gone against the market and bought oil in such a crisis? Someone who had been around, that’s who. Dan, alas, is no longer around but I am pretty certain he’d have been buying blue chip oil stocks back then.

What goes around comes around. The first shall be last, and the last shall be first. The collapse of oil ranked with a spectacular bankruptcy—the kind of thing that makes ordinary investors sell in a panic.

The chart above shows how you would have done if you’d gone out that day and bought any of several oil-related exchange-traded funds.

They’ve crushed the S&P 500 SPY,

Oh, and so much for the “work from home” trade. The Nasdaq Composite has done slightly worse than the S&P 500 index. And Amazon AMZN,

Granted, some of these profits are rewards for genuine risk. The Direxion Daily Energy Bull 2x Fund ERX,

The SPDR Oil & Gas Exploration & Production ETF XOP,

What strikes me as most interesting is the SDPR Energy Select Sector ETF XLE,

(This is not even counting the argument that we should all own energy stocks to hedge our own personal exposure to energy costs and inflation — as now.)

Yet in the early months of 2020 it also crashed, and anyone who shifted some of their portfolio into it on the day oil went negative has made triple the returns of the broader stock market index.

(Most of those gains were made before Putin invaded Russia, too.)

I’d argue that those gains far outweighed the risks of buying, say, Exxon back when it had a dividend yield of 11%.

Many people stick to simple portfolio strategies, based on long-term buy and hold positions in broad indexes. There is, of course, nothing whatsoever wrong with that. For most of us it’s probably the smartest approach.

But sometimes the best returns can come from betting against a crisis.