You need to pay more attention to dividends — this math shows why

CHAPEL HILL, N.C. – One of the best bear-market-protection strategies is hidden in plain sight: Dividend-paying stocks.

Most investors pay little attention to them. Because the stock market’s dividend yield in recent years has been at record low levels, traders interested in turning a quick buck aren’t interested. The financial media doesn’t help matters much, since dividends typically don’t change very much from quarter to quarter and are therefore considered boring.

Yet it’s precisely their boring nature that makes dividends attractive. Because companies are loathe to cut their dividends, their yields will increase during bear markets. A steady stream of dividends goes a long ways toward giving us the discipline and fortitude to hold on to stocks through a downturn.

Perhaps the best recent example of this comes from Exxon Mobil, XOM,

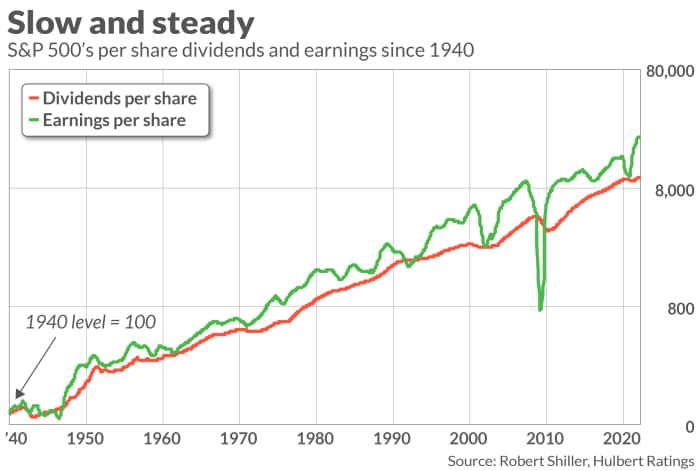

ExxonMobil’s case may be extreme, but nevertheless more the rule than the exception. When focusing on all rolling 12-month periods since 1940, the S&P 500’s SPX,

Another attractive feature of dividends is that they usually grow faster than inflation. Based on an average of all rolling 12-month periods since 1940, DPS growth has outpaced inflation by 2.4 percentage points per year.

Don’t think that these impressive inflation-adjusted returns trace to earlier decades when share buybacks were less of a factor. Since 1990, when share repurchases have been a major substitute for dividends among companies wanting to return cash to shareholders, DPS 12-month growth rates have been 3.2 percentage points higher than inflation.

An alternative to the 10-year Treasury

It’s dividends’ historical tendency to outperform inflation that makes dividend-paying stocks an attractive alternative to 10-year Treasurys. This advantage may not be evident to the short-term trader, given that the 10-year yield TMUBMUSD10Y,

Consider the cost-benefit calculation for buying a 10-year Treasury versus the S&P 500 Dividend Aristocrats ETF NOBL,

Assuming that the growth of S&P 500 Aristocrats’ DPS outpaces inflation over the next decade by the same margin as historically, and assuming that the CPI increases over the next decade at what the inflation-expectations model from the Cleveland Federal Reserve is currently projecting, then this ETF’s total dividend payments over the next 10 years will almost precisely match the 10-year Treasury’s total interest payments.

But that’s only half the picture. With the Dividend Aristocrats you also own shares of established blue-chip companies. Insofar as their price-only return over the next decade is even modestly positive, you will be significantly ahead of the U.S. Treasury.

With this thought in mind, I turned to my firm’s database of top-performing investment newsletters. The list below contains those S&P 500 Dividend Aristocrats that currently are also recommended for purchase by at least two of these top performers.

| Stock | Ticker | Number of newsletters recommending it |

| Cardinal Health | CAH | 4 |

| International Business Machines | IBM | 4 |

| 3M | MMM | 3 |

| Abbott Laboratories | ABT | 2 |

| Air Products & Chemicals | APD | 2 |

| General Dynamics | GD | 2 |

| Johnson & Johnson | JNJ | 2 |

| Medtronic | MDT | 2 |

| Procter & Gamble | PG | 2 |

| T Rowe Price | TROW | 2 |

| Target | TGT | 2 |

| Walgreens Boots Alliance | WBA | 2 |

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected].

More: These 10 dividend stocks with yields of at least 5% can help you take on stagflation or a recession