2 ‘Strong Buy’ Stocks Showing Monster Growth

Today’s financial world presents investors with a challenging environment. But even though markets are tough to interpret right now, and volatility has increased as a result, a smart investor can still find stocks that are delivering the goods. Sometimes, quite literally.

Two shipping company stocks have been showing high share price appreciation in recent months. These are sustained gains, that have far outpaced the S&P 500’s year-to-date performance. While we all know that past performance won’t guarantee future results, the best place to start looking for tomorrow’s high-growth stocks is among yesterday’s winners.

We ran the tickers through the TipRanks database to get a feel for what the Street has in mind for these names; turns out both are rated as Strong Buys. Let’s take a closer look.

Ardmore Shipping (ASC)

In business since 2010, Ardmore is a shipping company providing voyage charters, time charters, and commercial pool vessels. The company’s fleet of 25 product and chemical tankers averages only 6 years of age, making it one of the industry’s most modern. In keeping with its commitment to maintaining a modern fleet, in early April Ardmore announced the sale of three vessels – all built in 2008, and so well over the fleet’s average age – to Leonhardt & Blumberg. The sale, for $40 million, will net Ardmore some $15 million in cash proceeds.

Ardmore focuses on the transport of petroleum products and other chemicals to customers worldwide. Its tanker fleet ranges from 25,000 to 50,000 deadweight tonnes, and its relatively young age makes it more fuel-efficient than is commonly found in the industry, an advantage for Ardmore at a time of rising fuel prices.

Year-to-date, shares in ASC are up 83%. The company has managed this even though quarterly revenues have not yet returned to pre-COVID levels. In the most recent quarter reported, 4Q21, Ardmore had $52.5 million at the top line. This was up 25% year-over-year, but was still down 13% from the fourth quarter of 2019, before the pandemic. The company ran a quarterly net loss of 25 cents, in line with expectations and a 35% improvement from the year-ago quarter. Ardmore finished 2021 with $67 million in available liquid assets, a total that included $55.4 million in cash and cash equivalents as well as $11.6 million in undrawn credit.

Covering this stock for H.C. Wainwright, shipping industry expert Magnus Fyhr takes an upbeat stance. He notes that the company’s shares are rising, and writes, “Despite the appreciation, we believe ASC is attractively valued trading at a 40% discount to our estimated NAV compared to an 18% discount for the tanker peer group. In addition, with the product tanker market recovery gaining momentum, we believe the risk/reward remains attractive. Furthermore, with a high-quality fleet, we believe Ardmore is well positioned to capitalize on stricter environmental regulations as older tonnage is marginalized.”

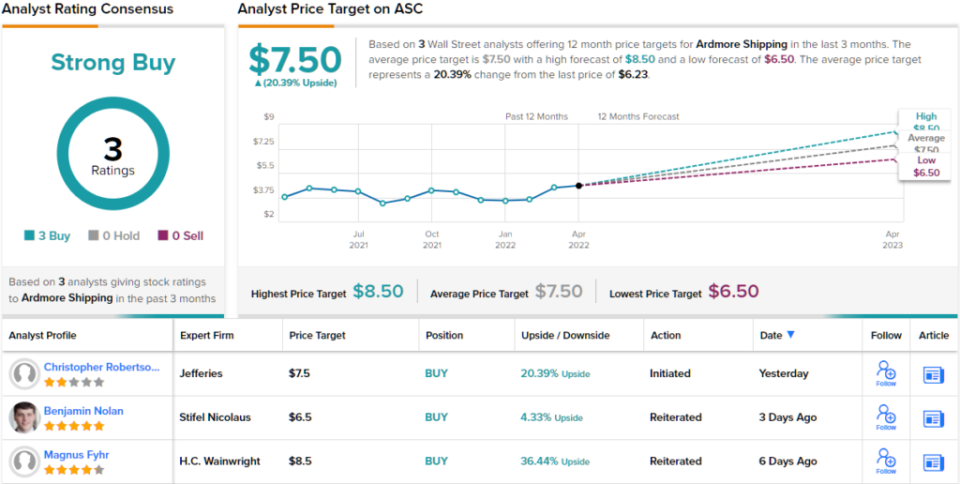

In line with these comments, Fyhr rates ASC a Buy along with an $8.50 price target. Additional gains of ~36% could be heading investors’ way should the target be met over the next 12 months. (To watch Fyhr’s track record, click here)

Small-cap shippers like Ardmore don’t always get the attention they may deserve – but all three of the analyst reviews here are positive, making the Strong Buy consensus rating unanimous. ASC shares are priced at $6.24 and their average target of $7.50 implies a one-year upside of ~20%. (See ASC stock forecast on TipRanks)

International Seaways (INSW)

Next up is International Seaways, another small-cap shipper – but a step up in size, as International boasts a market cap of $1.1 billion. International owns and/or operates a fleet of 88 vessels, ranging in size from 36,000 deadweight tonne (DWT) handymax tankers to giant 300,000+ DWT very large crude carriers (VLCCs) and to two even bigger 432,000 DWT floating storage and offloading (FSO) vessels. The company focuses its operations on the carriage of crude oil and petroleum products on the global sea lanes.

Compared to pre-pandemic levels – that is, to 2019, before the supply chain and trade disruptions began – International’s revenues remain depressed. However, they are rebounding from the lows hit during the COVID crisis, and registered sequential quarterly gains in 2H21. The company finished last year with a 4Q top line of $93 million, up an impressive 75% year-over-year. For 2021 as a whole, International posted revenues of $255.9 million. While this was down 36% y/y, it’s important to note that the company’s revenues bottomed out in 1Q21, and have been trending up since then.

In another point of importance for investors, International has realized some $25 million in cost synergies in the first few months of 2022, related to the company’s merger last year with Diamond Shipping. That merger made International one of the largest diversified tanker companies to be listed on the US markets.

All of this has caught the eye of Stifel’s 5-star analyst Benjamin Nolan, who described International Seaways as one of his ‘favorite names’ in tankers. Getting into details, Nolan writes, “While the tanker market has been weak, oil demand is recovering. The Russia-Ukraine conflict has pushed short term tanker rates materially higher, but longer term in the absence of price related oil demand destruction, we expect market conditions should improve significantly. With a large fleet benefiting from cost synergies and great fleet float, a strong balance sheet, and with shares trading at 82% of NAV, we expect there to be continued upside as the tanker market recovers…”

Based on all of the above factors, Nolan rates INSW shares a Buy along with a $13 price target. Therefore, the analyst expects the stock to change hands for ~21% premium over the next 12 months. This is on top of the 53% growth the stock has seen this year. (To watch Nolan’s track record, click here)

Nolan is bullish here, but the 4 unanimously positive reviews on record show that the Street agrees with this stance. INSW’s shares are trading for $22.28 and their $27.50 average price target suggests ~23% upside this year. (See INSW stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.