Still no stock-market bottom signal from VIX volatility gauge, market watchers say

Stock-market investors have been on a roller-coaster ride, but a closely watched measure of expected volatility has yet to convincingly signal that the selloff is set to bottom out, analysts said Monday.

The Cboe Volatility Index VIX,

The VIX’s close on Friday at 30.2 left it in a “no-man’s land” between 28 and 36, marking 1- and 2-standard deviations from the long-run mean, he wrote. The VIX did get to 35 in early action as stocks swooned early Friday, likely pulling in algorithmic traders and allowing the market to come back modestly over the course of the day.

“The bottom line here is that the 36 VIX level continues to ‘work’ as a sign of an intraday low, but we’d like to see it close at 36 or higher as evidence of a larger washout in U.S. equities,” Colas said. “That really should have happened on Friday, with the yield on the 10-year Treasury ramping to 3.14% and WTI crude back to $110/barrel. But it did not, and so we continue to wait for an investable bottom.”

In One Chart: Stock market selloff in ‘liquidation’ stage. Why it needs to get ‘hotter’ before it burns out.

Stocks saw violent swings last week, soaring on Wednesday after the Federal Reserve delivered a widely expected rate increase of 50 basis points, only to give it all back and then some on Thursday as the Dow dropped more than 1,000 points. Major indexes posted weekly declines on Friday, with the S&P 500 finishing at its lowest since May 19, 2021, while the Dow Jones Industrial Average DJIA,

The VIX has yet to take out its April high above 36, much less the March high above 37. Analysts have argued that indicates investors fear an even deeper selloff in coming months as the Fed prepares to continue tightening aggressively in an effort to rein in inflation.

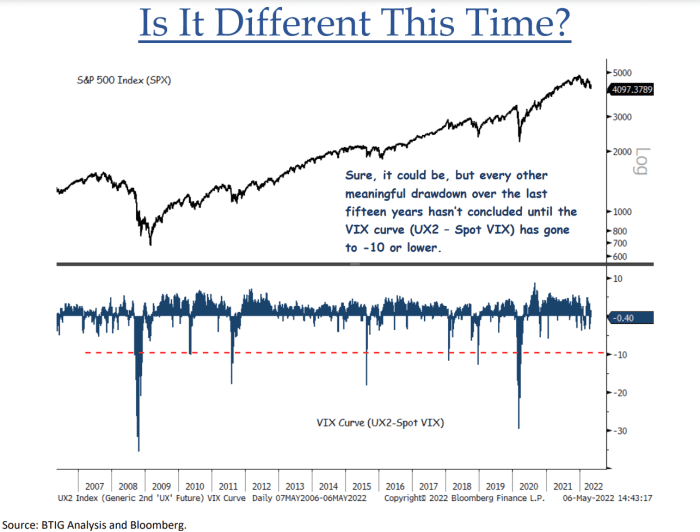

VIX futures also offer little comfort for those looking for a sign the lows are near, said Jonathan Krinsky, technical analyst at BTIG, in a Sunday note. While the nearby May futures contract VXK22,