Barrick Gold Stock Boasts Perfect Buying Opportunity

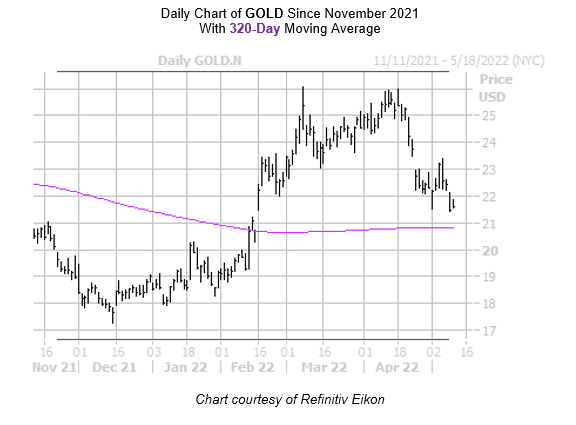

As gold prices struggle to continue their rise in the midst of a global economic selloff, mining stocks such as Barrick Gold Corp (NYSE:GOLD) have been suffering as well. However, Barrick Gold stock boasts a 13.3% year-to-date lead, and though it recently pulled back from annual highs near the $26 level, data from Schaeffer’s Senior Quantitative Analyst Rocky White suggests the stock may be flashing a buy signal as it nears a historically bullish trendline.

Specifically, GOLD recently came within one standard deviation of its 320-day moving average following an extended period above the trendline, defined for this study as having traded north of the moving average 80% of the time in the past two months and in eight of the last 10 trading days. The equity experienced two similar pullbacks within the past three years, which resulted in an average 21-day gain of 22.4%, with both returns positive.

At last check, Barrick Gold stock was marginally lower, off a paltry 0.3% to trade at $21.44. A move higher of similar magnitude would put the stock at $26.25, which is an area the shares have failed to reach since November 2020, and also help GOLD recover ground on its 8.2%, 12-month deficit.

A shift in analyst sentiment could create tailwinds for the equity. At the moment, four of the nine covering brokerages recommend a tepid “hold” rating, leaving the stock open to a round of upgrades.

An unwinding of pessimism in the options pits could send the shares higher as well. This is per the security’s 10-day put/call volume ratio at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which sits in the elevated 82nd percentile of its annual range, suggesting an unusually healthy appetite for bearish bets in the last two weeks.

Options are an attractive route at the moment, per Barrick Gold stock’s Schaeffer’s Volatility Index (SVI) of 43% that sits in the relatively low 23rd percentile of its annual range. This indicates options traders are pricing in extremely low volatility expectations for the time being. What’s more, GOLD ranks high on the Schaeffer’s Volatility Scorecard (SVS), with a score of 85 out of 100, meaning the security has consistently realized bigger returns than options traders have priced in.