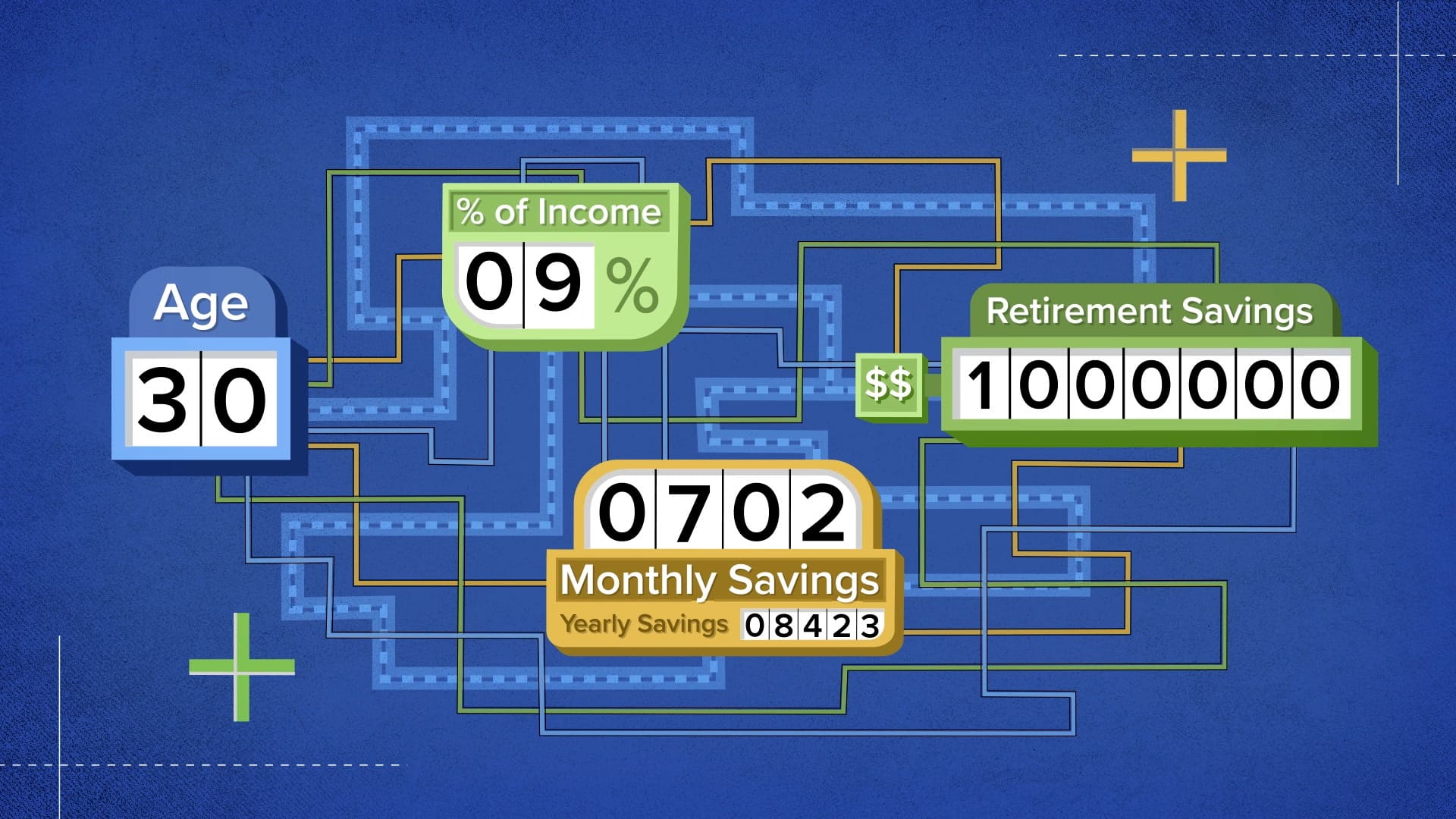

Thinking of retiring with $1 million? Let’s assume you make $90,000 a year, planning to save $1 million for retirement can seem daunting. But with dedication and discipline, you can get there regardless of your age.

As a rule of thumb, most financial advisors suggest you save 10% to 15% of your salary. But if your goal is to get to $1 million, the percentage you need to invest will vary widely based on how old you are when you start.

In this case study, we can tell you exactly how much of your $90,000 you’ll need to tuck away to save $1 million, broken down by the age at which you start investing.

More from Invest in You:

Want a 720 credit score? Here are four ways to improve yours

Ready to invest in the stock market? Here are three strategies for beginners

Here’s how to pick between a savings and money market account

Just a few things to remember: These numbers assume you have no money in your retirement plan, that you will get a conservative 6% return on your investments and that you will retire at age 65. The math also does not account for potential pay increases, employer matches, inflation or any of life’s other many variables.

Watch the video to dive into the numbers.

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox. For the Spanish version Dinero 101, click here.

CHECK OUT: Supersaver who banked 78% of his income and no longer has to care about money: How I did it with Acorns+CNBC

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.