China Cuts Mortgage Rates to Counter Collapse in Home Sales

(Bloomberg) — China’s central bank effectively cut the interest rate for new mortgages in an attempt to prop up the ailing housing market and boost the slowing economy.

Most Read from Bloomberg

The Sunday announcement from the People’s Bank of China means that first-home buyers will be able to borrow money at an interest rate as low as 4.4%, down from 4.6% previously. The change is aimed at supporting housing demand and will “promote the stable and healthy development of the property market,” the PBOC said.

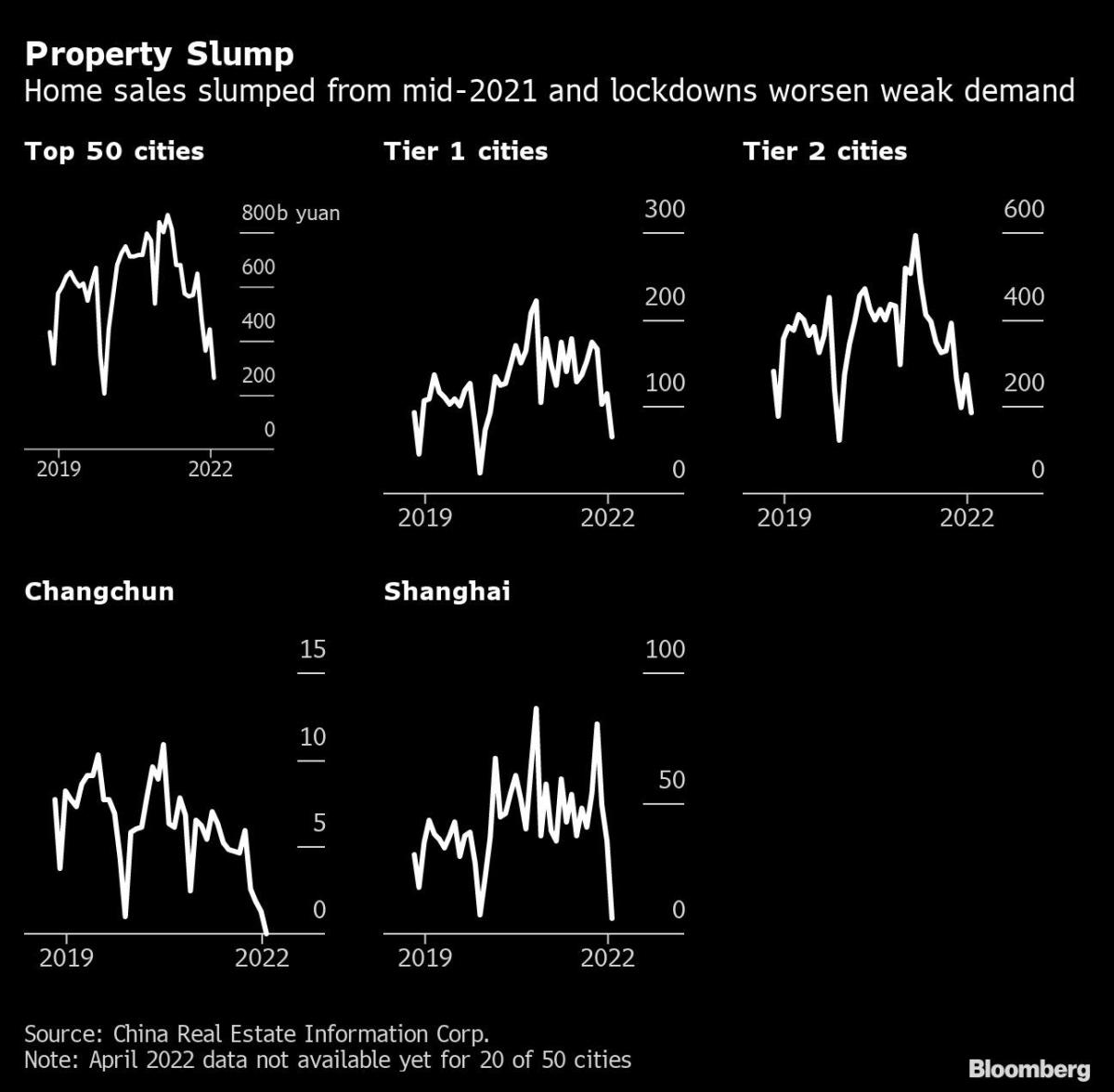

China’s housing market is a crucial source of growth for the domestic economy but has been in a slump for almost a year, with sales dropping at a double-digit pace every month since August 2021 and prices of new homes also falling after a government crackdown on indebted property developers. The increasingly restrictive controls and lockdowns this year to contain Covid-19 have worsened that situation, damaging confidence and severely limiting people’s opportunities to buy homes.

The cut “sends a loud and clear signal that policymakers are pushing for property policy easing with concrete measures,” Goldman Sachs Group Inc. economists led by Maggie Wei wrote in a report. “This announcement looks to be a step in the right direction, and more important than the previous local easing given that this is a national-level policy, but we think still more support is needed to stabilize the market.”

The decision to cut rates comes after a collapse in mortgage lending in April, with data released Friday showing a 60.5 billion yuan ($8.9 billion) contraction in new mortgages. That was despite repeated attempts by local governments to boost demand by loosening regulations and controls on property in cities and provinces across the country and signals from the central government that it would do more to stimulate the economy and the housing market.

However home sales continued to fall across major cities at the beginning of this month, dropping by a third in 23 major cities in the first week of May compared to the same period last year. That was on top of combined sales by the top 100 developers halving in the first four months of the year.

The rare Sunday statement on monetary policy from the central bank comes ahead of the Monday release of data for April, which is expected to show a broad slowdown in the economy. The March contraction in retail sales is forecast to have worsened due to lockdowns in Shanghai and other cities, industrial output growth likely slowed, and property investment is forecast to have fallen for the first time since May 2020.

Also on Sunday Shanghai announced that it would start gradually reopening from the six-week lockdown that has decimated activity and stopped industrial output in China’s most economically important city, as well as clogging the world’s largest port. However, based on how long it took other cities such as Xi’an or Changchun to return to anything like normal life after their lockdowns, the disruptions in Shanghai will continue for some time.

The PBOC also has the opportunity to cut policy interest rates on Monday morning, when the bank may announce the interest rate on its one-year loans to banks. In a recent survey, 13 of the 25 economists polled by Bloomberg expected the rate to stay unchanged at 2.85%, while 12 forecast a reduction.

Loan Prime Rate

The minimum interest rate on first-home mortgages will now be 20 basis points below the prime rate for a loan, the PBOC said in the statement. Most mortgages are longer than five years and are pegged to the five-year LPR which is 4.6% now, meaning the new floor is effectively 4.4%.

If the mortgage is only for one year then it could also be pegged to the one-year LPR, which is 3.7%.

“The announcement is a significant policy move for the property sector” as it “gives the green light to substantially lower the mortgage rate,” Macquarie Bank Ltd. economists Larry Hu and Xinyu Ji wrote in a report. “The policy signal from today’s cut is strong, because it’s the first action taken by the central government to support the housing market,” but “given the weak economic data, another LPR cut could happen soon,” they wrote.

The PBOC will announce the latest LPR on Friday, with some analysts expecting banks to reduce their rates after the central bank guided them to lower deposit rates and thus cut funding costs.

In the Sunday statement the PBOC also said it will guide banks in each city to set their own minimum rates based on the new national level. In April, PBOC officials said that banks in more than 100 cities had already cut mortgage rates by 20 to 60 basis points since March.

The minimum mortgage rate for buyers of second homes was unchanged, with the central bank reiterating that “housing is for living in, not speculation.”

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.