‘Deteriorating quickly’: U.S. earnings revisions could knock stocks down another 5% to 10%, warns Morgan Stanley

U.S. company earnings revisions are “deteriorating quickly,” threatening to deepen the stock-market’s losses so far this year, according to a note from Morgan Stanley’s wealth-management division.

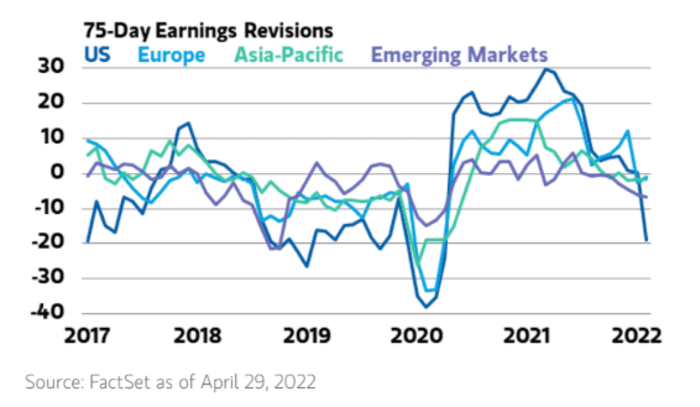

“Negative earnings revisions and negative economic surprises could produce another 5% to 10% decline in the S&P 500,” said Lisa Shalett, chief investment officer of Morgan Stanley Wealth Management, in a note Monday. “With the last two years a period of significant ‘overearning,’ reversion to the mean now makes U.S. earnings revision downgrades the worst among all regions.”

The U.S. stock market has tumbled this year amid high inflation that the Federal Reserve is trying to tame by raising interest rates. The S&P 500 index SPX,

Against the backdrop of rising rates and the jump in inflation, “positive earnings momentum has been critical in moderating stock market losses,” said Shalett. “But as inventory rebuilding matures and consumers shift their purchases toward services and away from goods, earnings expectations are having their day of reckoning.”

In Shalett’s view, “2022 was apt to be a year of paybacks,” after “extraordinary” results in 2020 and 2021 benefited from record government stimulus during the COVID-19 pandemic. The Fed is now tightening monetary policy to cool the economy as it aims to rein in the surge in cost of living.

The stock market’s “repricing has been driven by the reset in inflation expectations and the Fed’s plan for interest rates and balance sheet reduction,” she wrote. “The next phase is a recalibration of profit and economic forecasts from the unsustainable levels of the V-shaped 2020-21 recovery.”

That “rerating” has started, said Shalett. She pointed to earnings misses last week in the retail and technology sectors “due to excess inventories, high costs and price-related demand destruction.”

Major U.S. stock benchmarks ended sharply higher Monday, with shares in the financials sector SP500.40,