Later in the day, the UK Serious Fraud Office (SFO) charged Glencore with seven counts of bribery in Cameroon, Equatorial Guinea, Ivory Coast, Nigeria and South Sudan. A London judge will sign off on separate penalties for Glencore at a sentencing hearing June 21.

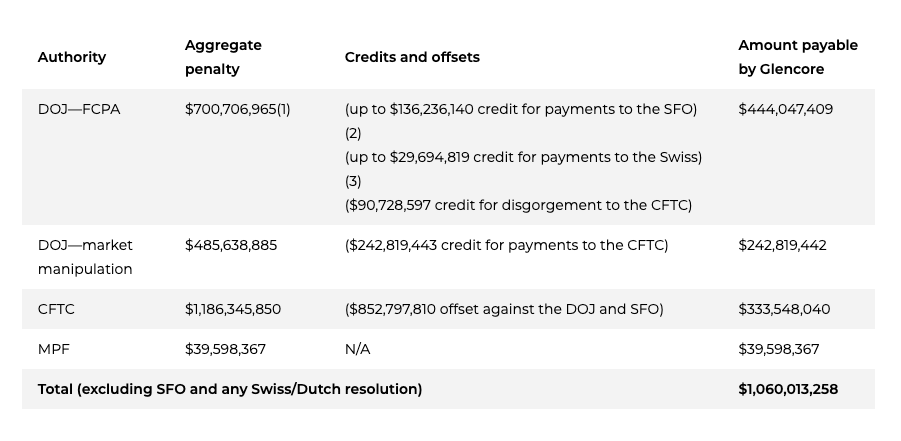

In the US, the miner pled guilty to violating the Foreign Corrupt Practices Act, agreeing to pay $700 million to resolve the bribery investigation and more than $485 million to settle market manipulation charges.

“Glencore today is not the company it was when the unacceptable practices behind this misconduct occurred,” chairman Kalidas Madhavpeddi said in the statement.

The firm has further agreed to pay more than $39.5 million under a resolution signed with the Brazilian Federal Prosecutor’s Office (MPF) in connection with its bribery investigation.

Over the past four years, Glencore has been under investigation by the US Department of Justice (DOJ), the SFO and Brazilian authorities for alleged money laundering and corruption.

The Swiss company disclosed in 2018 that the US DOJ had requested documents related to the group’s business in the Democratic Republic of Congo (DRC), Nigeria and Venezuela as part of a probe into possible corruption and money laundering.

Brazil also launched an investigation into Glencore and trading groups Vitol and Trafigura over alleged bribery of employees at state-run oil company Petrobras.

A year later, the UK’s SFO confirmed it was investigating suspicions of bribery by both the company and its staff.

Switzerland’s Attorney General followed suit, saying the probe was the result of a wide-ranging investigation by law enforcement agencies opened in early 2020.

Glencore, which is also subject to investigations from Swiss and Dutch authorities, has said the timing of those probes remains uncertain but would expect any possible resolution to avoid duplicate penalties for the same conduct.