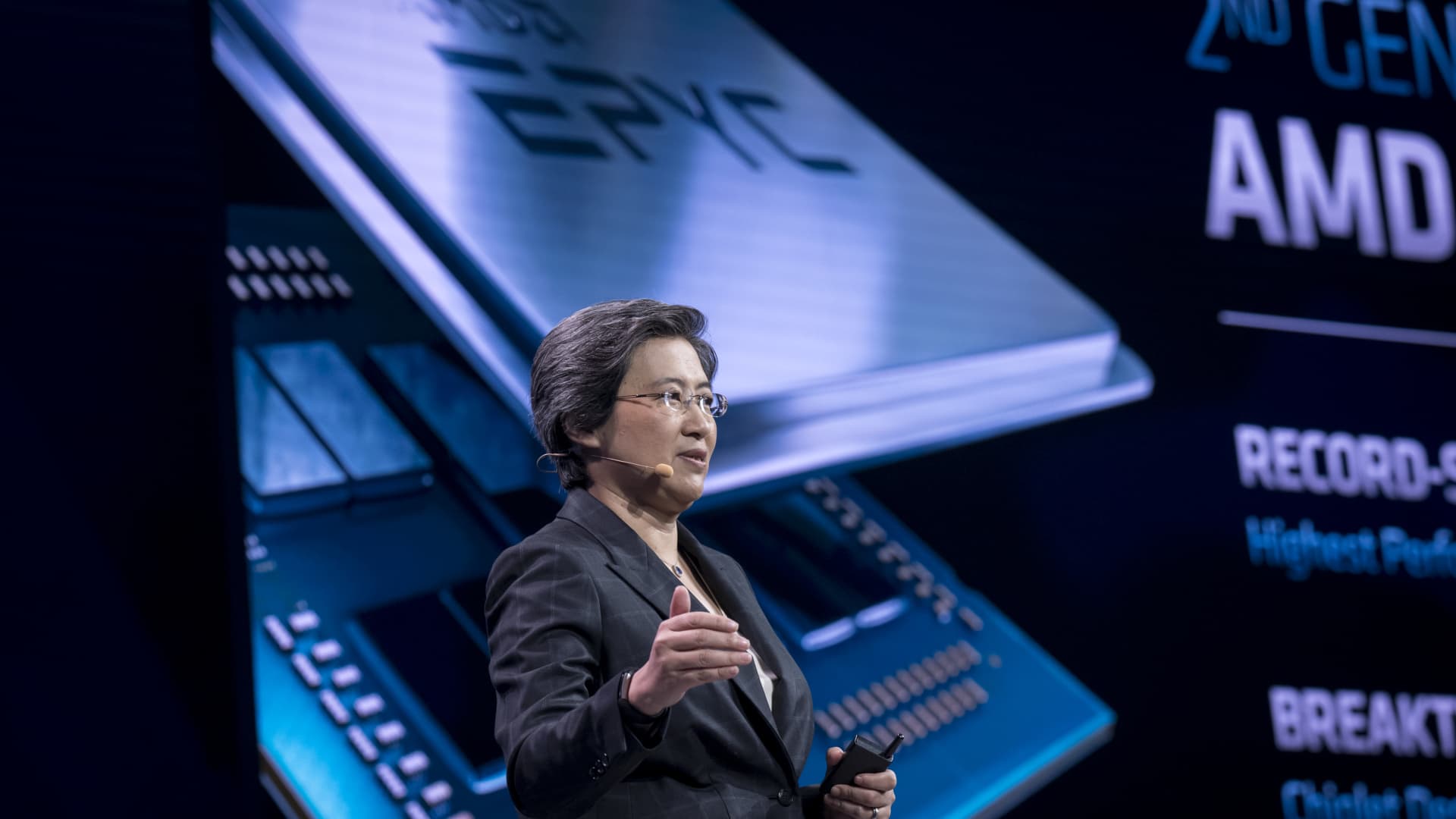

Technology stocks were hit hard Friday, and semiconductor firms were squarely in the path of the storm. Rising bond yields are part of the broader tech story. For the chip stocks, in particular, there appears to be another issue dragging the group down: an analyst downgrade of Micron Technology (MU). All four semiconductor stocks we own were down Friday, but we did not tinker with our positions. We held steady, and wanted to use this occasion to drive home a key point for investors — the importance of knowing what you own and why you own it. What’s happening Shares of Micron tumbled 7% Friday, after Piper Sandler analyst Harsh Kumar downgraded the stock to underweight from neutral. He cited Micron’s exposure to cyclical consumer markets such as smartphones and PCs, believing slowdowns in purchases on those products is bad news for Micron. “Today, the company has roughly 55% exposure to PCs, mobile, and other markets. In addition, the [dynamic random-access memory] market, which represents over 70% of total revenue, has already started to see price declines for most configurations,” Kumar wrote. The analyst isn’t negative on every part of Micron, though, and this is important for the point we’re making overall. “As of right now, we are only confident in the company’s data center business, which represents less than 30% of total company revenue,” Kumar wrote. What it means for us Beneath the surface, the semiconductor industry is complex. There’s a general understanding that these chips are super important in our digitizing world; some call them the brains of modern electronics. Not every chip designer is the same. They design different kinds of chips for different end markets — from gaming consoles to smartphones to PCs to automotive. For a variety of reasons, that nuance isn’t always reflected in stock moves. One reason is exchange-traded funds that bundle a bunch of chip stocks together, creating a sort of ETF-ization of the market. Heavy selling in a semi ETF such as the VanEck Semiconductor ETF (SMH) because of the Micron downgrade results in pressure on all chip names — even if they each serve different end markets. As owners of individual stocks, it’s crucial we see through it, that we understand what’s driving the news and whether it has substantive impact on the names we’re invested in. As we saw during this earnings season with the retail industry, some companies can do well while their rivals struggle. With that in mind, let’s examine our chip stocks — Nvidia (NVDA), Advanced Micro Devices (AMD), Marvell Technology (MRVL) and Qualcomm (QCOM) — through the context of Kumar’s concerns about Micron. That will help us make sense of their respective stock moves Friday and their near-term outlook. Nvidia Shares of Nvidia lost 4.45% Friday, making it the second-worst performing stock in the S & P 500’s semiconductor industry group. Micron was the worst performer. Nvidia’s two biggest markets are data center and gaming. Remember, Kumar wrote that the only part of Micron’s business he has confidence in right now is data center. When Nvidia reported fiscal first-quarter 2023 last week , its data center revenue jumped 83% year over year to $3.75 billion. That exceeded analyst estimates and made it Nvidia’s largest sales segment, narrowly edging out gaming’s $3.62 billion in revenue. A key reason we’re so bullish on Nvidia over the long term is data center growth driven by trends like cloud adoption. If anything, Kumar’s Micron note gives us confidence in our outlook on Nvidia’s data center business. We know there are near-term challenges Nvidia faces related to China’s Covid lockdown over the past few months and the Russia-Ukraine war; there also is some cyclicality to the gaming business, but management said last week the underlying dynamics remain “really solid.” Put it all together, and it’s clear to us there was no reason to lighten up on Nvidia shares because key parts of Micron’s business may see weakness. AMD AMD shares, which have rallied in recent weeks, fell 2.1% Friday. The chip designer, led by terrific CEO Lisa Su, has been transforming its business and expanding into secular growth areas like the data center. It also has a notable presence in gaming consoles such as Sony’s PlayStation 5 and Microsoft’s Xbox. The PC market is the one part of AMD’s business we want to think through in light of the Micron downgrade. AMD does have exposure there — but what we know, big picture, is that AMD has been focusing its efforts on commercial clients and more high-performance PCs. When the company reported earnings in early May, management acknowledged the PC market is softer than it was at the height of the Covid pandemic. However, in a May 4 interview with CNBC , Su stressed that AMD’s PC processor sales are still doing well overall because demand on the commercial and high-performance side is stronger than, say, low-end consumer laptops. In AMD’s first quarter, revenue in its computing and graphics segment, which includes its PC sales, rose 33% in Q1 to $2.8 billion. We found those results to be very solid, offering proof that AMD is focusing on the right slices of the PC pie. Of course, there are near-term risks for AMD, like a major economic slowdown that causes corporations to reduce spending to upgrade their computers. It’s just we already knew that before Friday, and so while we thought critically about whether any of Kumar’s Micron worries should extend to AMD, we concluded there wasn’t much new for us to grow concerned about. Marvell We just heard from Marvell last week, when the company reported record quarterly revenue of $1.45 billion. That was up 74% year over year and topped Wall Street’s forecast. Marvell’s sales and earnings guidance for the current quarter also was better than expected. On Friday, the stock fell 4%. One thing to remember about Marvell is that management has been pivoting its business away from consumer-centric areas while emphasizing end markets such as 5G, the cloud, networking and more. For example, Marvell said last week its data center sales in the first quarter rose 131% year over year to $640.5 million. While Marvell has its challenges, management indicates they’re largely related to the supply side. The “demand outlook for the year continues to be strong,” President and CEO Matt Murphy said on the earnings call, according to a FactSet transcript. “With respect to data center specifically, we did have a strong Q1 better than expected. We still have pent-up demand and lack of supply there for Q2, but we expect actually a re-acceleration in the data center in terms of our growth in Q3 and Q4,” Murphy said. It’s been a little more than a week since those remarks, and we do not believe anything has changed with Marvell’s outlook. We still like this one for the long term and nothing about potential Micron slowdown fears prompts us to change that view. Qualcomm Down 3.4% Friday, Qualcomm is the chip name we own that has the most risk related to the Kumar’s Micron downgrade. The reason for that is Qualcomm’s exposure to the smartphone industry, where the San Diego-based company has long been a key player. With CEO Cristiano Amon at the helm, Qualcomm has been diversifying its business into areas like automotive and Internet of Things (IoT). We are very much fans of this strategy, but it’s important to acknowledge that, for now, handsets are still Qualcomm’s largest chunk of chip sales. At the same time, despite concerns of a smartphone slowdown, Qualcomm’s handset revenues rose 56% year over year in the quarter ended March 27. One reason for the strength is Qualcomm is expanding its market share in Samsung’s Galaxy line, which is the No. 1 competitor to the iPhone. “We now have approximately 75% of the premium tier processor volume for Samsung’s Galaxy S22 smartphones, up from approximately 40% in the Galaxy S21,” Amon said on Qualcomm’s April earnings call, according to a FactSet transcript. Even so, we remain mindful of the concerns about smartphone sales at a time when inflation is squeezing consumers, and their spending is shifting toward services and experiences that they may have neglected earlier in the Covid pandemic. But so far this year, Qualcomm’s performance in this area has been strong. We also think our ownership of Qualcomm is supported by the stock’s valuation. It trades at just 11 times forward earnings, compared to a five-year average of 16, according to FactSet. We think that’s very cheap for a company of this caliber. (Jim Cramer’s Charitable Trust is long NVDA, MRVL, AMD and QCOM. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.