JPMorgan Strategists Say Equities Are Flashing a Bullish Signal

(Bloomberg) — Stock markets are flashing a bullish signal amid tentative signs that inflation volatility is peaking, according to JPMorgan Chase & Co. strategists.

Most Read from Bloomberg

As fears about hawkish central banks and a potential recession sparked a rout in US stock markets this year, the put to call open interest of S&P 500 options collapsed as demand for hedging subsided, strategists led by Nikolaos Panigirtzoglou wrote in a note on Wednesday.

“This reduced demand for hedging equity risk is a bullish signal as it likely reflects low equity positioning by investors,” they said. “There are some tentative signs that inflation volatility could be peaking, which would be consistent with markets continuing to look through the spike.”

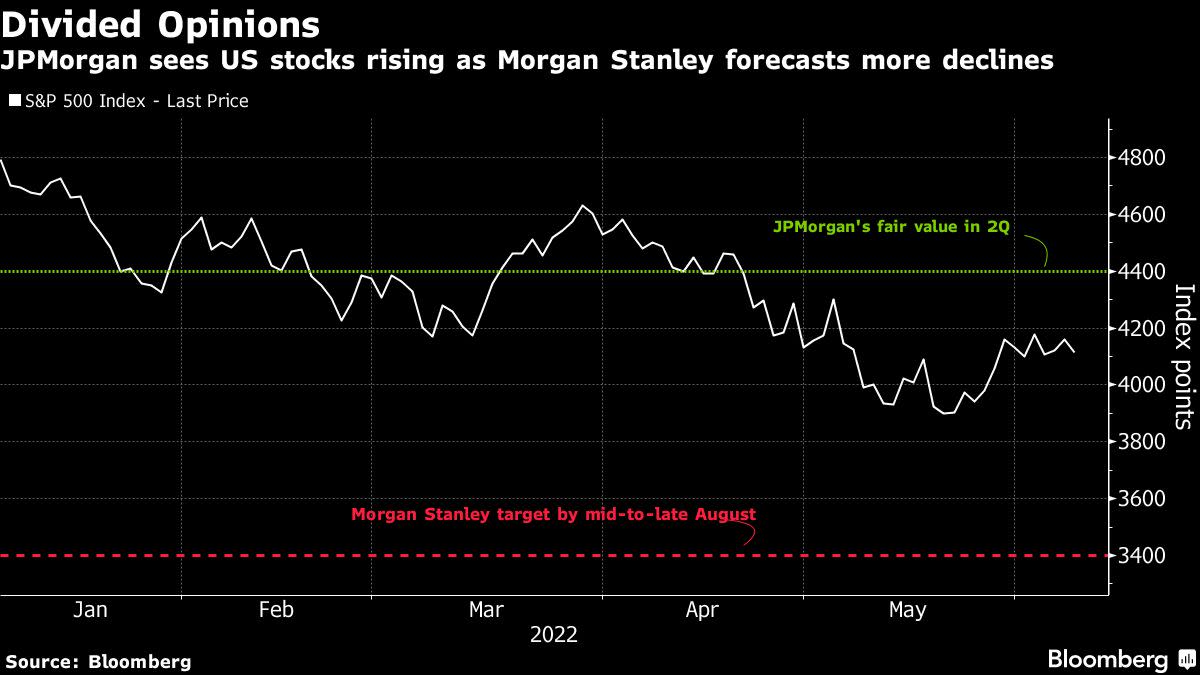

Panigirtzoglou said this implies a fair value of 4,400 index points for the S&P 500 in the second quarter — an upside of about 7% from current levels. In an adverse scenario, which assumes that markets start to factor in a rise in inflation volatility, the fair value falls to 3,350 points, the strategist said.

The call by Panigirtzoglou, a widely followed expert on Wall Street capital flows, comes just weeks after the S&P 500 flirted with a bear market as the Federal Reserve embarked on an aggressive rate-hiking path, fueling fears about a recession amid surging inflation. Although stocks have since tried to recover, a jump in bond yields above the key 3% level has kept risk demand subdued.

Strategists are divided on whether the stock rout has found a floor, with the likes of Morgan Stanley’s Michael Wilson forecasting that the US benchmark will trade close to 3,400 index points by mid-to-late August, implying another 17% downside from its latest close.

On Monday, JPMorgan strategists including Mislav Matejka reiterated their bullish view on stocks, saying “the fundamental risk-reward for equities is likely improving as we approach the second half of the year.”

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.