Iron ore price down on new China lockdown worries

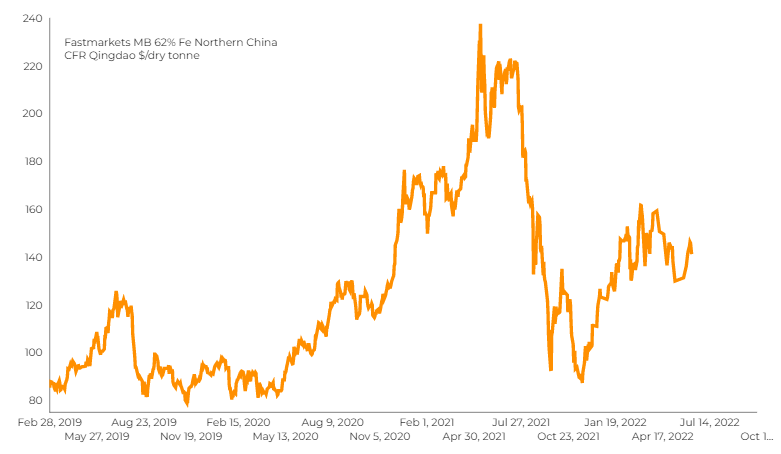

The most-traded September iron ore contract on China’s Dalian Commodity Exchange ended daytime trading 1.7% lower at 914.50 yuan ($136.83) a tonne.

Shanghai faces an unexpected round of mass covid testing this weekend, following the discovery of a few cases in the community, just 10 days after a city-wide lockdown that hurt businesses was lifted.

“China remains a big source of uncertainty for global growth,” JP Morgan analysts said in a note. While the economy’s reopening has led to a surge in China’s exports in May, it “also raises the risk that cases re-emerge”.

Meanwhile, spot iron ore in China traded higher this week, hitting a seven-week peak on Thursday at $148 a tonne, SteelHome consultancy data showed, as short-term demand picked up.

China’s iron ore imports rose 3% in May from a year earlier, data on Thursday showed, after disruptions to shipments by major suppliers eased.

The country ramped up its purchases – despite weak profits at steel mills – also because of the easing of covid-related curbs and Beijing’s stimulus support for the struggling economy.

(With files from Reuters)