‘We’re in technical recession, but just don’t realize it’: Bank of America sees more ‘shocks’ to come

The shocks aren’t over. Get ready. That’s the timely Friday advice of Bank of America, delivered hours before worse-than-expected U.S. inflation data knocked the wind out of Wall Street and left investors bracing for more aggressive central-bank action.

Data showed the cost of living surged 1% in May amid higher rents and gas and food prices, keeping the rate of U.S. inflation at a 40-year high. Annual inflation now sits at 8.6%, up from 8.3% and a new cycle high, the most rapid increase since 1981. The S&P 500 index SPX,

Don’t miss: Consumer sentiment plunges to record low in June, according to University of Michigan survey

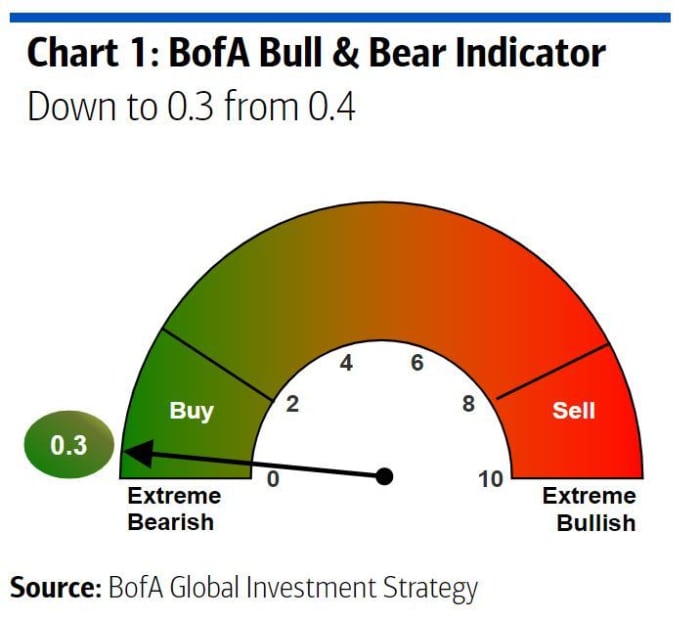

Taking a fresh look at the so-called bear-market rally in U.S. stocks that took hold in late May was a team at Bank of America, led by Michael Hartnett, the chief investment strategist. The bank’s own bull and bear indicator is now deep in “contrarian bullish” territory — with credit also looking “deeply oversold,” noted Hartnett.

So why do investors keep selling those rips? The inflation shock isn’t over, as driven home by Friday’s data, an interest-rate shock is just taking shape, an economic-growth shock is looming, and there is “no release valve from a peak in yields,” while the bear-market rally itself is “too consensus,” in Hartnett’s view.

He rattled off a number of such spikes in prices since the start of the year — a 141% surge in natural-gas prices; gasoline up 91%; wheat, 39%; soybeans, 33%; and corn and cotton, 30% each.

“We’re in technical recession, but just don’t realize it,” said Hartnett, who notes ever murkier consumer data and household and consumer balance sheets indicating a shallow recession ahead. He added that “what can turn shallow into deep is the great unknown of the shadow banking system.”

And of course, stagflation is also a risk, one that’s incompatible with the “goldilocks” S&P 500 price/earnings ratio of 20 over the past 20 years, he said, observing it should be nearer to 15 times.

And panicky investors may be getting more whiffs of reality, with the bank noting that $54.2 billion flowed to cash according to latest weekly data, the biggest in six weeks. Just $12 billion went to equities.