Credit Suisse warns of ‘new world order’ in markets

Credit Suisse has warned of a “new world order” in financial markets after central banks began aggressively ramping up interest rates.

The Swiss lender said markets had been caught in a “perfect storm”, with surging inflation, higher interest rates and the war in Ukraine all taking their toll on investor sentiment.

Michael Strobaek, global chief investment officer, said this storm had intensified in recent days after the Federal Reserve announced its biggest interest rate rise since 1994 and the Swiss National Bank wrongfooted markets with aggressive monetary policy tightening.

In a note to clients he wrote: “Both equities and bonds have corrected, which means that investors have had almost no place to hide. Even well diversified portfolios have taken a hit.”

He added: “This represents nothing less than a reset of the currently still low interest rate level to a new, higher level globally. During this adjustment, financial markets look set to remain volatile as the reset brings with it clear uncertainty and, of course, a much less accommodative monetary policy.

“Among the questions investors have to ask themselves is how long the rate hiking cycle will go and how deep the economic slowdown will be.”

However, the Credit Suisse executive said investors should not lose faith, adding that it would be “ill-advised” to exit markets now.

He said: “It is very easy to throw in the towel when market turbulence and perceived risks reach new peaks. Yet, I firmly believe that the situation is not as bleak as the market currently prices.

“One of our fundamental investment principles is that ‘time in the market beats timing the markets’. This, in my opinion, applies to the here and now.”

It came as a $3.6bn (£2.9bn) fund manager told investors to brace for a long bear market, warning the Federal Reserve was “orchestrating” a recession and that markets would not recover until interest rate rises had finished.

Richard Hodges, manager of the Nomura Global Dynamic Bond Fund, said: “The Fed is solely focused on reducing inflation (for now) and is orchestrating a recession; they aim to rebalance the differential between demand and supply by reducing the former.”

But he also struck an optimistic tone for recovery and urged investors to remain patient.

He said: “When the rate hikes stop, and investors can once again value risk with some certainty, cheaper asset prices across credit and sovereign bond markets alike will represent an incredible opportunity set for investors seeking attractive returns.”

Global markets regained some composure on Friday after a brutal sell-off that saw US shares plunge to their lowest since late 2020.

But the FTSE 100 still suffered its third weekly loss and the biggest since the early days of Russia’s war in Ukraine.

06:05 PM

Wrapping up

That’s all from us this week, thank you for following! We shall see you on Monday but, before you go, have a look at the latest stories from our business reporters:

06:04 PM

Oil will hit all-time high of $150 this summer, warns JP Morgan

Oil prices are heading for an all-time high of $150 a barrel, America’s biggest bank has warned. Louis Ashworth has more:

The price of crude could surpass a previous record of $147.5 a barrel by the end of this year as Western sanctions kick in, analysts at JP Morgan said in a report on Friday.

They also warned of further upwards pressures on crop prices, predicting corn could hit $13 a bushel, another record high .

“Conditions of acute scarcity persist across all commodities,” they said. “The world is entering summer – the traditional peak demand season – with inventories 19pc below historical norms. Lack of inventory buffer is leaving the market vulnerable to unplanned supply outages.”

Volatility in commodity prices has doubled since the onset of the conflict in Ukraine. The region is a cornerstone exporter of agricultural goods, and Russia – which has been subject to extensive sanctions – is a major fuel supplier.

05:44 PM

FTSE 100 closes in the red

It looked like investors might have something to cheer today after a bloodbath yesterday, but in the early afternoon the FTSE 100’s fortunes reversed.

The index ended the day 0.4pc lower at 7,016.

It came a day after the blue-chip index had given back more than 3pc of its value in the worst performance since early March, a day when a nuclear power plant in Ukraine was on fire.

Michael Hewson, an analyst at CMC Markets, said: “After the big losses of yesterday, as well as this week, European markets have tried to muster a semblance of a rebound as we head into the weekend, but are struggling to gain any sort of foothold, with a slide in commodity prices weighing on the FTSE 100, with copper prices sliding to their lowest levels this year, and oil prices on course for their first negative week since early May.”

05:22 PM

Another crypto lender freezes withdrawals amid market decline

In a sign of deepening turmoil in the crypto community, Babel Finance has become the second major digital-asset lender this week to freeze withdrawals, telling clients it is facing “unusual liquidity pressures” as it contends with recent market declines.

“The crypto market has seen major fluctuations, and some institutions in the industry have experienced conductive risk events,” the Asia-based lender and asset manager said on its website.

It comes a few days after Celsius Network, another crypto lending platform, paused withdrawals, swaps and transfers. Meanwhile, a tweet this week by Three Arrows Capital, a major crypto hedge fund, raised concerns about financial troubles at the firm, adding to the sense of broadening distress.

A recent market downdraft has sent the value of all crypto below $1 trillion (£820bn), a precipitous drop from its highs of $3 trillion late last year.

05:02 PM

US telecom firms agree to delay some 5G usage to avoid flight interference

The Federal Aviation Administration said that Verizon Communications and AT&T have agreed to delay some C-Band 5G usage until mid-July as air carriers work to retrofit airplanes to ensure they will not face interference.

The two telecom firms agreed in January to delay through July 5 switching on some wireless towers and depowering others near airports.

Verizon said the new agreement will allow it to “lift the voluntary limitations on our 5G network deployment around airports in a staged approach over the coming months.”

04:41 PM

Future on the rise as reader numbers grow

Media group Future is “on track” to hit targets for the year after its audience figures returned to growth, pushing the stock 5pc higher.

The publisher of The Week and FourFourTwo has seen “encouraging” trading so far during the second half of its current financial year, amid improving readership numbers.

The FTSE 250 group has also completed its acquisition of US digital women’s lifestyle publisher Who What Wear.

04:17 PM

China growth forecast slashed by Bank of America as country emerges from lockdowns

Bank of America has slashed its forecast for Chinese growth as a result of the country’s strict zero-Covid policies. Louis Ashworth reports:

Analysts at the bank predicted China’s economy will expand just 3.5pc this year, down from a previous forecast of 4.2pc.

They said lockdowns had “inevitably brought new disruptions,” adding: “Both investment and consumption demand have been impaired by the shock and resultant logistical bottlenecks, along with property market turmoil and labor market woes.”

The forecast suggests overall growth will fall well below Being’s target of 5.5pc, in a blow to Xi Jinping as he seeks re-appointment as the country’s president.

But they said the pickup in GDP would be strong in 2023 – at 6pc, versus a previous estimate of 5pc – as China unwinds restrictions following the Communist Party Congress later this year.

04:06 PM

Handing over

That’s all from me – thanks for following! Giulia Bottaro will see you through to the weekend.

03:56 PM

Oil prices tumble on recession fears

Oil prices have fallen sharply this afternoon amid growing fears of a global economic slowdown.

The Federal Reserve this week unveiled its biggest interest rate rise since 1994, fuelling fears that the US could be tipped into a recession.

Central bankers around the globe are grappling with the challenge of curbing surging inflation without harming the economy. But the slide in oil prices suggests traders are worried about a looming slump in demand.

Benchmark Brent crude dropped 3.5pc to $115 a barrel, while West Texas Intermediate slide 5pc.

03:36 PM

Second World War bike maker to build electric motorcycles in Britain

A 124-year-old British motorcycle brand that supplied the military during the Second World War and counts Keanu Reeves among its fans will build its new electric motorcycles in the UK after securing support from the Government.

Howard Mustoe reports:

The Government has committed £8.5m to Norton Motorcycles to help fund development of its new vehicles in the UK.

Developing the bikes will take 30 months and involve a “significant” number of extra jobs, the company said.

It was awarded funding by Advanced Propulsion Centre (APC), an initiative which aims to help businesses developing low carbon technology in the automotive sector.

Robert Hentschel, Norton’s chief executive, said the UK was a good location for the bike maker because of the “very high level of passion” for motorbikes in Britain.

He said Britain was likely to be a key market for sales and said Norton is hoping to draw in younger customers with its new electric model.

Norton originally began life as a bicycle parts manufacturer in Birmingham in 1898. It quickly moved into making motorcycles and by the 1930s was a supplier to the British military during the Second World War, alongside another iconic British brand, Triumph.

It was known for its racing bikes in the post-war years, with a close association to the Isle of Man TT race. Famous past owners included Steve McQueen, although it was a Triumph he rode in the film The Great Escape.

03:17 PM

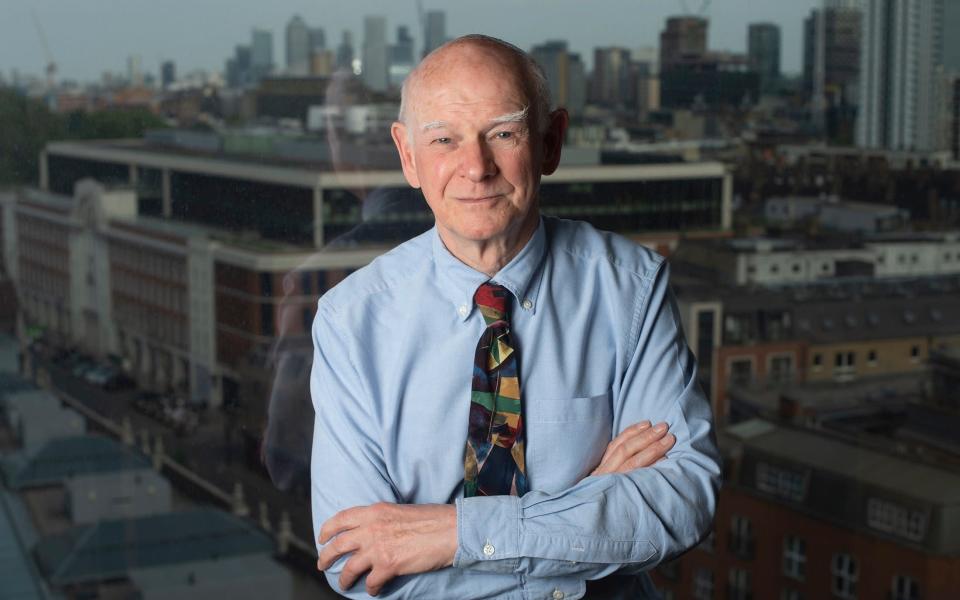

Bank of England should go faster on interest rates, says NatWest chair

The Bank of England should raise interest rates more quickly to prove its willingness to tackle inflation over the medium term.

That’s according to NatWest chairman Howard Davies, who added that the weak pound was compounding global pressure from rising energy and food prices.

He told Bloomberg: “If you get a very sharp exogenous shock, like an oil price increase of the sort we’ve had, and the war, then you can’t expect central banks to deal with that instantly.

“But what they must do is present a plausible path of interest rates which is going to deliver them back to the inflation target in 18 months to two years’ time.”

The comments from Mr Davies, a former deputy governor of the Bank of England, come a day after the central bank announced a cautious increase in interest rates to 1.25pc, though it did signal a more aggressive approach ahead.

03:01 PM

Nomura: Fed is ‘orchestrating’ a recession

Credit Suisse isn’t alone in sounding the alarm today.

A $3.6bn (£2.9bn) fund manager has told investors to brace for a long bear market, warning the Federal Reserve was “orchestrating” a recession and that markets would not recover until interest rate rises had finished.

Richard Hodges, manager of the Nomura Global Dynamic Bond Fund, said:

The Fed is solely focused on reducing inflation (for now) and is orchestrating a recession; they aim to rebalance the differential between demand and supply by reducing the former.

02:49 PM

Credit Suisse warns over ‘perfect storm’

There’s a fairly grim warning from Credit Suisse exec Michael Strobaek.

In a note to clients he wrote:

Both equities and bonds have corrected, which means that investors have had almost no place to hide. Even well diversified portfolios have taken a hit […]

This represents nothing less than a reset of the currently still low interest rate level to a new, higher level globally. During this adjustment, financial markets look set to remain volatile as the reset brings with it clear uncertainty and, of course, a much less accommodative monetary policy.

Among the questions investors have to ask themselves is how long the rate hiking cycle will go and how deep the economic slowdown will be.

02:41 PM

Wall Street opens mixed after sell-off

Wall Street’s main indices have opened mixed after a brutal sell-off triggered by the Federal Reserve’s aggressive interest rates rise.

The S&P 500 and Dow Jones were both trading broadly flat at the opening bell, while the tech-heavy Nasdaq rose 0.5pc.

02:28 PM

US factory output falls for first time in four months

US factory production declined unexpectedly in May amid ongoing supply troubles and hints of weaker demand.

The 0.1pc decrease followed 0.8pc increases in the previous two months, according to Federal Reserve data.

Total industrial production, which also includes mining and utility output, rose 0.2pc last month.

02:19 PM

Swiss billionaire nears deal for £92m London mansion

Swiss billionaire Ernesto Bertarelli is said to be snapping up a mansion in Belgravia for around £92m.

The exclusive property was built in the 19th century and has more than 80 rooms. It boasts a cinema, gym and a 20-metre swimming pool, Bloomberg reports.

The deal will be the latest in London for Mr Bertarelli, who sold his family’s fertility drug maker Serono for $8.6bn (£7bn) in 2006.

He is an investor in Crosstree Real Estate Partners, which owns The Standard Hotel opposite St Pancras and other buildings across the capital.

The billionaire recently divorced his wife, Kirsty Bertarelli, a singer and former Miss World contestant.

02:02 PM

Fed ‘acutely focused’ on returning inflation to 2pc

The Federal Reserve is “acutely focused” on returning inflation to its 2pc target amid the sharpest inflation in 40 years.

That’s according to chairman Jay Powell, who said another interest rate rise of 50 or even 75 basis points was likely at the next meeting in July.

The Fed this week raised interest rates by 75 basis points in the largest increase since 1994 and signalled more aggressive moves to come.

Officials expect rates to rise to 3.4pc by December and 3.8pc by the end of next year. That’s a big upgrade from the 1.9pc and 2.8pc they forecast in March.

Mr Powell said: “The Federal Reserve’s strong commitment to our price-stability mandate contributes to the widespread confidence in the dollar as a store of value.”

01:45 PM

FTSE 100 extends gains

The FTSE 100 has extended its gains as markets regain some composure after days of selling.

The blue-chip index is now up more than 1pc, driven higher by gains for Guinness owner Diageo and miner Glencore.

The domestically-focused FTSE 250 enjoyed even stronger trading, pushing 1.6pc higher.

However, both indices are on track for their third straight weekly decline as inflation and recession fears grip markets.

01:24 PM

SpaceX fires staff over letter criticising Elon Musk

Three SpaceX employees have been sacked after calling chief executive Elon Musk a “source of distraction and embarrassment” in an open letter.

Gareth Corfield has the story:

The letter, which was first circulated on Wednesday and reported by tech website The Verge, criticised Mr Musk for his frequent tweets, saying his missives were “de facto public statement[s] by the company.”

Musk is a heavy user of the social media site, which he is in the process of buying for $44bn. He uses Twitter to share corporate news but also trash-talk rivals such as Bill Gates and post memes.

His tweets have landed him in hot water with regulators in the past and made him one of the most popular users on the site, with 98.4 million followers.

“Elon’s behavior in the public sphere is a frequent source of distraction and embarrassment for us, particularly in recent weeks,” the letter said.

In response, SpaceX fired three employees who published the letter in a company-wide chat forum read by thousands.

01:09 PM

US futures rebound but recession fears weigh

Wall Street looks set to bounce back this afternoon after a brutal sell-off in the wake of the Federal Reserve’s biggest interest rate rise since 1994.

The benchmark S&P 500 and the tech-heavy Nasdaq have both plunged 6pc so far this week, with the former shedding nearly $2 trillion in this week’s rout alone.

The Fed raised rates by an historic 75 basis points this week, while others including the Bank of England have also tightened monetary policy, fuelling fears of a global economic downturn.

Futures tracking the S&P 500 rose 0.8pc, while the Dow Jones was up 0.6pc. The Nasdaq gained 1.1pc.

12:51 PM

Why the Bank resisted pressure to fight inflation harder – and what happens next

The Bank of England has been walking on a tightrope for months, torn over how fast to raise interest rates. But as other central banks gear up to fight rising inflation, it is beginning to look excessively cautious.

The nine-strong Monetary Policy Committee (MPC) is divided over which, painful, path to go down: while there is a need to curb price rises with higher borrowing costs, the economy could also need support as recession looms.

My colleagues Tim Wallace and Louis Ashworth have all the analysis you need on yesterday’s decision.

12:04 PM

Bank blames ‘shocks’ for inflation blunders

Huw Pill, the Bank of England’s chief economist, has admitted the MPC underestimated inflation after it was forced to increase its forecasts for the eighth time in a year.

But he insisted these revisions were due to economic “shocks” that the Bank couldn’t anticipate.

Here’s the full quote, courtesy of my colleague Louis Ashworth:

I think we have certainly had to revise up our forecasts over the last year, 18 months. So in the sense of the outcome of our forecasts, yes, we’ve underestimated inflation.

But I think… we have had a series of very big shocks and shocks that were unanticipated. I mean, notably the invasion, the rise in energy prices [and] omicron, one could extend to other things, too.

I think it’s important to see that a large part of why inflation has been revised up our forecast has been revised up through time, has been the incidence of these new shocks. Shocks by nature, we couldn’t anticipate.

11:50 AM

BoE: Wage price spiral would trigger more rate rises

The Bank of England’s chief economist has given some clear guidance on what could trigger bigger interest rate rises in the coming months.

Mr Pill said the Bank was focused on signs that inflation was driving up wages, with any worsening of the situation likely to spark a more aggressive approach.

He told Bloomberg: “If we do see greater evidence that the current high level of inflation is becoming embedded in pricing behaviour by firms, in wage setting behaviour by firms and workers, then that will be the trigger for this more aggressive action.”

It comes after the Bank raised interest rates by 25 basis points to 1.25pc, defying pressure to act more quickly after the Federal Reserve announced an historic 75 basis-point rise.

However, there was a hawkish tilt in language, with the MPC vowing to act more “forcefully” if necessary.

11:27 AM

Chinese stocks defy global sell-off

China stocks rose for a third straight week, defying a sell-off across global markets triggered by fears of aggressive rate hikes.

Investors are starting to see Beijing’s dovish monetary policy as supportive of battered stocks that will stand to benefit from the end of Covid lockdowns and massive stimulus.

Chinese stocks also benefit from a gush a foreign inflows, reflecting a sharp reversal of mood towards a market that was shunned by global fund managers just a month ago amid concerns over tough Covid curbs, harsh tech regulations and the fallout from the Russia’s war in Ukraine.

China’s benchmark CIS300 index rose 1.4pc to a three-month closing high, capping three consecutive weeks of gains. Hong Kong’s benchmark Hang Seng rose 1.1pc.

10:57 AM

UK settles into three-day office week

Britain’s workforce appears to be settling into a three-day office week amid a shift to more flexible working patterns after the pandemic.

Workers are favouring coming into the office on Tuesday, Wednesday and Thursday, with 23pc more visits per day than on Monday and Friday, according to data from IWG.

Tuesday has been the most popular day to be in the office this year, closely followed by Wednesday and then Thursday.

The trend is reinforced by the hospitality industry, whose leaders have said that Wednesday and Thursday evenings have become the new Thursdays and Fridays for drinking and dining out.

Overall, footfall grew by 15pc month on month in May – and is up 36pc since January – suggests the gradual return to the office is still ongoing.

10:41 AM

M&C Saatchi makes U-turn over takeover offer

M&C Saatchi has been forced into a dramatic U-turn over a takeover bid by Next Fifteen following a sharp drop in the marketing consultancy’s share price.

The advertising agency, known for its links to the Conservative party, said it would no longer support the takeover offer, despite agreeing a deal just weeks earlier.

Next Fifteen had offered around £310m for M&C Saatchi in a cash and share deal. But its share price has fallen more than 30pc since then, and the ad firm’s board said it no longer deemed the terms fair and reasonable.

Next Fifteen said it was disappointed by the move and insisted its offer was still the most attractive deal for M&C shareholders.

It acknowledged the drop in its shares, but says this was “similar to relevant market indices and sector peers”, while M&C’s share price had risen thanks to the proposed deal.

Shares in M&C Saatchi were trading 5.5pc lower in trading this morning.

10:22 AM

World’s biggest hedge fund in £5.9bn bet against Europe

The world’s biggest hedge fund has made a €6.9bn (£5.9bn) bet against some of the biggest businesses in Europe as recession looms, writes Patrick Mulholland.

US fund Bridgewater Associates, which has $150bn (£122bn) in assets under management, has emerged as the biggest short seller of European stocks. New disclosures show it has made bets totalling €6.9bn against almost half the EURO STOXX 50 Index, which is dominated by French and German businesses.

Bridgewater, run by famed Wall Street investor Ray Dalio, is shorting well-known European banks including Dutch lender ING, Spain’s Santander and France’s BNP Paribas. It has also taken short positions at major industrial companies such as French construction business Vinci and German chemicals giant BASF.

“These new big shorts from Ray Dalio make all other whale trades look like shrimp trades”, said Ivan Cosovic, founder of data and analytics firm, Breakout Point.

The positions were all put on since the start of the week amid mounting pessimism about the state of the European economy. Earlier this week Bank of America said more than half of global money managers are now predicting recession in Europe within the next 12 months.

Read Patrick’s full story here

10:07 AM

Pump prices continue to climb despite fall in wholesale costs

Fuel prices continue to rise across the UK despite a steady decline in wholesale costs over the last fortnight.

Petrol reached 187.51p a litre yesterday, according to the AA. Compared to this time last year, filling the typical 55-litre car tank has leapt from £71.92 to £103.13.

Diesel now averages 194.17p a litre at the pump.

Wholesale prices have fallen back from their peak at the beginning of June, and the AA said a failure by retailers to pass these savings on to motorists would be “nothing less than shameful”.

The AA said:

The lag in supermarkets passing on big cost increases, as new contracts updated their pump prices, might have explained why petrol prices continued to rise in the short term.

However, a fortnight on from wholesale prices starting to fall, these crippling pump price rises have yet to come to a halt let alone go into reverse.

With yesterday’s wholesale prices nearly 9p below the peak just before the Jubilee bank holiday, drivers should be seeing a drop in pump prices. The fuel trade’s failure to cut prices this weekend will be nothing less than shameful.

09:54 AM

Competition watchdog appoints first female boss for interim role

The competition watchdog will have its first female boss as it searches for a permanent chief executive amid a more aggressive approach to regulation.

Sarah Cardell, who is currently the Competition and Markets Authority’s most senior lawyer, will take over from Andrea Coscelli on an interim basis when he steps down in July after six years.

The watchdog has now begun the recruitment process for a new permanent chief executive.

The move means the UK has joined the EU, where Margrethe Vestager is in her second term as competition commissioner and the US, which last year promoted Lina Khan to become chair of the Federal Trade Commission.

It comes as the CMA flexes its post-Brexit powers in a more interventionist approach and looks to crack down on anti-competitive practices by tech giants.

09:44 AM

Gas prices head for biggest weekly gain since war started

Natural gas prices are heading for their biggest weekly gain since Russia launched its invasion of Ukraine as Moscow’s supply cuts deepen the continent’s energy crisis.

Benchmark European prices rose 8.4pc this morning, taking this week’s gain to more than 60pc.

Italian energy giant Eni said it will receive just half of its requested gas volumes from Gazprom today, compared to about two-thirds the previous day.

Flows through the Nord Stream pipeline – the biggest gas link from Russia to Europe – have been cut by about 60pc.

Russia has blamed the reductions on technical issues, but European leaders have described the excuse as lies and argued it was “politically motivated”.

The new threat to supplies is driving up prices further and threatening to derail Europe’s efforts to fill storage sites in time for next winter.

09:29 AM

Reaction: Tesco faces down Aldi threat

Dan Lane, senior analyst at Freetrade, says Aldi is a bigger threat to Tesco than ever.

Ken Murphy will hope his cocktail of Aldi Price Match, Low Everyday Prices and Clubcard Prices will keep customers around but it’s the first of that list that’s key now.

Aldi Price Match will become even more important as long as customers are forced into real discount mode. Tesco experimented with its own cheap chain in Jack’s and it just didn’t work, so it’s clear that keeping its ranges wide and its prices low has to be the strategy now.

But that’s far easier said than done, and that changing customer behaviour is also revealing which tills they’re flocking to.

In 2022, Tesco has lost 0.5 percentage points in market share, while Aldi has gained 1.3 and could well overtake Morrisons as the nation’s fourth favourite grocer.

Make no mistake, inflation-induced belt tightening will have a few more households heading to a German discounter.

All of the big four have bled market share this year while the challenger grocers have gained, this could only be the start too.

09:19 AM

Bank of Japan maintains ultra-low interest rates

The Bank of Japan has maintained ultra-low interest rates and its guidance to keep borrowing costs at “present or lower” levels as it focuses on supporting the economic recovery from the pandemic.

The decision, which was widely expected, highlights the BoJ’s position as the world’s last dovish central bank, with its peers around the globe racing to raise rates.

However, in a nod to the hit that the yen’s recent sharp declines may have on the economy, the BoJ said it must “closely watch” the impact exchange-rate moves could have on the economy.

Governor Haruhiko Kuroda said: “Recent rapid falls in the yen heighten the uncertainty on the outlook and make it difficult for companies to set business plans. It’s therefore negative for the economy and undesirable.”

Following a two-day policy meeting, the BoJ maintained its -0.1pc target for short-term rates and its pledge to guide the 10-year yield around 0pc by a 8-1 vote.

09:07 AM

Pound slips ahead of Bank speeches

Sterling has eased against a stronger dollar this morning, giving up some of its sharp gains following yesterday’s interest rate decision.

The pound rose strongly yesterday despite the Bank of England’s modest 25 basis-point rate rise, as traders focused on hints bigger rises could be in store in the coming months.

Markets are now turning their attention to speeches by policy makers Silvana Tenreyro and Huw Pill later today for possible clues about the outlook for inflation and monetary policy.

The pound fell 0.4pc against the dollar to $1.2308. Against the euro, it was down 0.1pc to 85.50p.

08:55 AM

Italy faces further squeeze on Russian gas supplies

Italy will receive only half the amount of gas it had requested from Russia today, adding to a squeeze on supplies after two days of disruption.

Energy giant Eni said Kremlin-controlled Gazprom would supply only around 50pc of the 63m cubic metres requested.

Kremlin spokesman Dmitry Peskov yesterday claimed reductions in supply were not premeditated and were related to maintenance issues, but Italian Prime Minister Mario Draghi dismissed his explanation.

Mr Draghi said: “Both Germany and us, and others, believe these are lies. In reality they are making a political use of gas like they are using grain for political use.”

Russian gas supply to Europe via the Nord Stream 1 pipeline fell further on Thursday, which Moscow blamed on delays in repairs.

Russia has said more delays could lead to it suspending all flows, derailing Europe’s efforts to refill its gas inventories before winter.

08:46 AM

Gatwick forces airlines to cancel 4,000 summer flights

There’s more travel chaos on the horizon, as my colleague Oliver Gill reports:

Holidaymakers flying from Gatwick this summer are to have their travel plans disrupted as the airport imposes restrictions on the number of flights for the first time in its history.

In a move designed to mitigate further travel chaos this summer, Gatwick will limit the number of daily flights to 825 in July and 850 in August. Ordinarily, up to 900 flights would take-off and land at the airport during these months.

The restrictions mean as many as 4,000 flights will need to be cancelled at Britain’s second-busiest airport, hitting the summer holiday plans of an estimated 800,000 people.

Stewart Wingate, Gatwick chief executive, said that the cap was designed to combat high numbers of same-day cancellations by airlines.

Gatwick had agreed the restrictions with airlines such as easyJet, Wizz and British Airways and Mr Wingate insisted that passengers on cancelled flights will be rebooked on different departures.

08:36 AM

FTSE risers and fallers

There’s a febrile mood on markets this morning as the FTSE 100 heads for its third consecutive weekly loss.

The FTSE 100 swung between gains and losses in early trading, with oil and energy stocks dragging down the index.

Miner Fresnillo was the biggest faller, shedding 2pc. BP, Shell, Rio Tinto and Anglo American were among the other losers.

Tesco shed 0.6pc after it warned inflation was denting consumer shopping habits.

Glencore was a notable exception, gaining 2pc after it forecast huge trading profits for the first half. There were also gains for export-focused stocks including Diageo and Unilever amid a fall in the pound.

The domestically-focused FTSE 250 rose 0.6pc, with publisher Future up 5.4pc.

08:26 AM

Glencore trading profit on track for new records

Glencore is set to unveil bigger trading profits in the first half than it normally makes in an entire year, putting it on course for a record 2022.

The FTSE 100 miner is cashing in on soaring prices and volatility as Russia’s war in Ukraine exacerbates an already-stretched commodities market.

Glencore expects trading profit in the first half to exceed $3.2bn (£2.6bn). That compares to record profit of $3.7bn it delivered in the whole of last year.

The company said: “Our marketing segment’s financial performance has continued to be supported by periods of heightened to extreme levels of market volatility, supply disruption and tight physical market conditions, particularly relating to global energy markets.”

However, it warned conditions would be closer to normal in the second half of the year.

08:22 AM

Klarna valuation ‘slashed by two-thirds’

Klarna is said to have slashed its valuation by two-thirds to $15bn (£12.2bn) as it struggles to drum up support in a fresh financing round.

The Swedish payments firm is currently in talks with investors about a new cash injection of at least $500m, which is about half its earlier ambition to raise up to $1bn, the Wall Street Journal reports.

The deal would value the buy-now-pay-later provider at $15b – much lower than both the $46bn valuation secured a year ago and the $30bn mark discussed in May.

Klarna, which was Europe’s most valuable startup in 2021, has seen its fortunes dramatically change amid a tougher climate for privately-held tech companies, sparked by soaring inflation and tighter monetary policy.

Last month the company announced it was laying off about 10pc of its employees in an effort to cut costs.

08:05 AM

Tesco boss: ‘No signs’ of fuel pressures easing

Ken Murphy, chief executive of Tesco, has warned that the recent surge in fuel prices shows no sign of abating.

He said: “I see no signs at this stage that there will be an easing of the pressure on fuel prices.”

The supermarket giant saw fuel sales soar 44pc to £2bn in the first quarter as it cashed in on record petrol and diesel prices.

But Mr Murphy denied accusations of profiteering, insisting the company was “very strongly on the side of the customer”.

08:01 AM

FTSE 100 opens higher

The FTSE 100 looks set to end the week in positive territory after global economic jitters sparked a huge sell-off yesterday.

The blue-chip index rose 0.3pc at the open to 7,064 points.

07:44 AM

Elon Musk tells Twitter staff to expect job cuts in first direct address

ICYMI – Twitter staff hoping for reassurance from their future boss have been left disappointed after Elon Musk used his first address to tell them job cuts are top of his agenda.

Gareth Corfield has the story:

The billionaire entrepreneur spoke to Twitter’s 7,500 staffers directly for the first time on Thursday, appearing via video link to answer questions and set out his plans.

Mr Musk, until recently the world’s richest person, warned employees on Thursday that he intends to perform “rationalisation of headcount” once he takes control of the company.

He told Twitter staffers he would also curtail a blanket work-from-home policy so only “excellent contributors” can continue working remotely, Bloomberg reported.

The crackdown forms part of ambitious plans to grow Twitter to 1bn users, Mr Musk said. Twitter currently has about 229m users and, at its current rate of growth, should reach a billion users in just over a decade.

The appearance followed weeks of worry and uncertainty for staff after Musk struck a $44bn (£35bn) deal to buy the social media site before raising doubts about the deal in a series of tweets. The Tesla boss said the transaction was “on hold” while he investigated the number of bots on Twitter.

Read Gareth’s full story here

07:35 AM

Reaction: Tesco must use scale to manage costs

Alex Smith at Third Bridge says Tesco will need to use its market position to negotiate down prices with suppliers.

Tesco is attempting to be the last of the big UK supermarkets to pass on inflation costs to customers as it looks to gain market share and use its scale to manage costs. It is also expanding the number of lines in its successful Aldi price match campaign.

Tesco’s market leadership gives it more bargaining power to negotiate down prices with suppliers. However, its relatively limited product range and fragile reputation means it can’t push negotiations too far.

Tesco was a pandemic winner and our experts expect it will continue to grow market share over the next 12 months. Its Clubcard scheme remains a competitive advantage for the group.

With the new display rule, supermarkets will give away premium promotional space to healthy food. However, with high inflation, our experts say that it is unlikely we’ll see a dramatic shift in carrier mix in the months ahead.

07:30 AM

Tesco sounds alarm on inflation

Good morning.

There are some early signs of how inflation is hitting retailers after Tesco warned the cost-of-living crisis was forcing customers to cut back.

Ken Murphy, chief executive of Tesco, warned the company was seeing “some early indications of changing customer behaviour as a result of the inflationary environment” amid “unprecedented” increases in the cost of living.

It came as the supermarket chain missed expectations for the first quarter, with UK sales slipping 1.5pc against strong lockdown trading last year.

Overall sales rose 2pc to £13.6bn, which Tesco said was 9.9pc ahead of pre-pandemic levels in 2019.

5 things to start your day

1) Swiss franc ‘better than gold’ to beat inflation Currency identified as a new safe haven after Switzerland delivers surprise rate rise

2) World’s biggest hedge fund in €6.9bn bet against Europe Santander and ING caught up in mega-short as eurozone faces recession

3) Gatwick forces airlines to cancel 4,000 summer flights Airport imposes daily limits that are set to affect 800,000 holidaymakers over coming months

4) Crypto meltdown triggers feeding frenzy for jobless tech talent Businesses scramble to take advantage of the current crypto winter in the hopes recruits will return to banking

5) Elon Musk tells Twitter staff to expect job cuts in first direct address Tesla chief aims to grow social media platform to 1bn users

What happened overnight

Tokyo stocks opened sharply lower on Friday after a rout on Wall Street as more central banks hiked interest rates in efforts to tame runaway inflation, fuelling recession fears.

The benchmark Nikkei 225 index was down 2.6pc, while the broader Topix index slipped 2.4pc.

Hong Kong shares opened with fresh losses on Friday morning. The Hang Seng Index fell 0.7pc.

The Shanghai Composite Index retreated 0.4pc, while the Shenzhen Composite Index on China’s second exchange slipped 0.8pc.

Coming up today

-

Corporate: Halfords (full-year results); Tesco (trading statement)

-

Economics: Inflation (EU), industrial production (US)