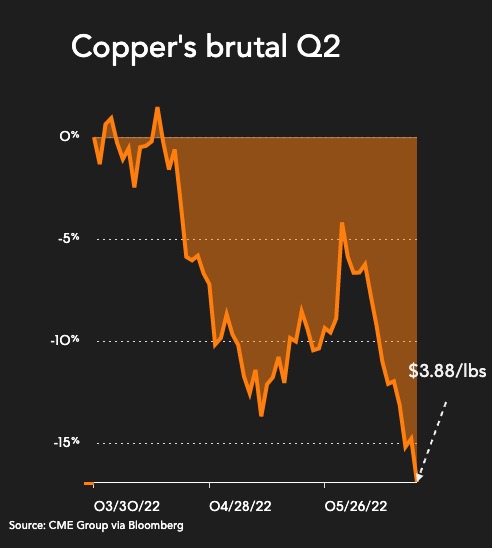

Click here for an interactive chart of copper prices

The most-traded July copper contract in Shanghai ended daytime trading 1.6% lower to 67,060 yuan ($9,971.60) a tonne.

“Base metals remain pressured by a challenging demand outlook related to China’s covid-19 lockdowns and to monetary policy tightening raising recession fears over the trade-off between inflation and growth,” Standard Chartered wrote in a note.

“We expect the base metals complex to continue to take its cues from macro developments, USD moves, external market moves and risk appetite trends.”

Stocks in Europe fell along with US futures and Asian equities amid ever-louder warnings that Federal Reserve monetary tightening may lead to an economic downturn. The dollar climbed.

Mining stocks also slid, with BHP Group down almost 10% from the previous week, Glencore down 8%, and Freeport-McMoRan down 16%.

“Investors should remember that Fed-induced slowdowns are simply a short-term abatement of the symptom — inflation — and not a cure for the problem — underinvestment,” Goldman Sachs Group said in a note.

“The quicker and the higher they need to hike, the higher the probability of a recession,” Christian Nolting, Deutsche Bank International Private Bank chief investment officer, said on Bloomberg Television, referring to monetary policy.

50,000 go on strike in Chile

On the supply side, Chilean state-owned copper producer Codelco, the world’s largest, was hit on Wednesday by a nationwide strike against the miner’s decision to close permanently an allegedly polluting smelter in the country’s central zone.

Unions demand that, instead of shutting down Ventanas, the company upgrades it. Codelco’s decision followed an environmental incident that saw dozens of people fall ill, the miner said June 17. The move was later backed by Chilean President Gabriel Boric and several of his ministers.

About 50,000 copper workers, including Codelco’s employees as well as contractors, joined on Wednesday the indefinite strike, the Federation of Copper Workers said in a statement.

(With files from Reuters and Bloomberg)