JPMorgan China Fund Ramps Up Bets on Tech as Bullish Calls Grow

(Bloomberg) — JPMorgan Asset Management is doubling down on China tech stocks after enduring a tumultuous selloff, betting that an easing of regulatory crackdowns and attractive valuations will pay off well.

Most Read from Bloomberg

Rebecca Jiang, who co-manages three China equity funds with almost $20 billion of assets, said she is becoming more optimistic on the sector as regulatory hurdles are being cleared, while macro policies offer support. The flagship China fund has snapped up shares of Alibaba Group Holding Ltd. and JD.com Inc. this year, according to filings as of end-May.

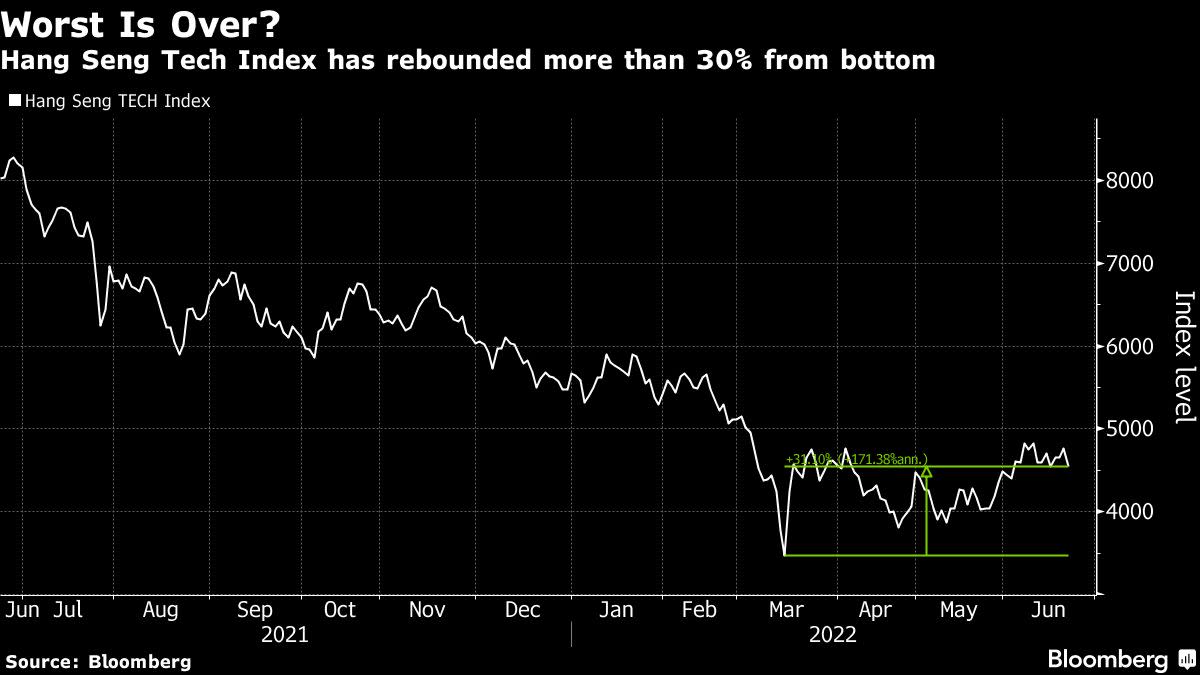

“A clearer and more defined regulatory framework around these Internet businesses is a definite positive,” Jiang said in an interview in Hong Kong this week. “The worst is over,” she said, adding that the firm has held on to most of its China tech holdings during a yearlong rout as the sector provides “critical value” to customers.

Her views echo a growing trend in China’s market, where investors have been rotating back into tech stocks after a year of heavy selling that wiped out almost $2 trillion at the height of the rout. And with Chinese authorities going full throttle in their efforts to revive the economy, the nation’s stocks have attracted buyers even as major indexes around the world tumbled into bear markets.

China’s benchmark CSI 300 Index has gained more than 5% in the past month, while the S&P 500 Index has tumbled about as much and the MSCI gauge of global shares fell almost 6%. The Hang Seng index of Chinese tech shares, meanwhile, has advanced more than 10% during the period, as authorities signaled a more lenient stance toward the sector.

The outperformance in Chinese stocks is driven by loose monetary and fiscal policy settings, even as global central banks led by the Federal Reserve rush to raise interest rates to curb red-hot inflation. China’s policy determination was highlighted again as President Xi Jinping, in a keynote speech to a virtual BRICS Business Forum on Wednesday, pledged to meet economic targets for the year.

From strategists at Morgan Stanley to Jefferies Financial Group, the drumbeat of bullish China rhetoric has been growing louder by the day, with Deutsche Bank AG saying Wednesday that it expects to upgrade its view on the market in the coming months. More fiscal stimulus is likely before President Xi Jinping secures a third term later this year, according to money managers at the German lender’s private banking unit.

Read: China Stocks Trouncing S&P 500 Wins Them Fans at Deutsche Bank

To be sure, betting on big tech has entailed losses. Jiang’s China fund lost 20% last year, sliding down the ranking after finishing in the top 5% among its peers in 2020. While still down about 20% this year, its more recent returns have started to turn positive.

READ: China Bulls Have Got It Wrong as Covid Zero Stays, Lombard Says

“Growth strategies have experienced a difficult period,” said Jiang. “But the regulatory headwinds and tightening could be a blessing in disguise for a lot of these Internet companies. I think this helped investors to identify and appreciate their real values.”

Going forward, Jiang said she’s looking at opportunities in other beaten-down sectors such as property, as well as policy beneficiaries including infrastructure and new energy.

Regulations on the property sector can “accelerate market consolidation and market share gains, particularly for the leading state-owned developers that are more conservatively run,” she said, adding that the fund has been increasing allocation in the sector.

The gradual easing of Covid restrictions, coupled with continued monetary and fiscal support, means Chinese stocks will continue to outperform global peers for the rest of the year, according to Jiang.

“Both from a global asset allocation perspective or on a standalone basis, the Chinese assets, equities we are talking here are looking attractive, particularly from the level it has fallen.”

(Updates throughout)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.