How much money do gas tax holidays actually save drivers? What we know, based on 3 states that put temporary suspensions in place

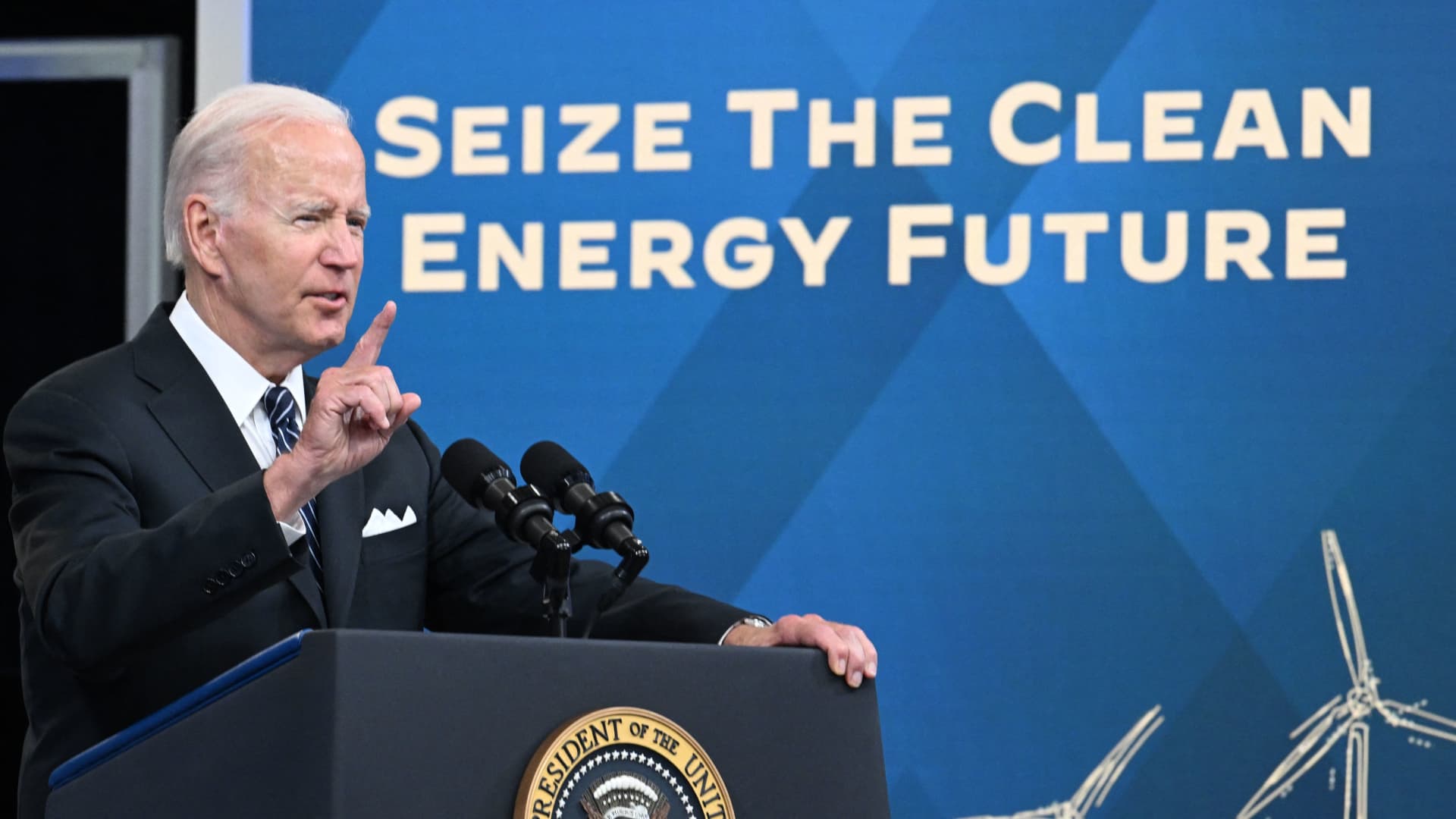

President Joe Biden has called on Congress to put a three-month federal gas tax holiday in place to help ease the financial pain drivers are experiencing at the pump.

With that, he is also asking state and local governments to provide additional relief.

The move comes as the average price per gallon of gas costs $4.93 per gallon, according to AAA, after recently topping $5 for the first time. One year ago, the average price per gallon was $3.08.

The federal gas tax amounts to 18.4 cents per gallon, or 24.4 cents per gallon on diesel fuel, which now costs an average of $5.81 per gallon.

In addition, states also impose their own levies on gas.

Gas tax holidays have already been implemented by several states, including Maryland, Georgia and Connecticut. In addition, New York recently began its own gas tax holiday on June 1, and Florida is slated to implement one starting Oct. 1. More states are also weighing some type of relief.

The three recent suspensions in Maryland, Georgia and Connecticut resulted in savings that were “mostly passed on to consumers at some point during the tax holiday in the form of lower gas prices,” according to a recent analysis by the Penn Wharton Budget Model at the University of Pennsylvania.

Yet experts say there are limits to just how much these temporary breaks may alleviate the costs drivers face.

How much state gas tax holidays helped drivers

The savings consumers saw from gas tax holidays in Maryland, Georgia and Connecticut varied by state, according to the Penn Wharton Budget Model.

In Maryland, up to 72% of the gas tax savings was passed on to consumers, the research found. In Georgia, the consumers savings portion ranged between 58% to 65%. And in Connecticut, it was between 71% to 87%. (Connecticut only applied the holiday to gasoline, and state tax on diesel fuel will actually increase by 9 cents a gallon on July 1 under legislation passed in 2007.)

Those price reductions were often not sustained during the entire holiday, the research found.

Now, New York has put a gas tax holiday into effect through the end of the year, suspending its taxes of about 16 cents per gallon. Florida is slated to give drivers a break from its 25 cents per gallon state tax throughout the month of October.

How much depends savings gets passed onto the consumer depends on supply and demand, according to Richard Prisinzano, director of policy analysis at the Penn Wharton Budget Model.

STATE GAS TAX HOLIDAYS

- MARYLAND

Gas taxes (per gallon): 36.1 cents on gas/36.85 cents on diesel

Suspension: March 18-April 16 - GEORGIA

Gas taxes (per gallon): 29.1 cents on gas/32.6 cents on diesel

Suspension: March 18-May 31 - CONNECTICUT

Gas taxes (per gallon): 25 cents on gas/No tax holiday on diesel

Suspension: April 1-June 30

The federal gas tax is paid by the refiner when the fuel leaves the refinery gate. The state gas taxes are paid by distributors or refiners. How much of that tax gets passed on to the consumer varies based on how fixed the supply is over the months the holiday is in effect.

For the federal tax holiday, 50% to 60% of the tax decrease may be passed on to consumers initially, though that may decrease over time, Prisinzano estimated.

Over a six- or nine-month period, that may add up to about $50 in savings, he said.

“The benefit only works if everybody maintains the same amount of driving, and the retailers don’t raise their prices any more,” Prisinzano said.

Why gas tax holidays may not be effective

Eliminating the federal gas tax would reduce prices at the pump, though not by the full 18 cents, predicts Marc Goldwein, senior vice president and senior policy director at the Committee for a Responsible Federal Budget.

Because refiners and oil companies can’t produce more, they may increase their pre-tax prices.

“Maybe consumers end up with 11 cents of savings at the pump, maybe less,” Goldwein said. “Even that savings is totally temporary.”

The Committee estimates Biden’s plan would reduce sticker inflation by 0.1% when it goes into effect. But then as soon as the gas tax holiday ends, it would increase inflation by more than 0.1%, bringing gas prices back to where they were or higher.

One-off state gas tax holidays may result in more savings for consumers, since they do not affect the national market, and therefore may not further disrupt the supply and demand imbalance, said Jared Walczak, vice president of state projects at the Tax Foundation.

A three-month federal gas tax holiday may result in just $20 or less in savings per driver, he said.

“Suspending the gas tax is largely a political gimmick,” Walczak said. “It is trying to patch over a larger problem.

“Policy makers trying to artificially bring down prices for a couple of months without doing anything about the underlying restrictions on supply are only going to make the problem worse in the long run,” he said.