SOL Breaks Above Key Downtrend and 21DMA, Eyes Rally to $60 as ETH Pushes Above $1.2K

Key Points

-

Cryptocurrency markets have enjoyed a much-needed recovery this week as markets pared back somewhat on hawkish Fed bets.

-

Bitcoin was last trading in the mid-$21,000s and Ethereum was above $1,200, up nearly 9% this week.

-

Solana broke above a key downtrend and its 21DMA this week, indicating a positive shift in near-term momentum.

Cryptocurrency markets have enjoyed some much-needed respite this week after taking a beating in the previous two weeks. As of Saturday, total cryptocurrency market capitalization had recovered to around $940 billion, up around 6.5% on the week and up around 23% from last Saturday’s lows around $760 billion. Still, total crypto market cap is around $350 billion lower since the start of the month.

Crypto market commentators said the sector latched onto the coat tails of a recovering US equity market. Analysts said risk assets got a boost this week by growing chatter about a recession and US consumer survey data on Friday that (somewhat) eased inflation fears, both of which dampened the outlook for monetary tightening from the US Federal Reserve.

Bitcoin was last trading in the mid-$21,000s, still below weekly highs in the $21,700 area, but about 4.5% higher on the week and over 20% up versus last Saturday’s lows near $17,500. Altcoins for the most part did better, indicative of the improvement in sentiment in cryptocurrency markets.

Ethereum (ETH)

Ethereum was last changing hands just to the north of the $1,200 level and close to weekly highs. ETH/USD is on course to post weekly gains of close to 9.0% and has rallied nearly 40% from last Saturday’s lows. But that still leaves the cryptocurrency lower by over 35% this month, lower by over 65% since the start of the year and down about 75% since last November’s record levels in the $4,800s.

Technicians are eyeing notable resistance in the form of the February 2021 lows around $1,300 and the 21-Day Moving Average just above it near $1,350. Continued uncertainty surrounding the global economy (recession coming?), global inflation and questions as to how hawkish global central banks will become suggests a broad rebound in crypto will be difficult in the weeks ahead.

But if ETH/USD can break above resistance in the $1,300s, that does open the door (technically speaking) to a push higher to the March 2021 lows above $1,500 and, beyond that, a test of mid-2021 and earlier-2022 lows in the $1,700s, where the 50DMA also resides.

Solana (SOL)

Solana broke above a key short-term downtrend this week and pushed convincingly above its 21DMA for the first time since early April. SOL/USD, which trades with on-the-week gains of around 23% and is up over 60% versus last weekend’s lows, is now eyeing a test of its 50DMA in the $44.50 per token area. The cryptocurrency was last changing hands just under $42.

Recent price action suggests Solana’s near-term trading bias may well be pointed towards further gains, broader cryptocurrency market conditions allowing. The bulls will be marking out key resistance in the $60 per token area, a further 40% up from current levels, as a potential near-term target.

Polkadot (DOT)

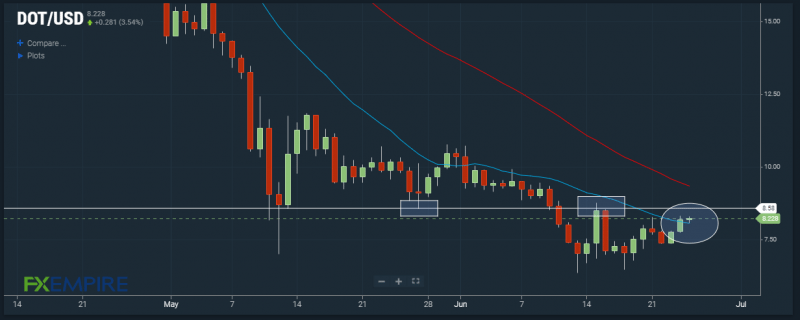

Polkadot was last trading with gains of about 9.5% on the week just above $8.20 per token, having now rallied nearly 30% from last Saturday’s more than one-year lows at $6.35. However, unlike some of its alt-coin peers like Solana, DOT/USD’s short-term technical outlook isn’t looking quite as promising.

DOT/USD has failed to break substantially to the north of its 21DMA and remains below a key area of resistance in the $8.60 area. Still, if broader crypto market sentiment continues to settle/improve next week, DOT/USD is in with a reasonable shout of testing this area of resistance.

Cardano (ADA)

The delay to Cardano’s Vasil hardfork upgrade announced earlier this week has weighed in recent days, with the cryptocurrency’s recovery this week lagging many of its major peers. ADA/USD was last trading just above $0.50 per token and with gains of only about 3.5% on the week.

Meanwhile, Cardano’s near-term technical outlook isn’t looking too great. ADA/USD has struggled to get above $0.50 this week and faces further resistance in the $0.52-0.55 area in the form of the 21 and 50DMAs plus a level of prior support turned resistance.

But as long as broader cryptocurrency sentiment remains supported in the week ahead (a big if), it should hold comfortably above recent lows in the low-$0.40s per token.

This article was originally posted on FX Empire