Brookfield’s Mark Carney on the firm’s new $15 billion bet on the clean energy transition

(Click here to subscribe to the Delivering Alpha newsletter.)

Brookfield Asset Management announced last week that it raised a record $15 billion for its inaugural Global Transition Fund. This marks the world’s largest private fund dedicated to the net zero transition, signaling that investors are still committed to establishing cleaner portfolios.

However, some blame the trend toward ESG-investing for high energy inflation. Critics say the focus on clean energy has curbed investment in fossil fuels, which may have otherwise helped boost supply.

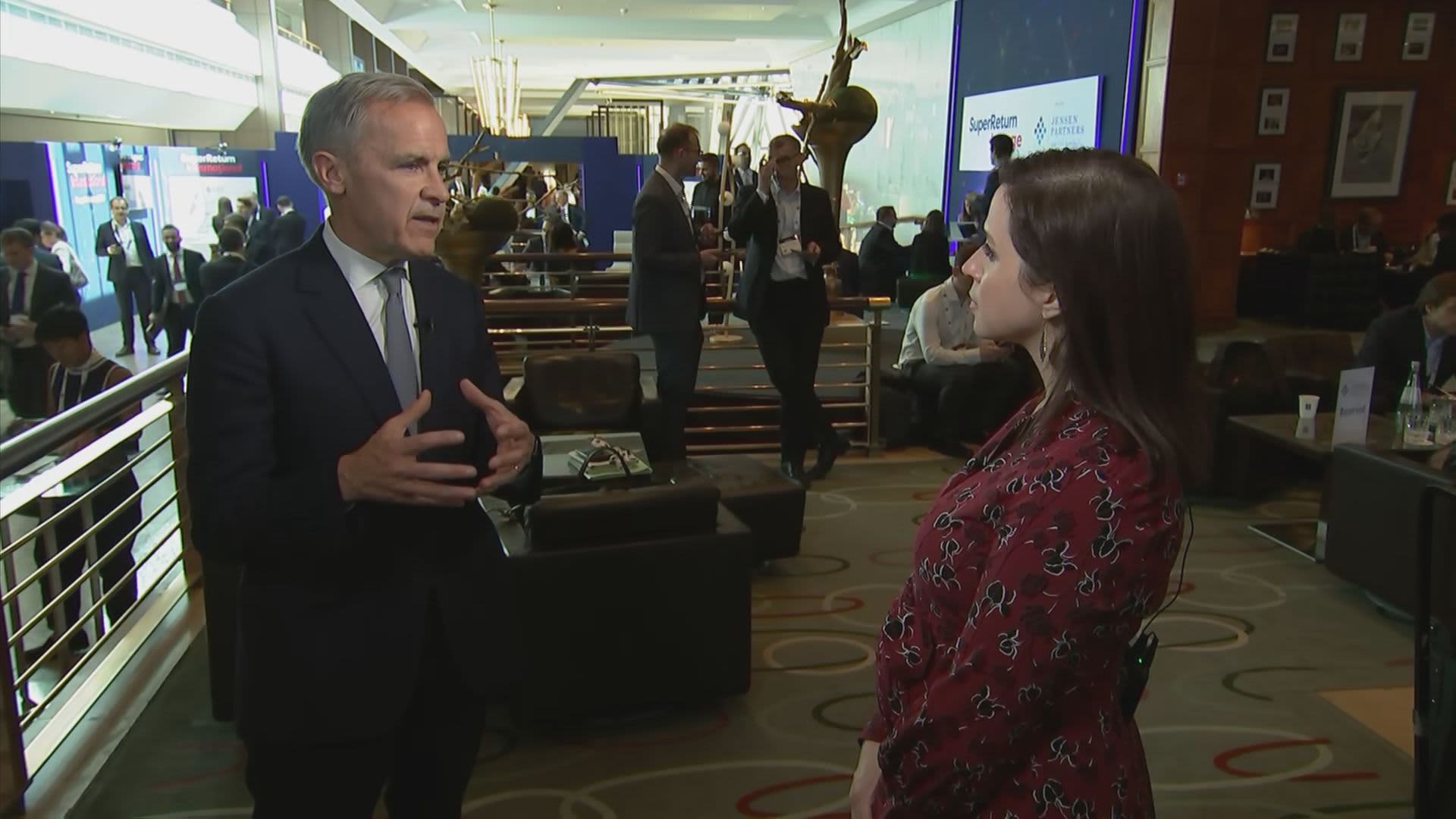

Mark Carney, co-head of Brookfield’s Global Transition Fund, says he does not subscribe to this critique. Carney sat down with CNBC’s Delivering Alpha newsletter at last week’s SuperReturn International conference in Berlin where he explained what’s driving inflation in gas prices and energy costs and weighed in on the state of U.S. monetary policy.

(The below has been edited for length and clarity. See above for full video.)

Leslie Picker: I want to pick your brain on kind of your central banker – if you can put that hat on for me, because there are so many crosscurrents right now. And I want to just first get your take on the US specifically, because that’s where the bulk of our audience is. Is a soft planning still on the table? Or do you think the hard decisions need to be made, and it likely may mean some more pain ahead?

Mark Carney: It’s a very narrow path in order for the U.S. economy to grow all the way through this. Unemployment has to increase. Financial conditions have already tightened a fair bit, I think they’re going to tighten a bit more, as well. And look, there’s also some pretty big headwinds from the world. China’s effectively in recession, or here in Europe, they’re on the cusp of a negative quarter because of the war and other factors. So, the U.S. economy is strong, it’s robust and flexible, the households are flexible, lots of positives here. But in order to thread the needle, it’s going to be tough.

Picker: Do you think 75 basis points is enough?

Carney: It’s certainly not enough to bring inflation back down and the economy back into balance, which is why what they imply about where policy is going, not just at the end of the year, but where it needs to rest in the medium term is going to be important.

Picker: Do you think that the Fed has lost the faith of investors, that investors now see them as being behind the curve in getting this under control?

Carney: I think the Fed itself and Chair Powell has acknowledged that, maybe they should have started earlier, recognizing that inflation wasn’t transitory. Those are all different ways that we can call it behind the curtain, they’ve acknowledged that. I think what the Fed is looking to do, and where they will retain investor support, is if it’s clear that they’re going to get a handle on inflation, they’re going to get ahead of this, that they don’t think that they can bring inflation down to target by just small adjustments in interest rates. The words and what chair Powell has been saying, what Jay’s been saying, in recent weeks and months, [they’re] establishing more firmly that they’re going to do their job on inflation because they recognize by doing that in the near term, it’s better for the U.S. economy, better for jobs in the medium term.

Picker: One of the factors that people have been highlighting in response to all the inflation that we’re seeing in the environment is this move toward ESG and this focus on renewables and disinvestment from fossil fuels. There are certain critics out there who believe that if we had focused more on that type of investment that we may not have the same kind of inflationary environment that we’re having, at least, in gas prices and energy costs and things like that. Based on what you’re seeing on the ground, is that actually the case? Is that critique or reality or is that just a talking point that people use?

Carney: No, I disagree with the critique. I think it’s something we’ve got to be conscious of going forward. And we’ll come back to that…we’re at the sharp end of the financial market, private equity world, and the debt world, and look, they got burned in U.S. shale in 2014-2015. No capital discipline in that sector. Destroyed a lot of value, and they withheld capital from shale, which was the marginal barrel of oil. Because of that, because of old fashioned capital discipline. And that’s what happened. That’s part of what got things so tight. Second point is the industry, as a whole, did not really invest or didn’t add barrels during COVID, like many other industries, didn’t add barrels during COVID and has been caught out by this resurgence of demand. Now, your question, though, is an important one going forward because we need to have sufficient investment in fossil fuels for the transition while there’s a significant ramp up in clean energy. So, the answer isn’t no investment in fossil fuels, and it is not the reason why gas prices are where they are. Unfortunately, it’s a combination of what happened over the course of the last five years, the reasons I just explained, and also, quite frankly, because there’s a war going on.

Picker: And that’s why you’re overseeing the energy transition strategy, not a clean energy strategy.

Carney: Brookfield is huge in clean energy. We’ve got 21 gigawatts existing, we’ve got 60 gigawatts in the pipeline all around the world. So, we’re very active in that. But what we’re focusing on just as much is going to where the emissions are, and getting capital to steelmakers, to auto companies, to people in utilities, people in the energy sector so that they can make the investments to get their emissions down. That’s where you find a huge amount of value, returns for our investors – ultimately, pensioners, teachers, fire, firefighters, others, pensioners around the world – that’s where we create value for them. You also do good by the environment because you get emissions actually down across the economy and that’s what we need.

Picker: And is that also the same goal with the Net Zero Asset Managers initiative? I think it’s $130 trillion worth of AUM behind this idea of having a net zero portfolio by 2050.

Carney: Yeah, and it’s very much about transition. So again, yes, a lot of it’s going to go to clean energy. I mean, clean energy needs are about $3 trillion a year. So, this is a huge investment opportunity, but again, going to where the emissions are, getting those down and helping to wind down emissions in sectors that aren’t going to run to their whole economic life. Look, we’re here in Europe, we’re here in Germany. Germany has put out a number of things. So, they’re going to have a clean energy system by 2035. They’re going to accelerate the approval process for these projects from six years to one year. They’re putting legislation in place across Europe. They’re tripling the pace of solar, they’re quadrupling the pace of hydrogen all this decade. Huge opportunity here in Europe, that’s being replicated elsewhere. But what comes with that is industrial decarbonization, if I can put it that way, and so Brookfield can play on both sides on the clean energy, but again, really going from everyone from tech to automakers to steel, to helping those companies move.

Picker: Interesting, because it’s industrial emissions that are the biggest chunk of the pie, not necessarily how you drive your car.

Carney: Well, yeah, it’s industrial emissions. Some of it is some of its autos, but some commercial real estate. We’re big in commercial real estate, we [have] got to get that down as a whole. And what this does is provide – we were talking moments ago about the macro economy, there’s some challenges with inflation. There’s actually some big positives with the scale of investment that’s required right at the heart of this economy. If I were to roll back the clock 25 years, the level of investment was about two percentage points higher around the world relative to GDP. Actually, we’re going to get that back through this process of transition that has big multipliers for growth and of course for jobs.