2 “Strong Buy” Penny Stocks That Could See Huge Long-Term Gains

The first half of 2022 was marked by concerns over inflation, rising interest rates and recession, with the S&P 500 registering its worst half year since 1970.

However, not everyone is seeing dark times ahead. Marko Kolanovic, head of global markets strategy for JPMorgan, believes that current conditions may also be a set-up for a rebound in the second half of the year, especially among the small-cap stocks. Kolanovic writes of this case, “If there is no recession – which is our view – then risky asset prices are too cheap. For instance, small cap stocks in the US currently trade near the lowest valuations ever.”

If Kolanovic is right, and we’re looking at a potential rebound in the small-cap sector, then the natural response for investors would be a move toward the ‘pennies,’ the stocks priced below $5 per share. While not always a sure indicator, low share price usually goes hand-in-hand with low market cap – but it also comes with the solid upside potential, as even small gains in absolute terms can quickly turn into large-percentage increases in share price.

That said, before jumping right into an investment in a penny stock, Wall Street pros advise looking at the bigger picture and considering other factors beyond just the price tag. For some names that fall into this category, you really do get what you pay for, offering little in the way of long-term growth prospects thanks to weak fundamentals, recent headwinds or even large outstanding share counts.

Taking the risk into consideration, we used TipRanks’ database to find two compelling penny stocks, as determined by Wall Street pros. Each has earned a “Strong Buy” consensus rating from the analyst community and brings massive growth prospects to the table. We’re talking about over 200% upside potential here.

Codiak BioSciences (CDAK)

We’ll start with Codiak BioSciences, a medial research firm working on new therapeutics agents for the treatment of a wide range of diseases that have in common high levels of unmet medical needs. Codiak’s main research focus is on exosomes, or the RNA degradation mechanism, and the thrust of the research is to create a class of medicines that use exosomes to transfer genetic material for a therapeutic effect.

The company currently has three drug candidates in clinical trials, all in early stages of testing. All three are under investigation as treatments for cancer. The two more advanced candidates, exoIL-12 and exoSTING, treatments for cutaneous T-cell lymphoma and solid tumors respectively, have both demonstrated ‘favorable safety and tolerability profiles’ in Phase 1 trials, which began in September of 2020. This past June the company released data on both trials showing clinically significant results, and justifying further studies. Codiak plans to initiate Phase 2 trials on both tracks in 1Q23.

On the third clinical track, the drug candidate exoASO-STAT6 started Phase 1 clinical trials earlier this year and the company announced the initiation of patient dosing at the end of June. The drug is being investigated as a treatment for myeloid rich cancers, and this trial will focus on developing a tolerability and safety profile to determine the proper dosing for later studies. Initial data is expected to be released during 1H23.

Codiak has several preclinical tracks underway, in addition to these clinical studies. The most prominent of the preclinical research programs is being undertaken with CEPI, the Coalition for Epidemic Preparedness Innovations, and is a broadly protective vaccine program as a prophylactic against SARS-CoV-2, the virus family causing COVID-19.

While Codiak shares have taken a hit year-to-date, at $2.82, several analysts believe the price tag represents a unique buying opportunity.

Among the bulls is David Nierengarten, 5-star analyst with Wedbush, who sees the recent clinical data as the key factor to consider. He writes, “We believe the data presented further validates CDAK’s exosome platform and has de-risked two of its therapeutic candidates, which we view as best-in-class molecules. With three programs in the clinic, two data catalysts expected over the next 12 months (final dose escalation data for exoSTING in 4Q22 and initial exoASO-STAT6 data in 1H23), and an EV of $50-60MM, we see a favorable risk/reward for CDAK.”

In line with his bullish stance, Nierengarten rates CDAK a Buy, and his $17 price target implies room for an impressive 513% upside to the shares over the next 12 months. (To watch Nierengarten’s track record, click here)

What does the rest of the Street think about CDAK long-term prospects? All of the other analysts that have thrown an opinion into the mix recently see the stock as a Buy, making the consensus rating a Strong Buy. Based on the $11 average price target, the upside potential lands at 289%. (See CDAK stock forecast on TipRanks)

Olema Pharmaceuticals (OLMA)

The second penny we’ll look at is Olema, an early-stage biopharmaceutical research company with a focus on estrogen-linked cancers. The company is working on the discovery, development, and long-term commercialization of estrogen receptor antagonist drug candidates, as therapeutic agents for cancers specific to women. Olema’s prime drug candidate program, OP-1250, is under investigation as a treatment for various types of metastatic breast cancer, both as a monotherapy and in combination with established treatments.

Last month, Olema released a clinical update on its OP-1250 studies, showing strong progress across the program, which includes two Phase 1b clinical trials.

The first of these trials is testing OP-1250 as a monotherapy against ER+ HER2 cancers. This trial, which is examining dose expansion in preparation for later stage studies, has shown both favorable tolerability and ‘encouraging’ anti-tumor activity. The second Phase 1b trial is a combination study with Palbociclib, and the first two cohorts have completed the dose limiting toxicity evaluation. That step has demonstrated compatibility in the combination study.

Olema expects further data releases later this year to show additional validation for OP-1250, and expects to begin a pivotal monotherapy study in 2023.

Going forward, to develop new drug candidates, Olema in early June announced a new agreement to launch a collaboration with Aurigene in the development of novel small molecule inhibitors in the oncology field. The agreement will commit Olema to pay out $8 million up front in licensing fees, with additional payments to Aurigene as clinical milestones are reached.

Canaccord analyst William Maughan lays out a clear path for Olema going to the end of this year, writing, “We think that data updates over the next 12-18 months will help characterize OP-1250 as a potential best-in-class agent and clarify the clinical development pathway, both as a monotherapy and in combination with currently approved agents… In 2H22 we expect mono and initial combo data with palbociclib, where we expect additive efficacy and will be watching neutropenia rates and continued lack of palbo metabolism alteration from OP-1250. In 2023 Olema expects to initiate a pivotal monotherapy study in ER+/HER2- mBC in 2L+. The design will depend on upcoming data, and we look forward to more clarity on the drug’s path to market and plan for clinical development while recognizing that combination therapy likely represents major upside beyond monotherapy.”

All of this prompted Maughan to rate Olema shares a Buy, along with a $12 price target. This target conveys his confidence in OLMA’s ability to climb 250% higher in the next year. (To watch Maughan’s track record, click here)

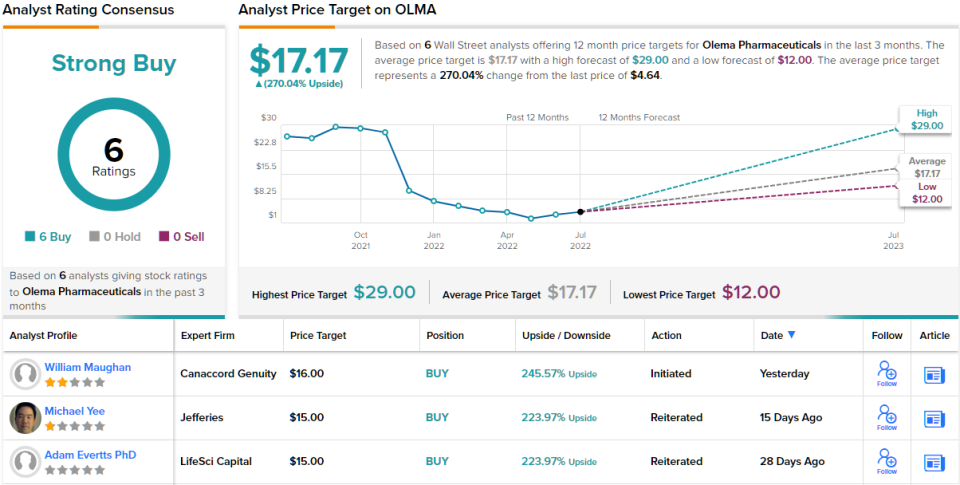

All in all, other analysts mirror Maughan’s sentiment. With 100% Street support, or 6 Buy ratings to be exact, the consensus is unanimous: OLMA is a Strong Buy. Shares are priced at $4.64, and the $17.17 average target implies 270% upside from that level. (See OLMA stock forecast on TipRanks)

To find good ideas for penny stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.