How you can avoid bond fund losses when rates rise

Bond funds that don’t lose money when interest rates rise? Sounds too good to be true, doesn’t it?

Such funds do exist, and my guess is that right now you’d jump at the chance to invest in them.

That’s entirely understandable, given recent carnage in the bond market: Year to date through July 7, long-term U.S. Treasurys have lost even more money than the S&P 500 SPX,

These bond funds that cushion you against such losses are known as rate-hedged bond funds. But you should know that their hedges carry a cost; there’s no free lunch, in other words. As I‘ll discuss below, these rate-hedged bond funds are probably most appropriate for investors with a very low risk tolerance.

To illustrate the costs and benefits of rate-hedged fund bonds, consider the iShares Interest Rate Hedged Corporate Bond ETF LQDH,

I wrote about this rate-hedged bond fund in the spring of 2021, when the CBOE’s Treasury Ten-Year Yield index TNX,

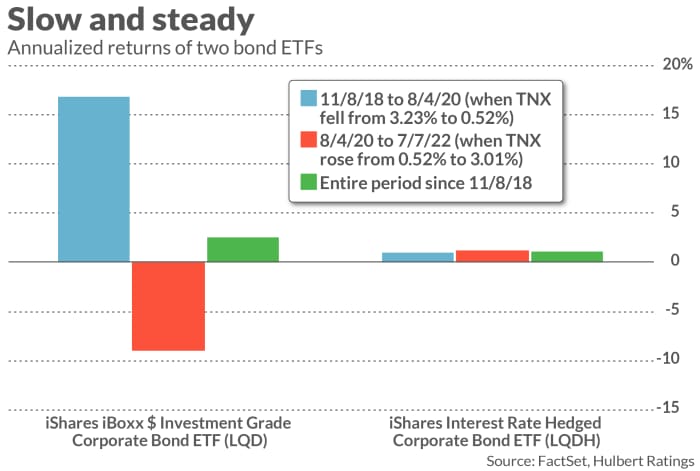

The accompanying chart compares the unhedged and the hedged bond funds’ returns over different periods since November 2018, when the TNX hit a multiyear high at 3.23%. From then until August 2020, this rate declined dramatically, which was good for bonds. Performance during this period is represented by the blue columns in the chart. As one might expect, the unhedged ETF far outpaced its hedged sibling over this period, producing a 16.8% annualized return versus just 1.0% annualized for the LQDH.

From August 2020 until today, in contrast, rates have risen back to more or less where they stood in November 2018, creating an environment very unfavorable to bonds. As you can see from the red columns in the chart, during this more recent period the hedged version came out on top by the impressive margin of plus 1.2% annualized to minus 9.0%.

What about performance over the entire period, during which the Treasury’s 10-year yield made a round trip from 3.2% to 0.5% and back again? Since rates overall were mostly unchanged, the expected return of the unhedged ETF would be its initial yield. And, sure enough, the LQD’s return since November 2018 has been 2.5% annualized.

The hedged ETF’s return over the same period was 1.1% annualized. The difference between this return and that of the unhedged ETF is a good estimate of the cost of the interest rate hedges.

The chart does a good job of illustrating both the volatility of the unhedged ETF and the cost of hedging against that volatility. If you had the intestinal fortitude to ride the bond market roller coaster over the last several years, then you earned a slightly higher return. If you instead chose the slow-and-steady approach, you did OK but not as well as investors in the unhedged ETF.

There’s no right or wrong answer on which approach is best. You may be entirely willing to give up more than an annualized percentage point in return for sleeping more easily at night. But if sleeping easily at night is not something that’s all that important to you, then you might very well opt for the unhedged version.

The point of this column is for you to be aware of this trade-off. Part of the return you earn from an unhedged bond fund is compensation for the higher volatility that you inevitably incur. It’s unrealistic to expect that you can avoid that volatility and still earn the same return.

No such thing as a perfect hedge

It’s also important to recognize that there is no such thing as the perfect hedge. That’s because there is no one interest rate, but instead myriad rates along the maturity spectrum from as short as a few weeks to as long as 30 years (and sometimes longer). Rarely is it the case that all those rates rise and fall in unison, so different bonds have different vulnerabilities to interest rate changes. This is especially worth keeping in mind for a fund like LQDH, which owns more than 2,400 individual bonds.

I go to the trouble of pointing this out to provide context for this ETF’s year-to-date loss of 4.6%. While that’s a lot better than the minus 15.5% year-to-date return of the unhedged version of this fund, it’s still a loss—indicating that the hedges the fund had in place weren’t perfect.

This is more of a short-term concern than over the longer-term, since over time the slope of the yield curve doesn’t change that much. That means your expected long-term return with rate-hedged bond funds is its current yield. The LQDH’s current 30-day SEC yield is 2.94%.

Since this is lower than the guaranteed 3.05% rate you can obtain by purchasing a 3- or 5-year U.S. Treasury, you might wonder if it’s worth it. Once again, the answer is a function of your tolerance for volatility. To the extent the LQDH’s hedges work, its expected return of 2.94% annualized will be achieved with less volatility than the Treasury’s 3.05%.

Only you know how much you value your sleep.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected].