A ‘who’s who of American business’ — big Wall Street names are marking the end phase of the bear market, says adviser

The good news about this bear market in stocks is that we’re more than halfway through it. The bad news is that we’re getting close to the final stage, when “everything must fall.”

That’s according to the blogger behind Irrelevant Investor and the director of research at Ritholz Wealth Management, Michael Batnick.

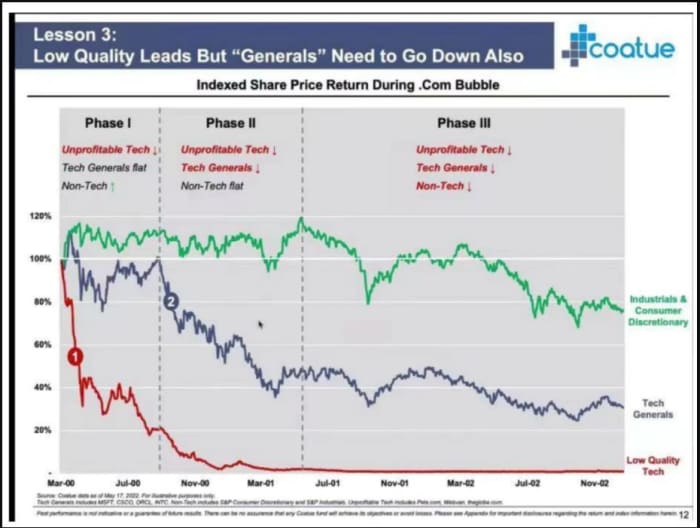

He first explains the order of “indiscriminate selling” in a such a down market — speculative names, the leaders, the rest. That has been the playbook in the past, as shown by his chart from hedge fund Coatue (via Eric Newcomer) that breaks down the dot.com bubble bursting:

A selloff in mid-2021 marked phase one, said Batnick. Meme stocks and some special-purpose acquisition vehicles got hit, along with Cathie Wood’s ARK Innovation ETF ARKK,

Earlier this year phase two swept in when the “tech generals fell one by one. Microsoft MSFT,

Read: Here’s why Britain’s Warren Buffett is sticking with Facebook’s parent and other beaten down techs

That brings us to the “everything” or phase three, and Batnick points out that only nine stocks representing $1 trillion in market cap were within 5% of their 52-week highs as of early Thursday, while 145 names representing $9 trillion are within 5% of 52-week lows.

He describes his list of more than 50 stocks in the latter camp as a “who’s who of American business.” They include Berkshire Hathaway BRK.A,

Also on that list are Nike NKE,

Read the full blog post here.