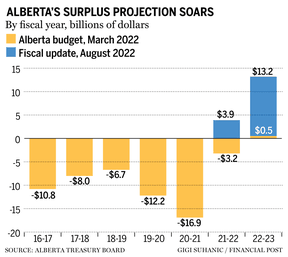

Alberta forecasts $13-billion surplus this year, slashes debt

Soaring energy prices and resource revenues catapult surplus higher

Article content

Alberta Finance Minister Jason Nixon said the province’s forecasted $13.2-billion surplus this year is evidence that the federal government shouldn’t be “betting against” the oil and gas industry.

Article content

“The federal government of this country has been betting against the oil and gas industry for the last several years and have told us at times that it was going to be the end of the oil and gas industry,” he said during a press conference on Wednesday. “Today’s numbers show that the federal government is wrong and that Alberta’s government was right to continue to stand with (this) industry.”

Article content

Nixon made the comments following the release of the province’s first-quarter fiscal update. The government cheerfully teared up financial estimates that had previously pegged Alberta’s budget surplus for this year at $511 million, as soaring energy prices and resource revenues have it now forecasting a $13.2-billion windfall for 2022-23.

Article content

The flood in resource revenues prompted the province’s United Conservative Party government to announce a massive $13.4-billion payment on Alberta’s debt this year, bringing the total down to $79.8 billion by early next year. Currently, the provincial debt sits at $93.1 billion.

Non-renewable resource revenue this year is now forecasted to reach $28.4 billion, by far the largest amount the province has ever reported.”You can tell by how big these numbers swing, the need for us as conservatives to continue to bring forward policies that do not put the province back on the natural resource roller coaster,” Nixon said.

“Instead of going back to the bad fiscal spending habits of previous governments, we are focused again on investing in the future of Albertans … and paying down debt.”

Article content

The latest surplus means the government is resuming its practice of indexing provincial income-tax brackets to inflation. That’s a move the province estimates will save Albertans about $300 million this year and around $680 million in 2023-24.

The province is also providing a $2.9-billion boost to the Alberta Heritage Fund, which was established under the government of former premier Peter Lougheed to ensure a portion of oil and gas royalties were set aside each year. In recent economic downturns, though, the value of the fund dipped as contributions were diverted to bolster general revenues.

Part of the reason the government’s budget estimates for this year have required such a dramatic correction is because the original forecasts released in February were based on an average West Texas Intermediate (WTI) price of US$70 per barrel. The benchmark North American oil price, however, averaged above US$100/bbl between April 1 and Aug. 23.

“While energy prices are high right now, Alberta needs to take this opportunity to strengthen provincial finances for the long term,” Nixon said.

• Email: [email protected] | Twitter: mpotkins

_____________________________________________________________

If you liked this story, sign up for more in the FP Energy newsletter.

_____________________________________________________________