If you need one more reason why stocks will likely lose money in September, here it is.

Finally, investors have a good reason for why the U.S. stock market will suffer above-average volatility and below-average performance this month: It’s the Fed.

I say “finally” because market analysts for weeks now have been searching for a reason to bet that 2022 will see a repeat of September’s famous seasonal tendency to be bad for the stock market. A week ago, I described September’s historical weakness as an “unsolved mystery.”

Read: What history says about September and the stock market

To be sure, the mystery still remains for any other year besides 2022. But there’s no mystery about what the U.S. Federal Reserve will be doing this month: In addition to continuing to aggressively raise interest rates, the U.S. central bank will be significantly accelerating the pace at which its balance sheet is being reduced.

At a minimum, this double-tightening can be expected to increase market volatility. Kent Engelke, chief economic strategist at Capitol Securities Management, focused on this consequence in a note this past week to clients: “Writing the obvious, the markets and the economy are entering into era that no one has yet experienced. Moreover because of the lack of experience, mistakes will be made. One trader described today’s Fed policy as driving 60 MPH over ice and pulling the emergency brake.”

“ The Fed’s double-tightening will lead to stock-market losses. ”

It stands to reason that the Fed’s double-tightening will lead to stock-market losses. Relatively few advisers are focusing on this outcome — at least among the more than 100 I regularly monitor. This implies that the double-tightening’s negative impact may not yet be fully discounted in stock prices.

Even fewer advisers are focusing on the central-bank tightening now occurring globally. Vincent Deluard, director of global macro at StoneX Financial, wrote this week in a note to clients that “the Swiss National Bank and the PBOC [People’s Bank of China] have started to aggressively shrink their bloated balance sheets. Even the uber-dovish Bank of Japan has reduced its balance sheet by ¥17 trillion since June and shrinking the ECB’s balance sheet is the next logical step for an institution who has been so far behind on rate hikes.”

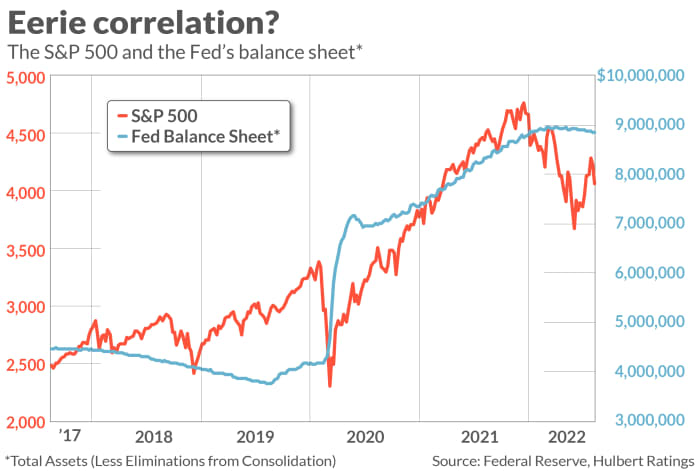

Another reason to suspect that the Fed’s double-tightening hasn’t yet been fully discounted in stock prices is that in recent years there’s been a close contemporaneous correlation between changes in the Fed’s balance sheet and the S&P 500 SPX,

This is worrisome since the Fed’s balance sheet hasn’t actually declined by much; it simply has stopped growing at its previous rate. That’s about to change, as Deluard notes: “Quantitative tightening will double to $95 billion a month in September. The jump will be all the greater as QT has run behind schedule this summer: the Fed’s balance sheet dropped by $63 billion since QT started on June 1st, about half the promised pace. Furthermore, the recent jump in mortgage rates has reduced prepayments so the Fed will likely need to actively sell mortgage-backed securities to meet its $35 billion monthly quota, rather than passively letting them roll off its balance sheet.”

It’s a bad sign that the stock market has already declined so much in the wake of a modest dip in the Fed’s balance sheet. This suggests that equity markets are more addicted to monetary easing than ever. It’s scary to contemplate how much pain will be necessary to cure the markets of its addiction.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected]

Don’t miss: Learn how to shake up your financial routine at the Best New Ideas in Money Festival on Sept. 21 and Sept. 22 in New York. Join Carrie Schwab, president of the Charles Schwab Foundation.

Also read: ‘Prepare for an epic finale’: Jeremy Grantham warns ‘tragedy’ looms as ‘superbubble’ may burst