A $3.2 Trillion Option Expiration Seen Worsening Post-CPI Rout

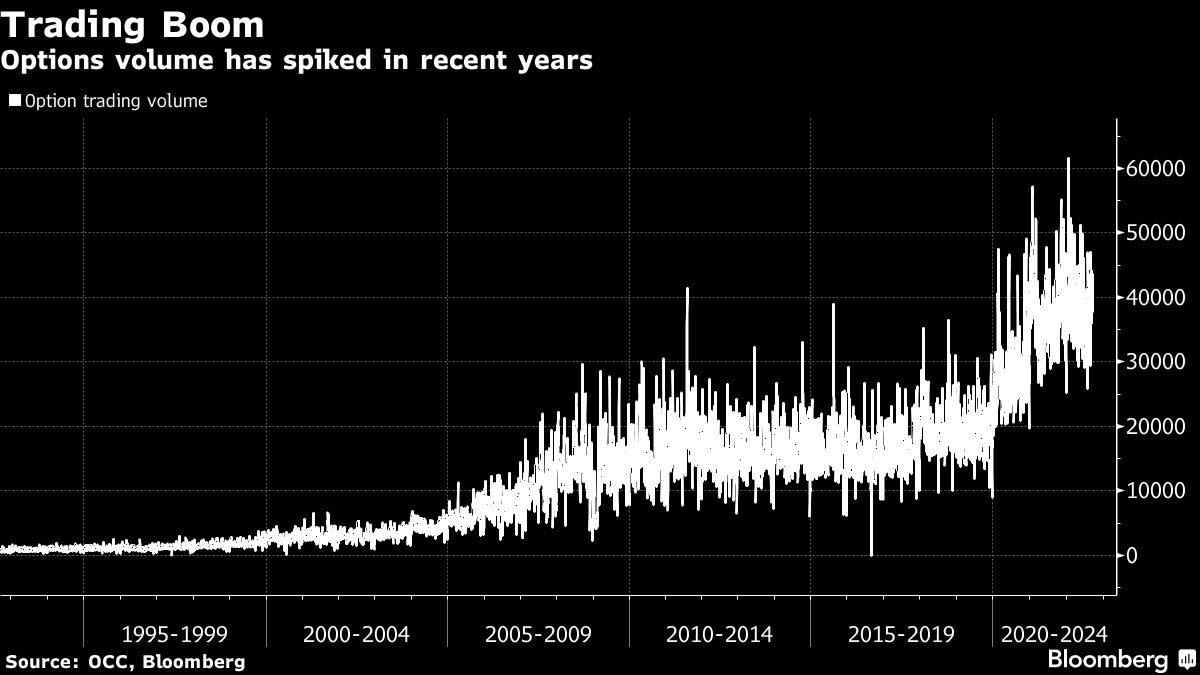

(Bloomberg) — Another wrinkle in a chaotic stock market where everything from the frenetic activity of quant traders to an ever-hawkish Federal Reserve is making investing harder than usual: A looming $3.2 trillion options expiry played a notable role in the Tuesday selloff.

Most Read from Bloomberg

As a hotter-than-expected inflation reading rocked Wall Street, a slew of bearish options that had become worthless during last week’s rally jumped back in the money, forcing market makers to sell underlying stocks to hedge their positions.

With those put contracts expiring Friday, the activity of dealers turned more sensitive to the movement in the cash market. After the S&P 500 fell below 4,000 — an area that harbors one of the highest open interest to roll out — selling intensified, according to Steve Sosnick, chief strategist at Interactive Brokers LLC.

“Once we broke through there, all hell broke loose,” Sosnick said on Bloomberg TV. “I have not been one of those to make too much hay about these expirations but lately they really have become significant.”

It’s the latest example of a controversial narrative that suggests that stocks effectively become a derivative of its own derivative — one that upends the traditional relationship between options and their underlying assets.

The interplay between the equity and options markets can be complex. To illustrate the dynamics, Brent Kochuba, founder of analytic service SpotGamma, calculated the gamma, or the theoretical value of stock required for market makers to buy or sell in order to hedge the directional exposure resulting from all price fluctuations in options.

Read more: Wishful Positioning Makes CPI Miss an Awful Day All Over Markets

At 8 a.m. Tuesday, dealer gamma was flat, according to SpotGamma’s estimate, meaning they didn’t need to do much hedging. After the data on August’s consumer price index hit the wire at 8:30 a.m., S&P 500 futures tumbled almost 3% in a matter of minutes. Instantly, dealer positioning flipped to a dynamic known as short gamma, meaning market makers had to trade with the prevailing trend — in this case selling stocks when they fall.

“Because these are short dated puts, their value changes much more rapidly,” said Kochuba. “Gamma is higher as you get closer to expiration. This leads to more active hedging, which expands volatility.”

The dynamic was a reversal from the previous week when an equity rally into this upcoming options expiration led to a decay in the value of put positions. That in turned prompted dealers to purchase stocks, adding fuel to market gains.

It’s unclear if the event known as OpEx will fuel fresh fireworks on Friday this time round. About $3.2 trillion of options are set to expire, obliging holders to either roll over existing positions or start new ones. The tally includes more than $2 billion of S&P 500-linked contracts and $505 billion of derivatives across single stocks scheduled to run out, according to estimates by Goldman Sachs Group Inc. strategist Rocky Fishman.

The good news is that there was a little sense of panic during the S&P 500’s $1.5 trillion rout on Tuesday, according to Amy Wu Silverman, an equity derivatives strategist at RBC Capital Markets. Stock trading volume was subdued, and the analyst didn’t see many new positions initiated in the derivatives market. That means, hedging activity from options dealers is likely to subside accordingly after Friday’s event.

“It’s definitely safe to blame options for some of the exacerbation of moves,” she said. “But it’s not really like this move freaked people out and made them add hedges.”

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.