Live news: Canadians’ debt costs hit record high on interest rate hikes

The latest business news as it happens

Article content

Today’s top headlines

Article content

2 p.m.

Fed holds interest rate steady

The United States Federal Reserve held the target range of the federal funds rate steady at 5.25 to 5.5 per cent.

Advertisement 2

Story continues below

Article content

The Fed’s policymakers also signalled that they expect to make three quarter-point cuts to their benchmark interest rate next year, fewer than the five envisioned by financial markets and some economists.

The relatively few number of rate cuts forecast for 2024 — which may not begin until the second half of the year — suggest that the officials think high borrowing rates will still be needed for most of next year to further slow spending and inflation.

1:35 p.m.

PwC pays $1.45 million in fines, costs to CPA Ontario for breaching code of conduct

CPA Ontario says accounting firm PwC has paid $1.45 million in fines and costs after 445 staff shared answers during mandatory internal training assessments between 2016 and 2020.

CPA Ontario says PwC self-reported the breach of the regulatory organization’s code of professional conduct.

The training was on accounting and auditing standards, audit strategy, planning, procedures and documentation, professional integrity and independence matters, and other issues related to audits.

CPA Ontario says the firm admitted to breaching its code of conduct.

Advertisement 3

Story continues below

Article content

The firm has paid a fine of $1 million and a further $455,000 in costs to CPA Ontario.

The regulatory organization says it has taken into account the remedial actions by PwC, which include ongoing periodic monitoring and internal discipline.

The Canadian Press

12:13 p.m.

Midday markets: TSX rises, Wall Street braces for Fed interest rate outlook

Strength in energy stocks helped Canada’s main index move higher in early-afternoon trading, while U.S. stock markets also gained ground.

The S&P/TSX composite index was up 0.27 per cent at 20,287.83 as the price of oil rose on reports of a strong drawdown in U.S. stockpiles that helped thaw a market frozen by concerns about excess supplies.

West Texas Intermediate climbed as much as 1.6 per cent to approach US$70 a barrel, rebounding from earlier declines as steep as 1.3 per cent.

On Wall Street, the S&P 500 was up 0.10 per cent at 4,648.32. The Dow Jones Industrial Average was up 0.04 per cent at 36,591.38 while the Nasdaq composite was up 0.06 per cent at 14,542.92.

U.S. markets are gearing up for what’s expected to be the most-important Federal Reserve decision of the year, with traders awaiting any signals on whether the market’s aggressive dovish bid is now overdone.

Article content

Advertisement 4

Story continues below

Article content

The Canadian Press, Bloomberg

10:30 a.m.

Markets open: Countdown to the Fed rate decision

Wall Street is gearing up for what’s expected to be the most-important United States Federal Reserve meeting of the year, with traders awaiting any indications on whether the market’s aggressive dovish bid is now overdone.

Stocks, bonds and the U.S. dollar saw mild moves amid bets the Fed will hold rates Wednesday and try to put a lid on expectations for rate cuts of over 100 basis points in the next 12 months. How the Fed frames its outlook for policy ending next year and 2025 via its “dot plot” could inject some uncertainty into the market that has run well ahead of the central bank’s forecasts.

The Federal Open Market Committee is poised to keep rates in a range of 5.25 per cent to 5.5 per cent — a 22-year high first reached in July. The decision and a statement will be released at 2 p.m. in Washington. Chair Jerome Powell will hold a press conference 30 minutes later. Economists surveyed by Bloomberg expect the median Fed projection will show two rate cuts next year and five more in 2025.

Advertisement 5

Story continues below

Article content

On Wall Street, the S&P 500 was up 0.15 per cent at 4,650.81. The Dow Jones Industrial Average was down 0.03 per cent at 36,565.76 while the Nasdaq composite was up 0.31 per cent at 14,577.89.

In Toronto, the S&P/TSX composite index was down 0.05 per cent at 20,222.80.

Bloomberg

9:36 a.m.

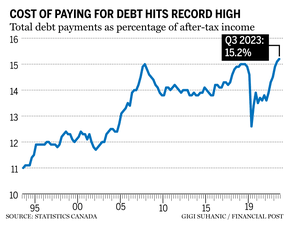

Canadians spend record amount to pay down debt

Canadians are spending more of their disposable income to pay down debt than ever recorded, as mortgage interest payments have nearly doubled since the Bank of Canada began hiking interest rates in early 2022.

The household debt service ratio, which tracks the total payments — principal and interest — that Canadians are required to make as a proportion of their disposable income, reached 15.22 per cent in the third quarter, the highest since data started being collected in 1990.

Statistics Canada released the figure in national balance sheet data on Wednesday. The report provides insight into the financial health of Canadians, who are the most indebted in the Group of Seven due to the high cost of housing.

Household wealth also slumped in the third quarter, as those higher debt costs were accompanied by weaker financial and housing markets. Household net worth — the value of all assets minus all liabilities — shrank 1.8 per cent to $16.2 trillion, the statistics agency said.

Advertisement 6

Story continues below

Article content

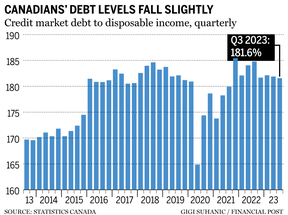

Still, the agency said the quarterly increase in household debt marked the slowest year-over-year expansion since 1990, suggesting that Canadians are putting the brakes on mortgage borrowing in the face of high interest rates.

Credit market debt as a proportion of disposable income also fell slightly to 181.6 per cent in the third quarter from 181.9 per cent in the second quarter. In other words, there was $1.82 in credit market debt for every dollar of household disposable income in the third quarter.

Since the Bank of Canada started raising interest rates in the first quarter of 2022, the amount of total mortgage interest payments has increased 89.6 per cent, the statistics agency said, leading to a 16.8 per cent drop in principal paid. The central bank held its benchmark rate at five per cent earlier this month.

Bloomberg

9:13 a.m.

Porter Airlines signs new partnership deal with Alaska Airlines

Porter Airlines has signed a new partnership deal with Alaska Airlines.

The companies say the interline agreement means that travellers can now buy combined Porter-Alaska itineraries directly from the Porter website or via third-party agencies.

Advertisement 7

Story continues below

Article content

Porter flights from Toronto to California are expected to start in January.

The new routes will allow passengers to fly directly into major Alaska Airlines hubs in Los Angeles and San Francisco.

Connections via shared Canadian airports are expected in early 2024.

Under the partnership, Alaska’s Mileage Plan members will also start earning points on Porter flights booked via Alaska Airlines from January and later in 2024.

Both VIPorter and Mileage Plan members will earn miles in their respective loyalty programs no matter where they book their flights.

The Canadian Press

8 a.m.

Dollarama profit and sales rise

Dollarama Inc. reported its third-quarter profit as sales rose compared with a year ago, raising its guidance for comparable-store sales.

The retailer says it earned $261.1 million or 92 cents per diluted share for the 13-week period ended Oct. 29, up from a profit of $201.6 million or 70 cents per diluted share a year earlier.

Sales totalled $1.48 billion, up from $1.29 billion in the same quarter last year.

Dollarama says the increase in sales was driven by growth in its total number of stores and increased comparable-store sales.

Comparable-store sales grew 11.1 per cent as the number of transactions rose 10.4 per cent and the average transaction size gained 0.6 per cent.

Advertisement 8

Story continues below

Article content

In its outlook, the company says it now expects comparable-store sales for its full year to grow 11 to 12 per cent, up from earlier expectations for growth of 10 and 11 per cent.

— The Canadian Press

7:30 a.m.

Natural gas to play role in shift away from fossil fuels under COP28 deal

COP28 climate talks in Dubai ended with a nod that lower-carbon fuels like natural gas will play a role in the shift to cleaner energy sources.

The summit’s final text recognized that such fuels “can play a role in facilitating the energy transition while ensuring energy security.” Producers have long argued that gas should complement the roll-out of intermittent renewables, replacing dirtier fossil fuels like coal and oil.

The proposal adds to an intense debate about the role of gas in the shift to clean energy. Major suppliers including Shell PLC and Woodside Energy Group Ltd. insist the fuel has a secure long-term role, and are pushing for more investments in new projects, while the International Energy Agency forecasts demand will peak this decade. Environmentalists argue that expanding gas production threatens 2050 net zero targets.

Advertisement 9

Story continues below

Article content

Gas has been heralded by the industry as the cleanest fossil fuel since it releases less carbon dioxide than coal when combusted. However, it’s responsible for rampant methane emissions, a byproduct of production that’s 80 times more dangerous than CO2. The COP28 text included a pledge to reduce methane pollution to near zero by the end of decade, and has been widely endorsed by the fossil fuel industry.

— Bloomberg

Stock markets before the opening bell

Stocks are treading water this morning as investors await the Federal Reserve’s interest rate decision later this afternoon.

Contracts for the S&P 500 and the Nasdaq 100 pointed to modest gains.

The central bank is widely expected to hold, but the latest U.S. inflation data raised doubts about the likelihood of an aggressive pivot toward policy easing. Investors are bracing for any warnings from Fed chair Jerome Powell that market expectations of policy easing are overdone.

The S&P 500 closed at the highest since January 2022 on Tuesday, while Treasury yields have tumbled on speculation the Fed will cut its benchmark rate by more than a full percentage point next year.

Advertisement 10

Story continues below

Article content

The TSX moved lower Tuesday, weighed down by losses in energy, utilities and battery metals.

— Bloomberg, The Canadian Press

What to watch today

- All eyes will be on the United States Federal Reserve today with the Federal Open Market Committee expected to hold the benchmark interest steady for the third meeting in a row. Markets will be looking for clues on the Fed’s next move when chair Jerome Powell speaks at a news conference after the 2 p.m. ET rate announcement.

- In Canada, Bank of Nova Scotia will release its new strategic plan at its investor day and discount retailer Dollarama Inc will release its earnings for the third quarter.

Need a refresher on yesterday’s top headlines? Get caught up here.

Additional reporting by The Canadian Press, Associated Press and Bloomberg

Article content

Comments