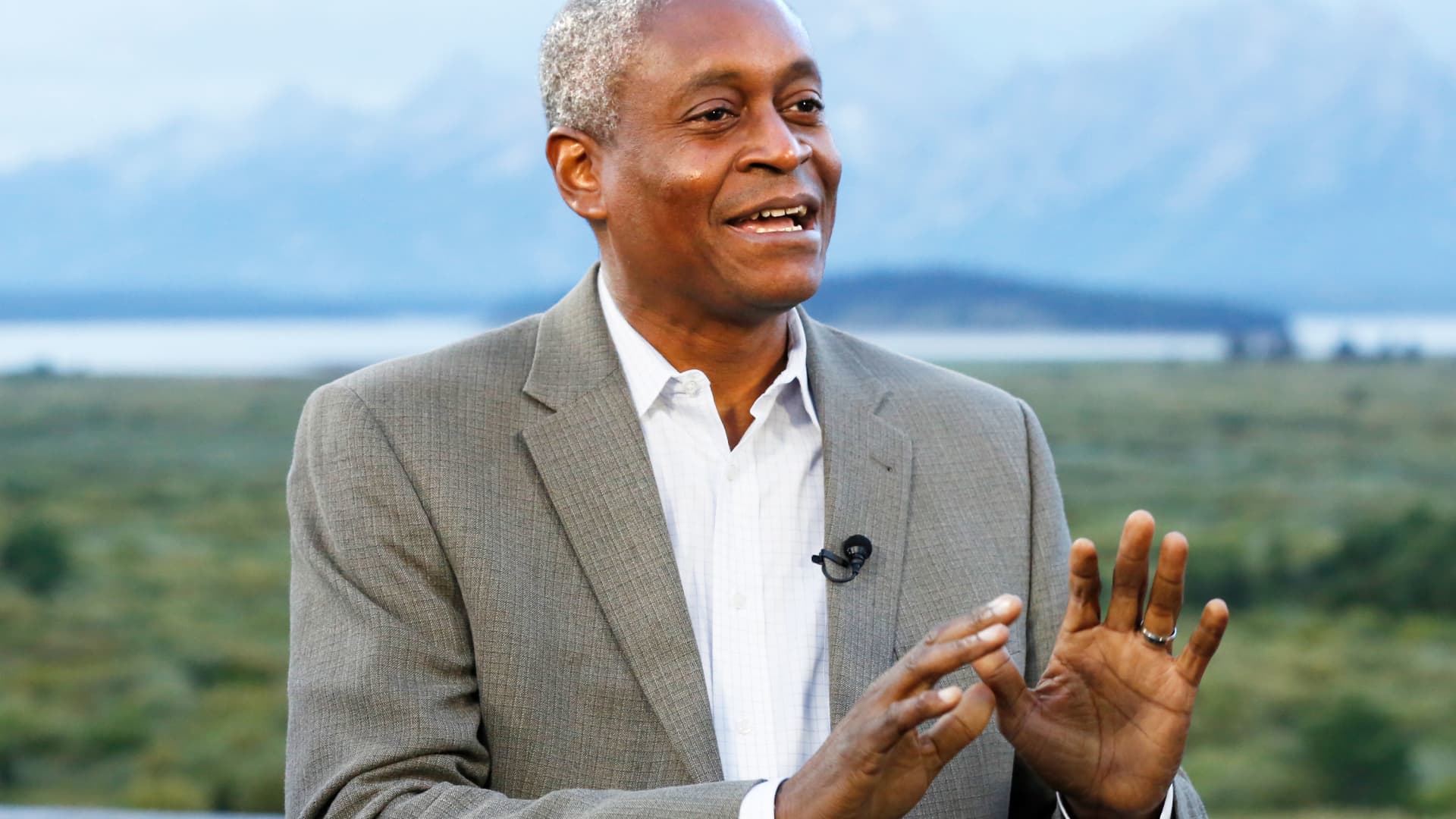

Fed’s Raphael Bostic expects rate cuts to happen in the third quarter

Atlanta Federal Reserve President Raphael Bostic expects policymakers to start cutting rates in the third quarter of this year, saying Thursday that inflation is well on its way back to the central bank’s goal.

Bostic, a voting member this year on the rate-setting Federal Open Market Committee, asserted that the goal ahead is to calibrate policy to be not so restrictive as to choke off growth while still acting as a bulwark against persistently elevated prices.

However, he said a “golden path” scenario of tamping down inflation while promoting solid growth and healthy employment is getting closer than many Fed officials had expected.

“Because I’m data dependent, I have incorporated the unexpected progress on inflation and economic activity into my outlook, and thus moved up my projected time to begin normalizing the federal funds rate to the third quarter of this year from the fourth quarter,” Bostic said in prepared remarks for a speech to business leaders in Atlanta.

While the remarks help illuminate a timeline for rate cuts, they also serve as a reminder that Fed officials and market participants have different expectations about policy easing.

Current pricing in the fed funds futures market points to the first cut coming as soon as March, according to the CME Group’s FedWatch measure. The implied probability for a quarter percentage point reduction has decreased in recent days but still stood around 57% on Thursday morning. Pricing further indicates a total of six cuts this year, or one at every FOMC meeting but one from March forward.

Bostic said he’s not dead set against cutting earlier than the third quarter, implying a move in July at the earliest, but said the bar will be high.

“If we continue to see a further accumulation of downside surprises in the data, it’s possible for me to get comfortable enough to advocate normalization sooner than the third quarter,” he said. “But the evidence would need to be convincing.”

A number of factors could change the calculus, such as geopolitical conflicts, the ongoing budget battle in Washington and looming presidential election, to name a few that Bostic cited.

Consequently, he advocated caution and said his approach will be “grateful and vigilant.”

“In such an unpredictable environment, it would be unwise to lock in an emphatic approach to monetary policy,” Bostic said. “That is why I believe we should allow events to continue to unfold before beginning the process of normalizing policy.”

Some of the data points Bostic said he will be watching include overall economic growth, inflation readings such as the Commerce Department’s personal consumption expenditures price index, and data on job growth and losses.

The Labor Department reported Thursday that initial jobless claims hit their lowest level since September 2022, a sign that the labor market remains tight.

Don’t miss these stories from CNBC PRO:

- Tesla versus BYD: Analysts prefer one of them — giving it up to over 70% upside

- Goldman says small caps to beat large caps this year. 10 cheap smaller stocks to buy

- DoubleLine’s Gundlach sees ‘very painful’ economic downturn, S&P 500 may be forming ‘double top’

- ‘One of the best valuations for AI’: Buy the dip in this Big Tech stock, strategist says