Posthaste: Canada’s standard of living on track for worst decline in 40 years

Slump in GDP per person threatens to be longest and largest since 1985, says study

Article content

Measuring a country’s growth can be contentious.

Article content

Measure Canada’s gross domestic product by aggregate and it doesn’t look so bad, but measure it by person or per capita and it’s dismal.

For example, between 2000 and 2023 Canada had the second highest rate of aggregate GDP growth in the G7, but one of the lowest growth rates per person.

When a country has had a population surge as Canada has, economists say measuring by person gives a better picture of its standard of living, and according to a new study by Fraser Institute that standard is headed for its biggest decline in 40 years.

Advertisement 2

Story continues below

Article content

The study by Grady Munro, Jason Clemens, and Milagros Palacios looks at the three worst periods of decline and recovery of real GDP per person in the country since 1985. They are between 1989 and 1994, years that included a recession, between 2008 and 2011, the aftermath of the great financial crisis, and this last that began in 2019.

This latest period is unique because even though GDP per person recovered for one quarter in mid-2022, it immediately began to decline again, and by the end of 2023 was well below where it was in 2019.

“This lack of meaningful recovery suggests that since mid-2019, Canada has experienced one of the longest and deepest declines in real GDP per person since 1985,” said the study’s authors.

Between April of 2019 and the end of 2023, when the last data was available, inflation-adjusted per-person GDP fell 3 per cent from $59,905 to $58,111. That is surpassed only by the declines in 1989 to 1992, when GDP per person fell 5.3 per cent and in the financial crisis, when it fell 5.2 per cent, says the study.

The latest decline has lasted 18 quarters, making it the second longest in the past 40 years. Only the decline of 1989 to 1994, which lasted 21 quarters, was longer.

Article content

Advertisement 3

Story continues below

Article content

Key, though, are signs that it is not over yet. GDP per person in the fourth quarter of 2023 was down 0.8 per cent from the quarter before, suggesting it is still on a downward track, said the study.

“The decline in incomes since Q2 2019 is ongoing, and may still exceed the downturn of the late 1980s and early 1990s in length and depth of decline,” said the authors.

“If per-capita GDP does not recover in 2024, this period may be the longest and largest decline in per-person GDP over the last four decades.”

Fraser Institute is not alone in flagging this problem. In a recent article for the Financial Times, Ruchir Sharma, chair of Rockefeller International, identified Canada as one of the countries that has suffered a steep decline in real per-capita income growth and a drop in their share of global GDP.

A leader among the so-called “breakdown nations,” Canada’s GDP per capita has been falling 0.4 per cent a year since 2020, the worst rate among 50 developed economies.

“Widely admired for how it weathered the global financial crisis of 2008, [Canada] missed the boat when the world moved on, driven by Big Tech instead of commodities,” wrote Sharma. “New investment and job growth are being driven mainly by the government.”

Advertisement 4

Story continues below

Article content

Not only does Canada lag most developed economies, Canadian provinces also fall far behind almost all U.S. states, said Trevor Tombe, a professor of economics at the University of Calgary, in a column last year for the Hub.

Ontario last year had a per-person level of economic output similar to Alabama, said Tombe. The Maritimes were below Mississippi, and Quebec and Manitoba lag West Virginia.

Canada’s strongest economy, Alberta beat the U.S. average, but ranked 14th overall.

“It’s roughly comparable to New Jersey and Texas, but 13 per cent below California and nearly one-quarter below New York,” wrote Tombe.

Sign up here to get Posthaste delivered straight to your inbox.

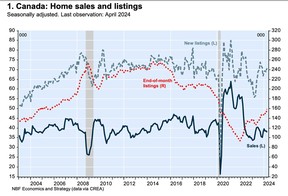

Canada’s housing market saw a surge of listings in April to their highest level in five years. Newly listed homes rose 2.8 per cent from the month before, making the 6.5 per cent jump in the number of properties on the market the second largest month-over-month gain on record.

Shaun Cathcart, chief economist with the Canadian Real Estate Association which released the data, said this spring was the opposite of last when a rush of buyers jumped into the market when new listings were at a 20-year low.

Advertisement 5

Story continues below

Article content

With home sales down and listings up, Canada’s housing market is more balanced than since before the pandemic, said CREA.

- Today’s Data: United States housing starts and building permits, industrial production and capacity utilization

- Earnings: Lightspeed Commerce Inc, Canada Goose Holdings Inc, ATS Corp, Walmart Inc, Deere & Co, Take-Two Interactive Software, Applied Materials Inc

Have you ever had a company report great earnings, or what you thought were great earnings, only to see its share price plunge 20 per cent or more after the earnings release? Sure, you have. We’ve all been there. It might be enough to make you re-evaluate your holding, but it shouldn’t, says investing pro Peter Hodson. Often, a stock can decline on good earnings news for a whole slew of reasons, and not many of them are bad. Find out more from FP Investor

Recommended from Editorial

Advertisement 6

Story continues below

Article content

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you wondering how to make ends meet? Drop us a line at [email protected] with your contact info and the general gist of your problem and we’ll try to find some experts to help you out while writing a Family Finance story about it (we’ll keep your name out of it, of course). If you have a simpler question, the crack team at FP Answers led by Julie Cazzin or one of our columnists can give it a shot.

McLister on Mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Read them here

Today’s Posthaste was written by Pamela Heaven with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at [email protected].

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Comments