Economic uncertainty is pushing Canadians to save at a rate not seen in decades

Savings are up, spending is down and debt levels are high

Article content

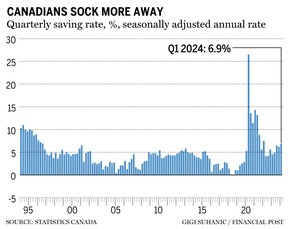

The Canadian household savings rate jumped to 6.9 per cent in the first quarter, a level not seen since 1996, excluding the pandemic.

The savings rate measures the amount Canadians set aside from disposable income, expressed as a percentage. When the pandemic forced Canadians into lockdown and consumption cratered, the rate surged to abnormal levels, hitting 26.5 per cent in the second quarter of 2020. But it declined rapidly before it started to climb again during the second half of 2023 and into this year.

Advertisement 2

Story continues below

Article content

The current rate of saving is well above 2019 levels, when it hovered between one to two per cent.

Economists have offered two explanations for the recent run-up, the first being that wage growth is now outpacing the rate of inflation, which gives Canadians access to more disposable income.

“A while ago, inflation was higher than hourly earnings, so it was really hurting people,” said Brooke Thackray, research analyst at Global X. “Now, just recently because inflation has come down, average hourly earnings are above inflation, so there’s been more money for them.”

The other explanation is that Canadians are pessimistic and are preparing for a potential economic downturn.

“If you want to put a less positive spin on it, you could say that people are spending less because they’re worried about the economy, they’re worried about high levels of debt, they’re worried about high levels of interest rates,” said Josh Sheluk, portfolio manager at Verecan Capital Management. “Savings rates have tended to rise during weaker periods economically during the last 25 years.”

Advertisement 3

Story continues below

Article content

Canada’s unemployment rate jumped to 6.4 per cent in June and there are signs of a slowing economy.

The latest retail trade data and the business outlook survey from the Bank of Canada show Canadians are pulling back on consumer discretionary spending. Additionally, Canadians are contending with high levels of debt, with Canada’s debt-to-income ratio hitting 180 per cent, the worst in the G7.

Trevor Tombe, economist and professor at the University of Calgary, argues the current savings rate is not seen equally among age cohorts in Canada. While the younger generation of Canadians typically save more, Tombe says the biggest contributors to this recent jump are older Canadians aged 65 years old and up.

“The dissaving rate among older households has risen a lot from negative 29 per cent two years ago to negative 16 per cent today,” Tombe said. “Higher interest rates boost their income considerably and consumption is typically not going to increase as much, so that just leads to more savings.”

Recommended from Editorial

Tombe said older people tend to hold high-yield investments and younger people typically carry more debt, creating an unequal story when it comes to the impact interest rates have on disposable income across generations.

• Email: [email protected]

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Comments