Interest rates look ‘high’ given Canada’s softening economy: Economists on July jobs numbers

Economists expect central bank to cut rates for third consecutive time next month

Article content

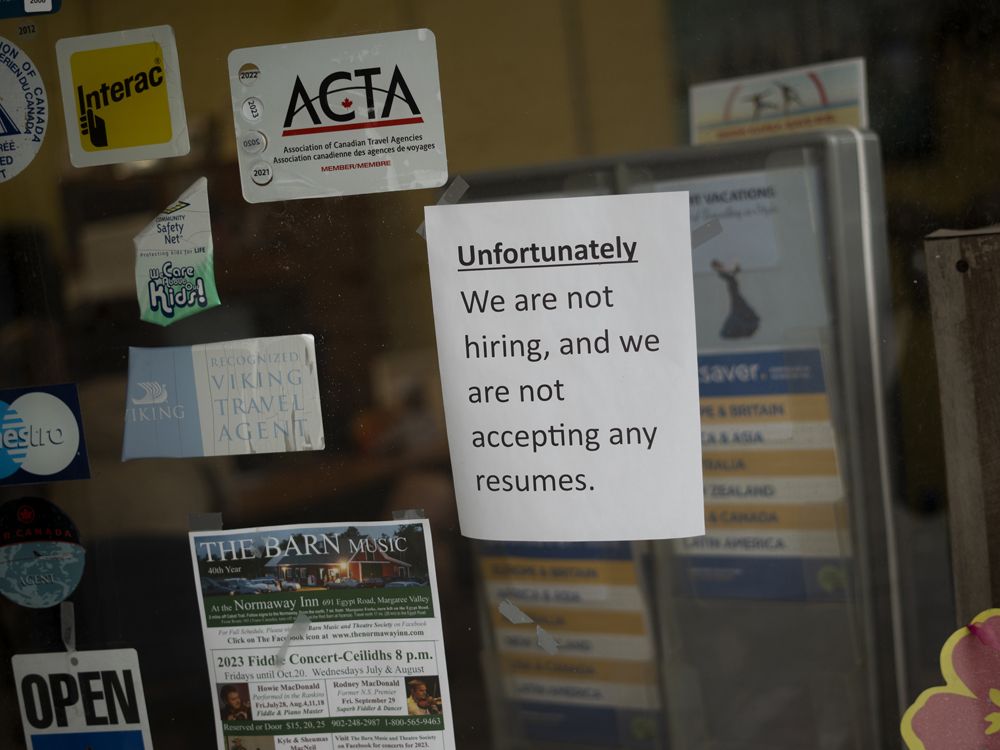

Statistics Canada released its latest jobs report on Friday, which showed the country’s unemployment rate held steady in July at 6.4 per cent, while the economy lost 2,800 jobs and the employment rate dipped — mirroring June’s results, when positions fell by a negligible 1,800.

Economists tracked by Bloomberg predicted the jobless rate would rise to 6.5 per cent and the economy would add 25,000 positions.

Advertisement 2

Story continues below

Article content

The jobs market has been on the Bank of Canada’s radar, but the bank’s latest deliberation minutes showed that officials have intensified their focus to the labour market out of concern that further weakness could crimp consumer spending and economic growth.

Here’s what economists think the July jobs data mean for the Bank of Canada and interest rates:

‘Turn for the worse’: Capital Economics

This is the second consecutive month that the economy has lost jobs, which might suggest the “labour market has taken a turn for the worse,” said Stephen Brown, deputy chief North America economist at Capital Economics, in a note.

Brown doesn’t think that is the case, however, attributing the drop to low hiring among younger Canadians.

“The one per cent month-over-month rise in hours worked tells a much more positive story,” he said.

What will concern the Bank of Canada is the strong year-over-year 5.2 per cent increase in the average hourly wage rate.

Still, Brown thinks the bank will plow ahead with another 25 basis point rate cut at its Sept. 4 meeting.

“But the continued strength of wage growth maintains a high bar for a 50-basis-point cut move, as markets were recently beginning to price in,” he said.

Article content

Advertisement 3

Story continues below

Article content

‘Largely mixed’: CIBC Economics

“The details of the jobs count were largely mixed,” Andrew Granthan, an economist with Canadian Imperial Bank of Commerce, said in a note, with the number of full-time positions rising by 62,000 and part-time falling 64,000 — though Statistics Canada said it recorded a “sharp decline” in private sector employment.

Still, the number of hours worked rose, and that should bode well for July gross domestic product, Grantham said.

He doesn’t think the July report will do much to ease the Bank of Canada’s rising concerns about the labour market, despite the fact that the unemployment rate “held steady.”

CIBC is now calling for rate cuts of 25 basis points at each of the three remaining Bank of Canada meetings this year. It increased its projected number of cuts after the release of weaker-than-expected U.S. jobs numbers last Friday.

‘Run its course’: RBC Economics

“There was nothing in the July Canadian labour force data to say that the ongoing cooling in labour markets has run its course,” Nathan Janzen, assistant chief economist at Royal Bank of Canada, said in a note.

Advertisement 4

Story continues below

Article content

Janzen said the unemployment rate — up nearly one percentage point from a year ago — would have risen in June if not for the “large drop” in the labour force participation rate. It fell to 65 per cent from 65.3 per cent in June.

Further, the number of people looking for work declined by 11,000 even though the population grew by 125,000.

The economist doesn’t seem too worried about wage growth.

“Further signs of softening in labour markets — and slower growth in other measures, including those from business payrolls — argue that wage growth will continue to slow,” he said.

Given Canada’s “softening” economic picture, interests rates look “high,” Granthan said.

Recommended from Editorial

RBC expects the Bank of Canada to cut rates for a third consecutive time next month.

No lipstick for ‘pig of report’: Rosenberg Research

Canada’s declining jobs participation rate was the only thing that kept the unemployment rate from rising to 6.9 per cent instead of 6.4 per cent, economist David Rosenberg of Rosenberg Research, said in a note.

Advertisement 5

Story continues below

Article content

Digging into Friday’s jobs numbers, Rosenberg said the employment-to-population rate — a measure the Bank of Canada follows — continued to slide in July, falling for the third consecutive month, to 60.9 per cent from 61.1 per cent in June, and the “lowest since August 2021.”

Other signs of stress in labour market were evident.

“It is becoming much more challenging to find a job for those who are unemployed for the long term (27 weeks or more),” he said. Those without work for 27 weeks or more made up 18.7 per cent of the unemployed — up from 17.9 per cent in June and “a cycle low of 14 per cent,” he said.

In addition, the unemployment rate is up 1.6 percentage points from its July 2022 low of 4.8 per cent. Increases of this magnitude are typically seen during recessions, Rosenberg said.

“The Bank of Canada acted too late but is now on its game and more rate cuts are surely coming our way — all the way down on the policy rate to at least the mid-point of ‘neutral’ at 2.75 per cent,” the economist said.

And Rosenberg doesn’t think the bank will stop there but will keep going past the neutral rate.

• Email: [email protected]

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Comments