Posthaste: Canada and the world brace for the Fed â and the suspense has rarely been higher

Odds of a smaller or bigger cut still close to a coin toss

Article content

The world’s most powerful central bank is poised to cut its interest rate when it meets Wednesday, and rarely has there been so much suspense about the outcome.

The United States Federal Reserve‘s decision comes in a week that Bloomberg describes as a “36-hour monetary roller coaster” which includes policy decisions by central banks in the United Kingdom, Japan, Brazil and South Africa.

Advertisement 2

Story continues below

Article content

“There has rarely been so much uncertainty over central bank intentions,” analysts at Edmond de Rothschild wrote in a note. “They are caught between signs of economic weakness and inflation which is stubbornly resisting a return to the 2 per cent target.”

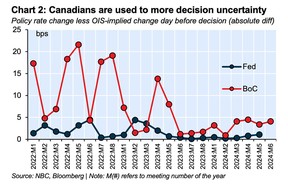

The Bank of Canada has been known to come up with a few surprises, but rarely has the Federal Reserve done so, said National Bank of Canada economist Taylor Schleich. Unexpected moves from the Fed have the tendency to throw global markets for a loop.

Since 2022, overnight indexed swap markets have correctly predicted the outcome of all 21 Fed meetings and the day before the decision, have never priced in more than five basis points of uncertainty, he said.

Before the weekend, it was still “a virtual coin toss” whether the Fed will go for a 25 or 50 basis-point cut, Bloomberg reported. This morning odds had swung to a 60 per cent chance of a deeper cut.

Not since the lead-up to the financial crisis in 2007 have bond traders been so divided about the outcome of a Fed meeting, said Bloomberg.

Whatever the Fed decides it will affect Canada.

Article content

Advertisement 3

Story continues below

Article content

If Fed chair Jerome Powell and company opt for the smaller cut the Canadian dollar could take a hit, said Avery Shenfeld, chief economist at CIBC Capital Markets. CIBC expects a quarter point from the Fed Wednesday, followed by two 50-bps cuts.

“It’s hard to overstate the significance of the Fed giving the all-clear sign for inflation — particularly the significance for Canadian mortgage rates,” said MortgageLogic.news analyst Robert McLister.

A cut by the Fed signals that the U.S. economy is weakening, and if this in turn slows Canada’s output, “it’s possible that markets aren’t pricing in a big enough drop in our overnight rate,” he said.

Among Canada’s big six banks, CIBC has already trimmed its target for the Bank of Canada’s interest rate by a quarter point to 2.25 per cent, said Shenfeld.

But to stay out of recession the central bank also needs to pick up the pace, he said. CIBC now expects the Bank of Canada to cut rates by 25 bps in October, and 50 bps in both December and January. Previously their forecast had been for smaller cuts.

Sign up here to get Posthaste delivered straight to your inbox.

Advertisement 4

Story continues below

Article content

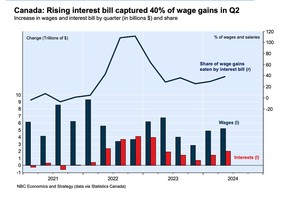

Canadians saw wages grow at the fastest pace in a year in the second quarter, but a big chunk of those bigger paycheques was gobbled up by the higher cost of debt, says National Bank of Canada.

The cost of servicing household debt consumed an amount equivalent to 40 per cent of the additional wage growth in the quarter, said economist Matthieu Arseneau, who brings us today’s chart — the highest share recorded in the past year.

“With the weak labour market likely to moderate wage growth, the rising interest burden is expected to remain a significant share of household income growth for the foreseeable future, limiting the potential for a strong rebound in consumer spending growth,” he said.

- The Canadian Real Estate Association releases its figures for August home sales today.

- Today’s Data: Canada manufacturing sales, United States empire manufacturing

Advertisement 5

Story continues below

Article content

Recommended from Editorial

You can transfer assets to your spouse in-kind, but spousal attribution rules prevent a higher-income spouse from transferring assets to a lower-income spouse to avoid higher taxes. However, certified financial planner Andrew Dobson says there are strategies you can employ to help improve your overall family tax efficiency. Find out more.

Build your wealth

Are you a Canadian millennial (or younger) with a long-term wealth building goal? Do you need help getting there? Drop us a line with your contact info and your goal and you could be featured anonymously in a new column on what it takes to build wealth.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his mortgage rate page for Canada’s lowest national mortgage rates, updated daily.

Today’s Posthaste was written by Pamela Heaven, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at [email protected].

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Comments