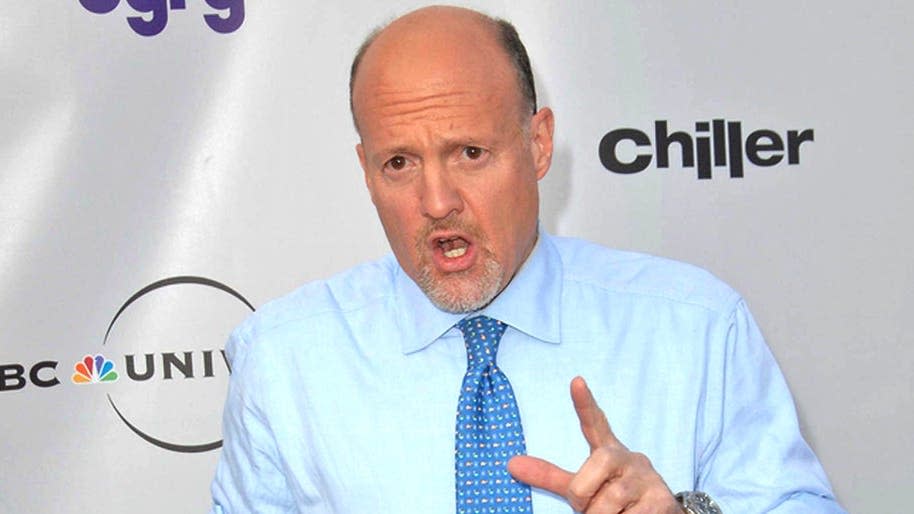

Jim Cramer: This Utilities Stock Is A Buy, Calls Wells Fargo A ‘Winner’

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

On CNBC’s “Mad Money Lightning Round,” Jim Cramer said Wells Fargo & Company (NYSE:WFC) is going to go higher, adding that it’s a “winner.”

On Sept. 17, the San Francisco-based bank launched specialized Application Programming Interfaces (APIs) for its Commercial Banking clients, expanding its API portfolio.

These APIs offer real-time data access aimed at boosting sales, improving liquidity, reducing credit risk, and cutting expenses for floorplan and channel finance clients across several industries.

Trending Now:

“It’s had too big a move up,” Cramer said when asked about Iron Mountain Incorporated (NYSE:IRM). “Let’s move on.”

On Aug. 1, Iron Mountain reported better-than-expected second-quarter financial results and issued FY24 AFFO guidance above estimates. Also, the company increased its quarterly dividend.

Palantir Technologies Inc. (NYSE:PLTR) is a “cold” stock, Cramer said.

On Sept. 17, the company inked a multi-year, multi-million-dollar contract with Nebraska Medicine. As per the deal, Palantir will utilize its Artificial Intelligence Platform (AIP) to enhance healthcare through transformative technologies.

The “Mad Money” host recommended buying PG&E Corporation (NYSE:PCG). “That stock is a good one, rate increase or no,” he added.

On Sept. 12, B of A Securities analyst Ross Fowler reinstated PG&E with a Buy and announced a $24 price target.

Keep Reading:

This article Jim Cramer: This Utilities Stock Is A Buy, Calls Wells Fargo A ‘Winner’ originally appeared on Benzinga.com