Posthaste: What tax break on GST could mean for Bank of Canada 50 bps rate cut

Ottawa pledges tax holiday on raft of consumer goods plus rebates for millions of Canadians

Article content

The Liberals’ announcement Thursday of roughly $6.3 billion in GST/HST breaks and rebates has some economists wondering what that rush of cash into people’s pocketbooks could mean for the Bank of Canada and interest rate cuts.

When inflation was soaring, the Bank of Canada weighed in on federal spending and deficits, calling on government to maintain budget discipline to avoid fuelling consumer demand in ways that could exacerbate the rising cost of living.

Advertisement 2

Story continues below

Article content

That happened when inflation was peaking at 8.1 per cent in June 2022. At the time, the Bank of Canada launched a rate-hiking cycle that saw borrowing costs leap to five per cent from a low of 0.25 per cent.

Today, year-over-year headline inflation has cooled to the central bank’s target rate of two per cent. Policymakers have cut rates four consecutive times with debate swirling about whether the central bank should cut by another 50 basis points when it next meets on Dec. 11.

The Bank of Canada’s benchmark lending rate stands at 3.75 per cent. Economists at banks and financial services companies are forecasting a terminal interest rate of as low as two per cent or lower.

Royce Mendes, managing director and head of macro strategy at Desjardins Group, said the cuts in the form of GST exemptions from Dec. 14 to Feb. 15, 2025, on a variety of items from children’s clothing to Christmas trees, represents roughly 0.2 per cent of gross domestic product (GDP) “and could have a high fiscal multiplier, meaning it could translate into a noticeable boost to growth in the first half of next year.”

Article content

Advertisement 3

Story continues below

Article content

In addition to the GST exemptions, Canadians making under $150,000 per year will also receive a $250 rebate in the spring, with the rebates accounting for nearly $5 billion of the package.

Mendes said that the GST holiday will “mechanically lower inflation” for the simple reason that items on the exemption list will cost less.

But he doesn’t think that will hold sway with the Bank of Canada, which “will look through that type of move.”

“Central bankers will be more interested with the impacts on growth and underlying price pressures,” Mendes said.

He thinks the cuts and rebates could affect how fast and how far interest rates come down and believes that this move by the Liberals closes the books on any possibility of a jumbo 50-basis-point (bps)rate cut in December.

Chances of a larger-than-standard 25 bps cut fell after Tuesday’s consumer price index report showed the rate of inflation accelerating to two per cent last month from 1.6 per cent in September.

“We continue to see a 25 basis point rate cut in December, with quarter-point cuts the norm in 2025, as the Bank of Canada carefully searches for a slightly stimulative policy stance,” Mendes said. “The announcement should all but close the door to a 50 basis point cut next month.”

Advertisement 4

Story continues below

Article content

Stephen Brown, assistant chief North America economist for Capital Economics, thinks the GST holiday will be a wash in terms of its effect on inflation.

“The two-month tax cut will result in lower inflation over December and January but then boost it over February and March, so shouldn’t have any direct implications for policy,” Brown said in an email.

The rebate cheques are another matter, however.

“The rebate cheques are more important, given those are the larger fiscal stimulus,” he said.

Brown cited former Bank of Canada governor Stephen Poloz who reckoned that $5 billion added to the deficit stimulated economic growth to the same degree as a 25 bps interest rate cut, though, Brown noted that assessment dates from a time when the economy was “much smaller.”

That means it’s possible the rebates will stimulate the economy less.

“At the margin, this small stimulus could result in at most one less 25 bps rate cut from the bank, although it’s not enough on its own to make us change our forecasts,” Brown said.

Capital Economics is currently calling for another 50 bps rate cut from policymakers.

Advertisement 5

Story continues below

Article content

Derek Holt, vice-president and head of capital markets economics at Bank of Nova Scotia, also thinks the Liberals’ plans could result in one less interest rate cut by the Bank of Canada.

“It makes it more likely the (Bank of Canada) will deliver a smaller rate cut of 25 bps in December rather than a bigger one, and may modestly trim the amount of rate cuts they deliver next year,” Holt said in an email.

Holt wondered if the GST cuts will really be temporary.

“It’s an obvious step toward priming the electorate for an election call and I can’t see the government allowing prices to go right back up in February when an election will be three months closer at hand than it is now,” he said.

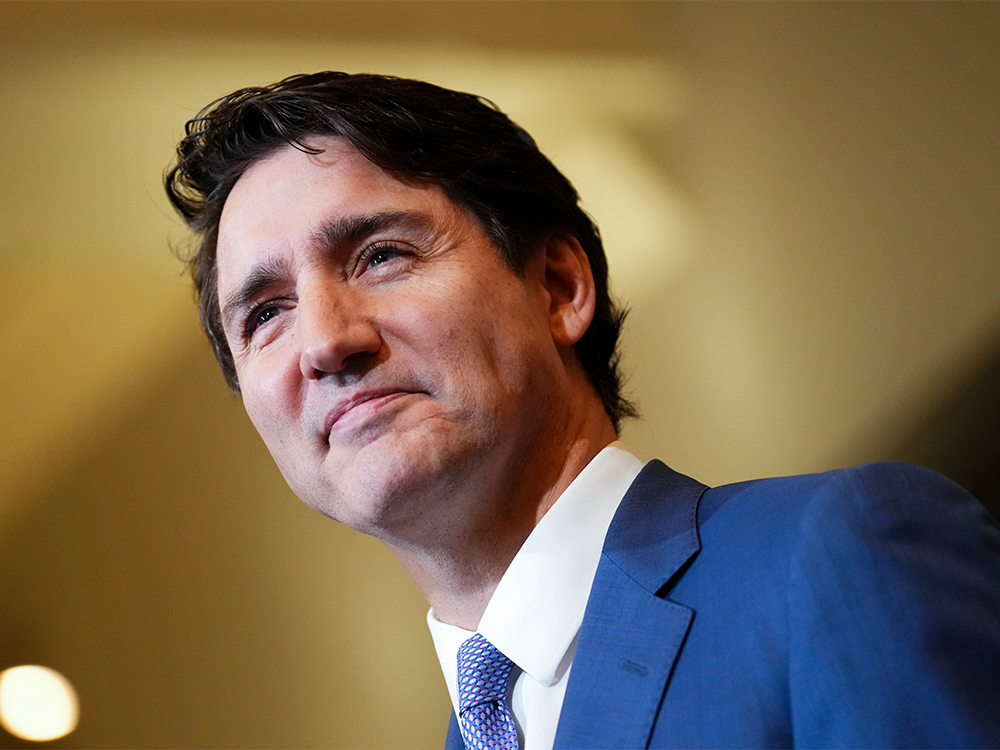

That possibility, combined with the Justin Trudeau rebates and the $200 cheques Ontario Premier Doug Ford will send out to 15 million Ontarians in the new year, would all else being equal give people more to spend, he said, something that could fuel inflation.

Sign up here to get Posthaste delivered straight to your inbox.

A new class of unlikely property barons has emerged amid a national housing crisis.

Advertisement 6

Story continues below

Article content

That is, individuals and corporations who bought real estate back in the day and are now either selling the property for huge sums to a developer, or looking at ways to develop it themselves, as Telus Corp., Leon’s Furniture Ltd. and Canadian Tire Corp. Ltd. are doing.

“We need to look at some of these people that you wouldn’t normally think of as being housing developers and see them as an important piece in solving the (housing) puzzle,” said one housing expert. — Joe O’Connor, Financial Post

To find out more about these new property barons, keep reading here.

- Today’s data: Statistics Canada releases retail sales for September.

Recommended from Editorial

Advertisement 7

Story continues below

Article content

Financial planning is a process that includes retirement, tax, investment, insurance, and estate planning, along with financial management of how much you earn, spend, and borrow. A comprehensive financial plan should incorporate these six key areas, but what a financial plan looks like and how often you should update yours is a mystery to many Canadians. Read Jason Heath’s primer on creating a financial plan here.

Hard Earned Truths

In an ongoing series about what the next generation needs to know to build wealth, we offer Hard Earned Truth #7: The pros can’t pick stocks and neither can you. So, what should an investor do? Read on.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Read them here

Financial Post on YouTube

Visit Financial Post’s YouTube channel for interviews with Canada’s leading experts in economics, housing, the energy sector and more.

Today’s Posthaste was written by Gigi Suhanic, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at [email protected].

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Comments